Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

6 contributions to TGE

How to start with $1,500 small account

"I have $1500 and struggle with strategy." If you're trading with less than $10,000–specifically if you're sitting at $1,500–you need to play the game differently. The truth is, smaller accounts don't have the luxury of high-frequency trading or taking on a massive risk. Every trade matters, and strategy is everything. Most traders with small accounts fails because they chase quick cash, or jump into risky setups – I know you be doing that. If you're still building, swing trading and leap options are you best friend. What you need to do if you have $1,500 (or a small account in general): 1. Avoid day trading Day trading is a trap for small account. It's statistically proven that 90% of retail day traders fail. Instead, focus on swing trading strategies that give you time to be right. 2. Use a 60-90 expiration time Pick options that expire 60-90 days out to avoid short-term noise. Give yourself some insurance. Also look for Delta strikes between 38 to 25 to maximize the probability of moving in the money. 3. Trade LEAP options LEAPS options are some of our favorite here inside TGE Max, because it reduces stress and allows the trade to develop. Instead of starting out at 25 Delta, we start with 48 to 50 Delta, meaning for every dollar move, we're getting a bigger payout upfront. We're not trying to double our money overnight. We're stacking predictable, compounding wins. 4. Paper trade first For the love of god, please do not put real money on the line until you've tested a strategy for at least 2-3 months. *Psst..you can find a strategy inside the classroom. It teaches you how to find undervalue or overvalued stocks based on EPS and expected move. Paper trading will help you build confidence and avoid emotional decision-making. Once you've been successful at that, go ahead and try out a small account of $1,500 to $2,000. The goal is to be consistent and attempt to be profitable for 4 to 6 months. Even if that means 1% gain.

Went from -76% down to almost breakeven

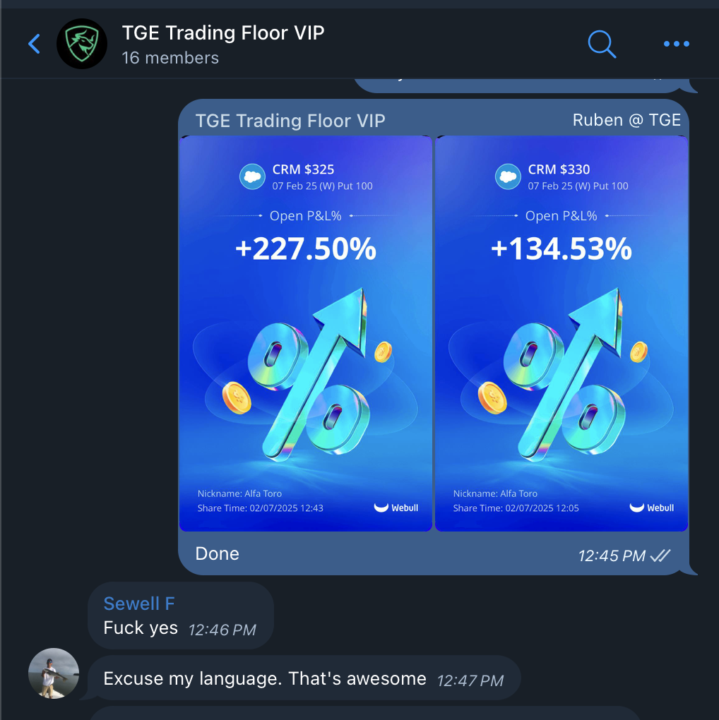

So I took a trade on ELF through earnings—on paper, everything lined up. But, like any trade, we can only make educated hypothesis. We can't predict the future. I got a leap contract, and as soon as the market opened after ELF's earning, it tanked 20%. I thought the lowest was going to be $75, and I was mentally prepared to be down 50% max. But at open, I was down 70%–and that hit hard. Losing money isn't fun, and that shook my confidence as a trader. January spoiled me–I pulled a 200% return that month. So this ELF trade was a punch in the gut. But here's the thing, you can't let one trade define you. Inside TGE Max, we traded CRM and took 2 strikes: ✅ First contract: 134% return ✅ Second contract (further OTM): 227% return We also grabbed a SNOW call, which I didn’t screenshot, but that was another 40% return. Total return for today: ~400%. Almost recovered most of my ELF loss. These were 0DTEs, so I couldn’t size as aggressively as usual. Risk management first—always. But even with that, I ended the day nearly flat despite a rough start. How did I manage to pull through after ELF lost? I have to stay sharp, be mechanical, define risk, and take action. If I let one trade make me hesitate, I'll miss the next opportunity. This game is brutal, but you can't let them change your system. This game isn't about winning every trade–it's about staying in the game long enough to win big. /Ruben

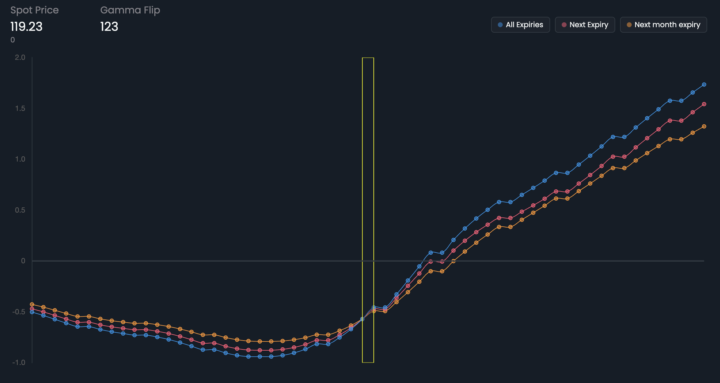

NVDA to 100?

With NVDA below $123 Gamma flip point, this could amplify the volatility. MM will have to chase price action by dynamically hedging short gamma exposure. Thoughts? And are you buying the dips for the long-term?

$HOLO

Anyone ever heard of Microcloud Hologram? I’m thinking there is a spike coming soon

🔑🔓 [START HERE] The Shortcut To Profits

Thank you for being here, and if you plan to stay, read this post carefully! Starting June 2024, any new member who does not reach Level 2 - #ActionTaker within 7 days will be removed from the community. It’s simple: get 5 points to level up and stay. Each like on your comments or posts = 1 point. So, get involved and contribute! 🎁 Free Gifts 🎁 1. Schedule your free onboarding call. 2. Access the TGE Free Community Blueprint Course to get started. 🥇 #1 Rule 🥇 You’ll get value by being here, but you’ll get even more by contributing. That’s the heart of TGE Free. 🚫 What NOT to do: - No DM farming (“comment below and I’ll send it over”) - No spam or links in posts/comments. Let’s keep it valuable for everyone. 🎯 Our Goal 🎯 We are here to help you level up your trading game, connect with like-minded traders, and offer a space where we support each other’s growth. 🚧 What TGE Free solves: - Confusion in strategy - Lack of trade clarity - How to grow in the market 💰 The Result 💰 An engaged community of traders sharpening their skills and winning more trades! ⚡️ Ready to take action? - Participate, post, and comment to level up. - Follow the rules, and we’ll help you grow faster. - Keep an eye out for the onboarding call and the blueprint course to kickstart your journey! ______________________________________________________ 2 WAYS TO WORK WITH RUBEN: 🔥 TGE PRO 🔥 In TGE Pro, you'll gain access to: - Actionable Trade Setups: Real-time trade setups to act on instantly. - Behind-the-Scenes Access: Exclusive insights into my trading thought process during live trades. - Strategy Feedback: Personalized feedback and advice on your trading strategies. - Weekly Market Overview: Join our live Zoom sessions every week for market analysis and Q&A. Whether you’re looking to refine your trading discipline or gain the edge with new strategies, TGE Pro is packed with value. Click here to join TGE Pro.

![🔑🔓 [START HERE] The Shortcut To Profits](https://cdn.loom.com/sessions/thumbnails/89ebe62e39ca4d5181789fa121b6c52b-d0148df8965d15f5.jpg)

1-6 of 6

@kandice-newton-7909

I am new to stocks/trading. I am trying to retire from the healthcare field before I hit 40 lol LETS MAKE IT HAPPEN!! I am very excited

Active 1d ago

Joined Jan 25, 2025

Powered by