Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Tax Pro Hub

84 members • Free

71 contributions to Tax Pro Hub

Happy Wednesday — Hump Day check-in 🐪✨

If your week feels heavy right now, that’s not a sign you’re failing… it’s a sign you’re in the middle of it. And the middle is where most people quit. Today’s mission isn’t to “do it all.” It’s to move the needle — even a little. ✅ Finish the one task you’ve been avoiding ✅ Show up for 20 focused minutes ✅ Post the thing, make the call, take the walk ✅ Do the next right step Momentum isn’t built by motivation. It’s built by keeping promises to yourself, especially on the days you don’t feel like it.

Tax Pros 🔥 Today is go-time.

Tax season is officially open, and this is your reminder: move like a professional, not like a hobby. ✅ Check your pipeline first thing (new leads, form submissions, missing docs) ✅ Set your client communication standard (24–48 hour touchpoint, clear next steps) ✅ Protect your process (ID, income docs, dependents, bank info, signed 8879 before transmit) ✅ Work your hours, not your emotions (stay consistent even on the “off” days) This season isn’t about luck, it’s about systems + speed + compliance. Let’s make it clean, profitable, and smooth for every client. 💪🏽📲

Tax Pro Hub Family 🔥

If you’re in here feeling overwhelmed, behind, or like you’re “not moving fast enough” this is your reminder: You’re not failing. You’re building. Tax season comes with pressure, curveballs, software issues, missing docs, last-minute clients, and people who swear they “sent everything” 😭 but you’re still showing up. That matters. Here’s the mindset for this week: ✅ Progress over perfection ✅ Solutions over stress ✅ Systems over scrambling ✅ Consistency over motivation If something breaks, we don’t panic. We pivot. If a client is difficult, we stay professional. If you make a mistake, you learn fast and tighten the process. Drop a quick check-in below ⬇️ 1. What’s one win you had this week? 2. What’s one thing you need help with right now? We’re not doing this alone.

🚨 Due Diligence Reality Check: Form 8867 Is Not Your Protection

Most tax pros think due diligence starts and ends with Form 8867. But here’s the hard truth: 8867 is just the starting point, not your shield. When preparers get hit with IRS penalties, it’s rarely because they forgot to attach a form. It’s because they couldn’t prove the client actually qualified. The IRS doesn’t hand you a perfect script of every question to ask. Beyond the basic worksheets, you are responsible for building the proof. ✅ What Due Diligence REALLY Requires Your job is to create a file that shows: - Qualifying questions based on tax law - Documented answers in the client’s file - Follow-up questions based on their responses and documents - Notes that show you caught issues, addressed inconsistencies, and resolved them ⚠️ There Is No “One-Size-Fits-All” Due Diligence File Every client situation is different. Your documentation should clearly show how and why the client qualifies for: - the credit(s) - the filing status - the dependent(s) - any claim that affects the refund What gets most tax pros fined isn’t always fraud. It’s thin documentation: - No written questions - No follow-up notes - Vague “yes/no” answers with no details - No explanation of mismatched info 🧾 Your Due Diligence File Should Tell a Story A clean file should read like this: “Here’s what the client said. Here’s what they provided. Here’s what didn’t add up. Here’s what I asked. Here’s what fixed it. Here’s why they qualify.” So if the IRS reviews the return, they can follow the logic without you in the room. 🛡️ Due Diligence Isn’t Busywork It’s your professional shield. If you haven’t reviewed how you document client qualification lately, do it now. Because when due diligence matters most… it’s already too late to recreate it.

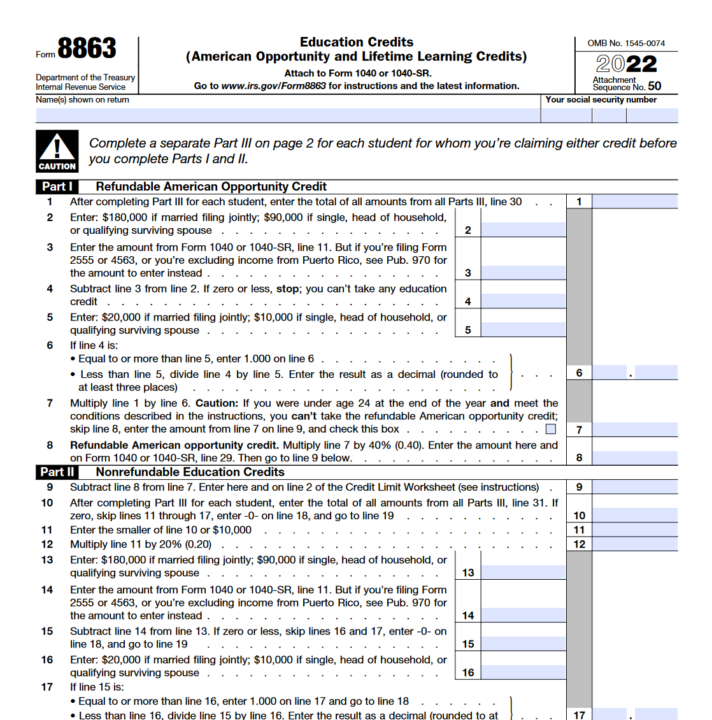

American Opportunity Tax Credit (AOTC): Quick Guide for College Costs

What it is (plain English):AOTC helps with the first four years of college. It’s worth up to $2,500 per student each year, and up to 40% ($1,000) can come back as a refund even if you don’t owe tax. IRS Who can qualify: - Student is pursuing a degree/credential and is at least half-time for one academic period that begins in the tax year. - Student hasn’t finished 4 years of higher education before the year starts and hasn’t claimed AOTC (or Hope) more than 4 total years. - No felony drug conviction by year-end. - Income limits: full credit if MAGI ≤ $80k single / $160k MFJ; phases out to $90k / $180k; above that, not eligible. IRS What expenses count: - Tuition, required fees, and course materials (books, supplies). - Doesn’t include room/board, transportation, insurance, or non-required fees. IRS What you need to claim it: - Form 1098-T from the school (most students receive this by Jan 31). - Form 8863 attached to your tax return. - If a 1098-T is missing, you may still qualify in specific exception cases (e.g., school not required to issue one) and you must be able to prove enrollment and payment.

1-10 of 71

@jodie-brown-6217

Just a girl trying to leave a legacy.

Active 6h ago

Joined Aug 21, 2025