Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Retirement Freedom Seekers

66 members • Free

Retirement CASH FLOW

464 members • Free

9 contributions to Retirement CASH FLOW

Can kicking!

Looking back to when I was like 40 years old, I distinctly remember thinking I need to get moving on my retirement plans but I just don't have any extra cash to do anything. Then came the dreaded ...I'll start to do this next ________. Does this sound familiar? Drop me a line below

The thing about taxes...

Everyone spends so much time trying to take tax deductions to reduce their income but most spend no time investing with their self directed IRA's to accumulate tax free income that has the ability to grow exponentially. Here's an example: You open a Roth IRA in 2026 and contribute $625 per month for the entire year. Starting in 2027 you have $7,500 to invest. Everyone says yeah but what can I do with that tiny amount? You lend it out to someone that needs it. many people need a chunk of money until their next payday. Like Realtors. Realtors don't get a weekly check, they are paid by commission often times with large gaps in between paydays. You lend them $7,000 and in 2 months they give you back $8,500. You continue to make the $625 monthly contributions and you are in business! You made $1,500 from that one loan and pay zero taxes on the $1,500 for ever! If you do that 3 times in one year that would be $4,500 in tax free profit off of a $7,500 seed money investment! I hope you can see the potential to grow this thing into a monster in 5 or 6 years.

Monday Real Estate Madness!

Wait...don't tell me... You don't have any money to buy real estate. Right? No💵 Get out there and find a deal anyway! 🏡 Call a Realtor and tell them you are looking for a deal, if they don't know what you are talking about go call another one! 📞 Use the 1% rule. Figure out what the rental income would be. That number should be more than 1% of the purchase price. Monthly rental income totals $3,800 then your offer should be less than $380,000 The lower you go under $380,000 the better the deal! When you find a deal bring it to this community

Straight from Rich Dad Poor Dad

Asset or Liability? 🤔 Most people never get this one simple idea: An asset puts money in your pocket.A liability takes money OUT of your pocket. That’s it. That’s the whole game. 👇 1️⃣ Your house - If it costs you money every month (mortgage, taxes, repairs) and doesn’t pay you… it’s a Liability. - If it’s a rental that sends you cash flow every month after all expenses… it’s an Asset. 2️⃣ Your car - Car payment, insurance, gas, repairs = money leaving your pocket every month 🚗💸 - Unless that car is being used to produce income (delivery, Turo, business vehicle that nets profit), it’s a liability. 3️⃣ Your credit cards - If you’re using them to buy stuff that doesn’t pay you back… that balance is a liability. - Debt tied to cash-flowing assets (notes, rentals, etc.) can be good if the cash flow > payment. 4️⃣ Investments - Stocks that don’t pay you? You hope they go up. That’s speculation. - Notes, rentals, private lending, cash-flow deals? They PAY YOU while you sleep. That’s an asset. 5️⃣ Retirement accounts - A 401(k) sitting in mutual funds, praying the market behaves = 🚩 - A self-directed account owning notes, rentals, private deals spitting out cash flow = real assets. If you look at your life right now… Are you stacking assets or collecting liabilities with fancy names? 👇 Drop one thing in your life that you thought was an asset… but now realize is actually a liability.

Before I ever had an “investment portfolio” 👇

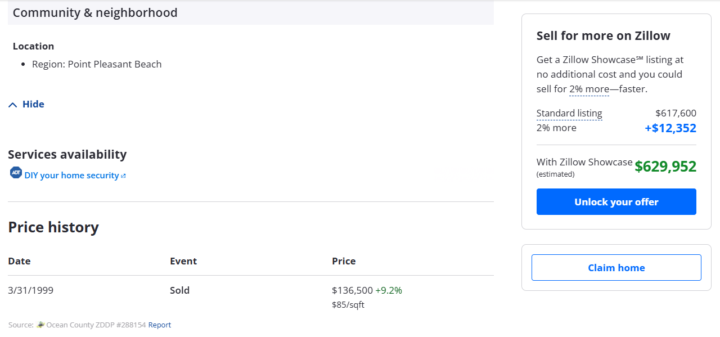

I didn’t even know what that phrase meant. Portfolio was a word rich Wall Street people used on TV. I was just trying to keep the lights on and be happy I could at least make enough salary to allow my wife to be a stay at home Mom. Here’s what actually changed for me 1️⃣ I started looking for things that made sense to me. I bought a study course on late night Infomercial How to buy your first Investment Property with No Money Down Carlton Sheets. 4 Payments of $74.99 2️⃣ That was it I poured over this material and did what he said. I got my team together and looked at as many properties as my Realtor would take me to. I still have that Study course and in that book I wrote April 1 1999 I bought my first rental income property following the magic 1% rule. Rents must be greater than 1% of the purchase price. Rent = $1,400 and the purchase price was $136,500 💬 Your turn:Where are you right now? - “No portfolio, no clue (that was me).” - “Just getting started.” - “Already building, want to go bigger.” Does this get you excited? Let's jump on a call Use this link https://calendly.com/mike-2347/30min Drop it in the comments so I know who I’m talking to 👇

1-9 of 9

Active 39m ago

Joined Jan 9, 2026

Powered by