Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Paid In Full

301 members • Free

Content Cartel

1.3k members • Free

Group Juice

1.3k members • Free

WealthyPreneurs™ x FUNNELS.com

432 members • $97/month

Blank Napkin

84 members • Free

Main Way to Wealth

16.2k members • Free

52 contributions to (Free)The Creditprenuer Group

🔥💥 Free Perplexity Pro Hiding in Your PayPal App!🔥

🚨Attention, Creditpreneurs! I came across something pretty cool. Perplexity Pro is free for a whole year if you sign up through your PayPal app. While I was on my phone earlier, I noticed in the offers section that Perplexity Pro currently has a promotion for a 12-month free subscription. If you haven’t used it before, it's similar to ChatGpt. Perplexity is like having a research assistant that never sleeps. It pulls real-time data, cites every source, and helps you plan, learn, and create much faster. Here’s how to grab it: 1. Open your PayPal phone app (the offer may only show there) 2. Go to the Offers section 3. Find Perplexity Pro and link your PayPal 4. Enjoy a full year free These types of promos don’t stick around long, so check your app and take advantage while it’s still up.

Credit score increase, again!

My score increased 6 points. This is a result of strategy that I've learned in this forum. I'.m giving thanks!

Free Lead Generation Funnel (For 2 People Only)

Hey everyone 👋 I’m testing a simple lead generation funnel I’ve been building it’s designed to help creators and business owners attract leads automatically (without needing to post every day or spend on ads). Before I roll it out fully, I’d love to offer 2 people a free setup so I can get some feedback and see how it performs in different niches. Here’s what you’ll get: A simple, ready-to-use lead generation funnel (landing page + offer) Guidance on how to plug it into your current workflow A quick review to help you improve conversions If you’re down to test it out, drop a comment or DM me what you do — I’ll pick 2 people this week 👇

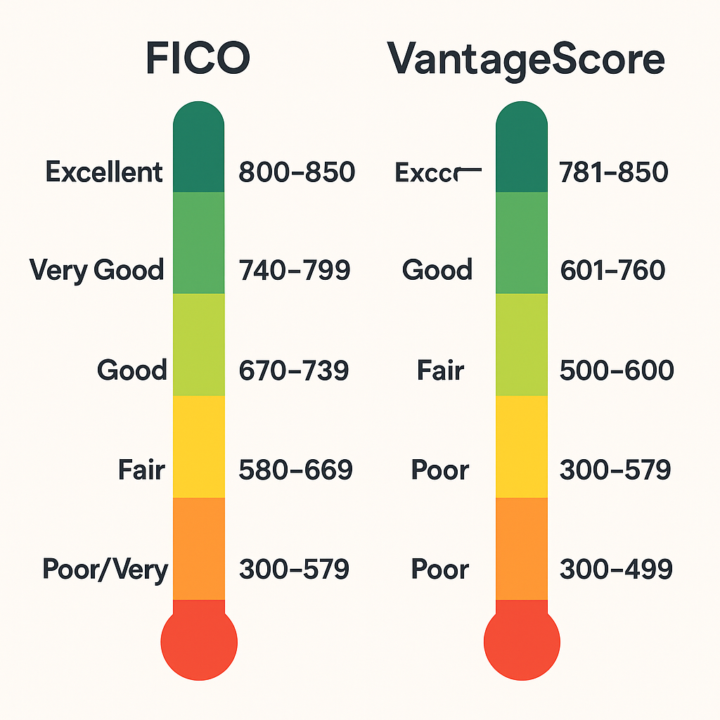

FICO vs VantageScore Ranges for Classification (Eric Kinney Repost)

𝗘𝘅𝗰𝗲𝗹𝗹𝗲𝗻𝘁/𝗘𝘅𝗰𝗲𝗽𝘁𝗶𝗼𝗻𝗮𝗹: FICO: 800–850 VantageScore: 781–850 𝗩𝗲𝗿𝘆 𝗚𝗼𝗼𝗱/𝗚𝗼𝗼𝗱: FICO: 740–799 VantageScore: 661–780 𝗚𝗼𝗼𝗱/𝗙𝗮𝗶𝗿: FICO: 670–739 VantageScore: 601–660 𝗙𝗮𝗶𝗿/𝗣𝗼𝗼𝗿: FICO: 580–669 VantageScore: 500–600 𝗣𝗼𝗼𝗿/𝗩𝗲𝗿𝘆 𝗣𝗼𝗼𝗿: FICO: 300–579 VantageScore: 300–499

1-10 of 52

@lisa-davis-3964

20 yrs in lending. Been in the credit struggle, now I share what I’ve learned. Let’s connect 🙌

Online now

Joined Aug 25, 2025

INTP

Georgia

Powered by