Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Owned by Joey

Professional algorithm development for NinjaTrader 8 & TradeStation. Hedge fund quality trading software at retail prices. Join serious traders.

Memberships

Trading Secrets

1.8k members • Free

5-Minute Futures

7.4k members • Free

Trading Boss VIP

45 members • Free

28 contributions to 5-Minute Futures

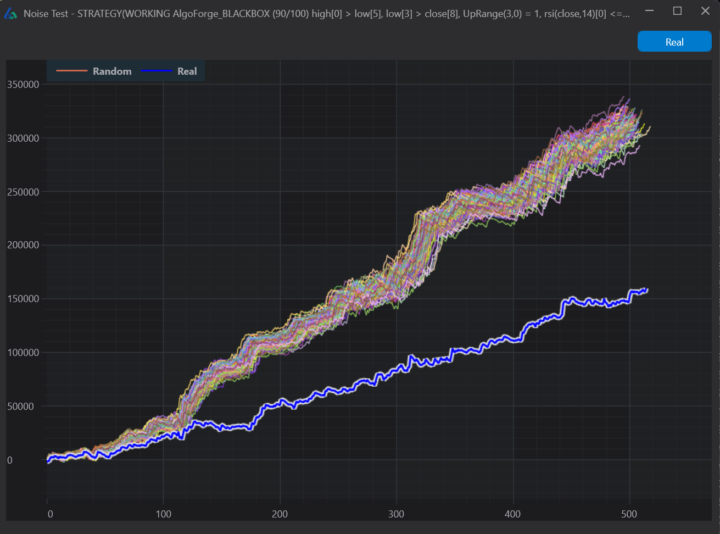

What makes a good noise test?

Hey @Kevin Gong . Just doing some strategy building right now. I know before you mentioned you like the noise test to be right around the mid-point for a "PASS" in your book. What does a noise test like this tell you? Is it really bad?

Build Alpha Questions

Hey @Kevin Gong! Just some questions regarding Build Alpha, how you rank your strategies, and if you had a checklist, how it would go! This is what I mean by checklist in my head, kind of some sort of scoring metrics from "Most Important" to "Least Important". 📊 CORE SCORING (0–100) — unchanged backbone 1) P&L / Drawdown Ratio — 25 <5 → 0 | 5–9.9 → 10 | 10–14.9 → 20 | ≥15 → 25 2) Average Trade (Net P&L ÷ Trades) — 15 <$50 → 0 | $50–99 → 8 | $100–149 → 12 | ≥$150 → 15 3) Trade Count — 10 <400 → 0 | 400–665 → 5 | ≥666 → 10 4) Monte Carlo Positioning — 20 Top quadrant (blue > most sims) → 0 Mid (~50th pct) → 10 Lower 50% → 20 5) Liquidity Test — 15 Liquidity lines < blue → 0 | Mixed → 7 | All > blue → 15 6) Noise Test — 10 Any flat/negative → 0 | All +, blue far above → 5 | All +, blue modestly inside cluster → 10 7) Variance Test — 5 Wide w/ negatives → 0 | Wide mostly + → 3 | Tight, no negatives → 5 8) Other Factors — 0 (Win %, Meta Systems, Slippage excluded from core; discuss qualitatively) ➕ BONUS CONFIRMATION (+0–10) — show separately - Sharpe ≥1.5 → +3 | 1.2–1.49 → +2 | 1.0–1.19 → +1 - Profit Factor ≥2.0 → +3 | 1.7–1.99 → +2 | 1.5–1.69 → +1 - E-Ratio ≥1.3 → +2 | 1.1–1.29 → +1 - Equity Curve Consistency (smooth slope, distributed profits) → +2 (minor lumpiness +1) Report core /100 and bonus /10 separately. Max total = 110. 🎯 SCORE INTERPRETATION (CORE ONLY) 90–100 Hedge Fund Ready | 75–89 Strong Candidate | 60–74 Decent but Risky | <60 Not Deployable

FREE copy of Hormozi's new book ($100M Money Models)

I have 199 FREE QR codes to give away for Hormozi's new Money Models book, so if you need one comment below "Me" and I'll DM it to you. Prioritizing clients first, first come first serve for all members of 5-Min Futures! Happy Money Models Launch Day & Birthday Weekend to Alex Hormozi :) P.S. Free Money Models Audiobook here PSS. Free Money Models Course here 👉(must own a skool community 1st)

NQ 60m Algo I Built Today

Been really trying to fine tune my Algo Building skills these last 2 weeks. Here is something I cooked up today, I think its pretty good. Would rate it about 90/100 (100 being perfect). Multiple pictures here over analysis, just scroll to the right to check it out! @Kevin Gong

Futures Data for BA

Google Drive Folder for Futures Data For BA you will need TS data if you want to test anything below daily bars. Here's a gdrive containing futures market data for: - 5min - 15min - 30min - 60min - 1440min (equivalent of daily bars but with accurate holiday data) Futures Markets: - AD - BO - BP - BTC - C - CD - CL - EC - EMD - ES - ETH - FC - FV - GC - HG - HO - JY - KW - LC - LH - MP1 - NE1 - NG - NK - NQ - O - PL - RR - RTY - S - SF - SI - SM - TU - TY - US - VIXX - W - YM

1-10 of 28

@joey-wachter-6907

Joey, Owner of Timeless Trading LLC, Automated Trading Group

Active 10d ago

Joined Dec 4, 2024

Powered by