Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

The AI Advantage

72.2k members • Free

Money Broker Society

8.8k members • Free

FACEFORWARD AI™

5.2k members • Free

The AI Advantage Community

255 members • Free

Insurance Sales Success!

13.9k members • Free

Millionaire Women Collective

10k members • Free

OfferLab

9.6k members • Free

Sm. Business Owners of America

67 members • Free

The Digital Marketing Bar

67.7k members • $17

20 contributions to Money Broker Society

Funding For Real Estate

Good afternoon, if a person has at least a 648 credit score could they get approximately $20k to $30K for funding for real estate?

Introduction

Aaniin/Hello, My name is Kyle Little and I'm an Red Lake Nation Band of Ojibwe Native from Red Lake, Minnesota. I'm new to skool and all of the options that are here at our disposal. I own First People Properties a real estate company based out of northern Minnesota. I'm currently the only property company on the Red Lake Indian Reservation with licenses to operate on the reservation and stateside. I wanted to introduce myself and let everyone know I'm excited to see how far we can go and looking forward to seeing what everyone can achieve.

Close rate

What's the average close rate for referrals? I get that it depends on the quality of the leads. I'm just trying to get a ballpark.

0 likes • 1d

@Sean McConeghy That’s a solid approach Facebook groups can work well, but the close rate usually comes down to how well the leads are pre-qualified before the call. When people raise their hand organically in groups, you can still get decent conversions, but tightening the screening tends to make a big difference. I actually know a funding/referral expert who works specifically with investors generating leads through social platforms and helps them dial in qualification and handoff so close rates improve without paid ads. If you’re open to it, I’d be happy to make an introduction.

Family Office Exec., Private Lender, Banker & Mind Mentor

Hello Experienced leader. Just interested in adding value and connecting. Some insights I picked up along the way. Wealth is a mind state. All actions and realities are governed by your beliefs and your quantum energy field. Change this and you change your reality. But it doesn't happen overnight. It involves taking action repetitive steps over time.

1 like • 1d

@Josh Kimbrough-El Appreciate that perspective, Josh. I like how you tied clarity back to simplicity, willpower, and ultimately a deep WHY—that through-line often gets overlooked when people overcomplicate growth. The reminder that desire strengthens will over time really lands. From what you’ve seen, what’s the biggest obstacle that prevents people from sustaining that willpower once the initial motivation fades environment, habits, or conflicting beliefs?

1 like • 1d

@Josh Kimbrough-El That’s a powerful insight, Josh. Proximity really does shape belief and behavior without the right environment, accountability, and mentorship, it’s easy for momentum to fade. The idea of balancing mentors, peers, and mentees is especially interesting. For someone who recognizes that gap, what’s the most effective first step you’ve seen for intentionally building that sphere of influence when they don’t currently have access to it?

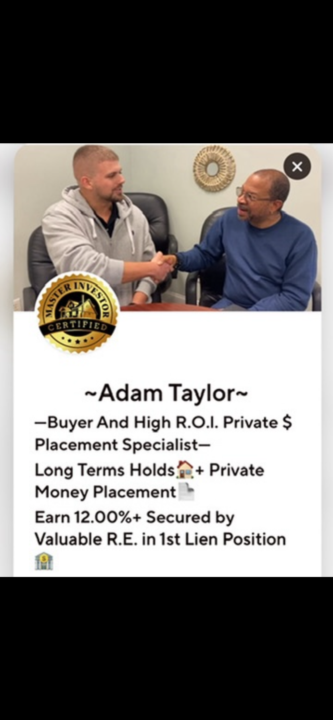

Set it and Forget it 1st Lien Opportunities

Interested in working with someone who has a perfect track record? Hi! My name is Adam Taylor, I'm a real estate investor from Virginia Beach, VA. I've Used private money lenders for the last 5+ years. Real Estate is my full time business. What i've learned over the years is the importance of having great borrower and lender relationships. A typical deal example for us is buying properties for $30-$50k and our lenders 30-50k loan is secured by a house valued at typically double or triple their loan amount. (most often triple.)I specialize in solid markets at low price points which makes a great opportunity for private money lenders with $1O0k or less who are looking for 1st Position Liens.We also have a 100% perfect, on time, payment track record with our private money lenders. We provide a mortgage, promissory note, the lender listed on the insurance as the loss payee and a personal guaranty. Our typical terms are 12.00-14.00%, First Lien Position, Fully Amortized over 48-60 months. (Set it and forget it) I can be reached fastest by text @ 757-793-1827. Message me now to be added to our list to get first dibs on our next opportunity. https://blinq.me/cmj9oshuy0789s60nlyryccpq?bs=icl

2 likes • 2d

@Adam Lee Thanks for sharing, Adam this is a clear breakdown and I like how you’ve structured the lender protections and first-lien position. The low purchase price with strong equity coverage definitely stands out. For lenders coming in at the lower end (around $30–50k), are these typically single-property notes, or do you ever cross-collateralize across multiple properties?

1 like • 1d

@Adam Lee Appreciate the clarification, Adam that makes sense. Keeping it one lender per property definitely keeps things clean and transparent, especially from a risk and servicing standpoint. How do you typically structure the exit on these deals—are most paid off through refinance, resale, or longer-term rental stabilization?

1-10 of 20

@juniper-magnolia-1558

Passionate student focused on learning, growth, and making meaningful connections.

Active 7h ago

Joined Jan 20, 2026

Powered by