Activity

Mon

Wed

Fri

Sun

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

What is this?

Less

More

Memberships

Passive Prospecting Community

2.3k members • $97/m

BoldTrail Academy

218 members • Free

4 contributions to BoldTrail Academy

12 week lead generation series

Join our 12-week BoldTrail Academy series focused on mastering lead generation with kvCORE tools. Each Friday, we’ll cover essential strategies like Smart CRM management, landing pages, squeeze pages, social media integration, text codes, property boosts, email campaigns, market reports, IDX websites, open house apps, smart numbers, and analytics. Designed to maximize leads with minimal costs, this series empowers agents to build and sustain a thriving real estate business. Every Friday at 10am PST zoomwithalexdyer.com https://us02web.zoom.us/j/7886946092?pwd=ejVjNnNRY09xQlcxR05YL0lmdGsvdz09

Blog Content: Invest Smarter: Find Out How Real Estate Tokenization Can Enhance Your Portfolio!

Tokenizing real estate—converting property ownership into digital tokens on a blockchain—is poised to revolutionize the housing market, enhancing accessibility and affordability for both buyers and renters. Key Advantages of Real Estate Tokenization: - Fractional Ownership: Tokenization enables fractional ownership, allowing investors to purchase portions of a property. This lowers the entry barrier, making real estate investment accessible to a broader audience. - Enhanced Liquidity: Traditionally, real estate investments are illiquid, requiring significant time to buy or sell. Tokenized assets can be traded on secondary markets, providing investors with greater flexibility and quicker exit opportunities. - Global Accessibility: By leveraging blockchain technology, tokenized real estate becomes accessible to a global pool of investors, diversifying investment opportunities and increasing market participation. - Efficiency and Transparency: Blockchain's decentralized ledger ensures transparent and secure transactions, reducing the need for intermediaries and lowering transaction costs. Impact on Housing Affordability: - Lower Investment Thresholds: Fractional ownership allows individuals to invest smaller amounts, democratizing access to real estate markets and enabling more people to benefit from property appreciation and rental income. - Community-Driven Development: Tokenization can facilitate community investment in local real estate projects, promoting the development of affordable housing and empowering residents to have a stake in their neighborhoods. - Innovative Funding Models: Real estate tokenization can introduce new funding mechanisms for affordable housing projects, attracting a diverse range of investors and expediting project completion. Challenges and Considerations: While the potential benefits are significant, several challenges must be addressed: - Regulatory Compliance: Navigating the complex legal landscape surrounding securities and real estate transactions is crucial to ensure compliance and protect investors. - Market Adoption: Widespread acceptance of tokenized real estate requires education and trust-building among investors, developers, and regulatory bodies. - Technological Infrastructure: Robust and secure platforms are essential to manage tokenized assets and facilitate transactions effectively.

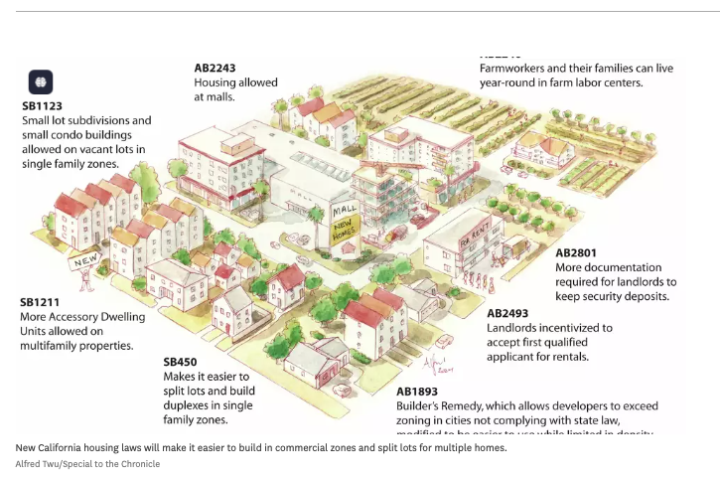

Blog Content: 2025 New Housing Laws

As we approach 2025, California is set to implement several new housing laws aimed at addressing the state's housing crisis by streamlining development processes and increasing housing availability. Here's an overview of the key legislation: - AB 2243: Expands upon 2022's AB 2011 by allowing housing developments in all commercial zones, including regional malls up to 100 acres. This facilitates the transformation of underutilized commercial properties into residential units, promoting mixed-use developments. - SB 684: Simplifies the subdivision of multifamily lots, enabling property owners to create up to 10 housing units on urban parcels under 5 acres. This amendment to the Subdivision Map Act aims to increase housing density in urban areas. Wikipedia - SB 450: Clarifies and strengthens the California HOME Act (SB 9), which permits property owners to split single-family lots to build additional housing units. The bill limits the design and zoning standards cities can impose on such projects and expedites the approval process, aiming to reduce local barriers to development. Wikipedia - SB 1211: Increases the number of accessory dwelling units (ADUs) allowed on a property, permitting up to eight detached ADUs on a lot, provided they do not exceed the number of existing units. This legislation seeks to boost the availability of affordable housing options. Wikipedia - SB 1164: Provides property tax exemptions for new ADUs for up to 15 years, incentivizing homeowners to add these units and thereby increasing the state's housing supply. Wikipedia These legislative measures reflect California's commitment to innovative solutions for its housing shortage, focusing on repurposing existing spaces and reducing bureaucratic hurdles to development. As a real estate professional in the Sacramento metro area, staying informed about these changes will be crucial for advising clients and identifying new opportunities in the evolving market landscape.

kvCore like a pro is vital training

The training Alex provides for KVcore is essential and timely. Right NOW is the time to embrace not only the most powerful CRM available, but to realize it directly ties into critical social media marketing tools that today's agents need to be integrating into their growth. I'm looking forward to upcoming trainings on AI and additional modules on integrating with social networks. Thank you Alex!

2

0

1-4 of 4

@john-olson-9614

Serving Sutter, Nevada, Butte, Placer, Yolo, Sacramento CA and Surrounding Counties

Active 211d ago

Joined Aug 16, 2024

Powered by