Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

Mobility & Injury Prevention

182.1k members • Free

Tax Smart Investor Club

980 members • Free

AD

Airbnb Deepdives

115 members • $9/m

Vacarya Academy

3.9k members • Free

AA

Airbnb Arbitrage Roadmap

5.1k members • Free

2 contributions to Tax Smart Investor Club

1031 exchange, cash out refi, or HELOC?

We have an LTR in an area with higher than normal appreciation (SF Bay Area) so ideally I'd like to hang onto that property if possible, but I want to use the equity to buy something else also. Is it better to cut ties and do a 1031 exchange, try a cash out refi or do a HELOC? The thing that's making this a hard decision is we currently have a fixed 2.65% rate on it!

Welcome: Here's what to do first!

✅Write a post introducing yourself, what you can give, and what you need ✅Ask all the questions about real estate and taxes that you have ✅If you find value, share it with someone you know may also find value

0 likes • Oct '25

@Ana Klein, CPA No, I don't (neither does my wife). If my understanding is right, an ALF is considered active income, right? So, I should be able to do a cost seg and use 100% bonus depreciation against my W2 income without having REPS status (or using the STR loophole, of course)? We would be out-of-state semi-absentee owners but I could easily see myself spending 500+ hours between remote coordination, frequent communications with onsite staff, occasional onsite visits etc.

1-2 of 2

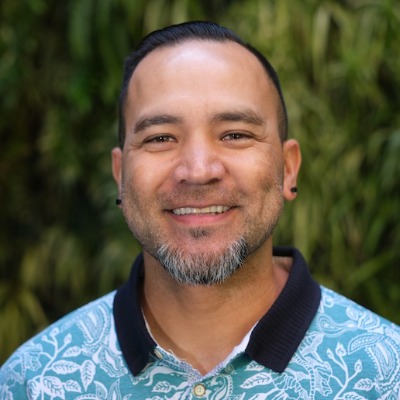

@kalani-kotrys-8335

Husband and father of 3. Originally from Hawaii now living in the Bay Area. Brand new to STRs. My goal is to replace my W2 income in 2-3 years.

Active 35d ago

Joined Oct 16, 2025

Powered by