Write something

🚨 Memphis headline worth a quick read:

https://wreg.com/news/memphis-tax-preparers-plead-guilty-to-fraud-false-returns My takeaway for all of us: don’t let “refund culture” pressure you into positions you can’t support. Guardrails for this season: - If it feels inflated, slow down. - Ask the extra questions (income, expenses, basis, business purpose, substantiation). - Document everything: source docs + client explanations + your notes on how you got there. - If it’s not supportable, we don’t file it. Period. Your notes and workpapers aren’t busywork—they’re how we protect clients, the firm, and each other.

1

0

📚 Tax Pros: 1098-T Reminder for Clients

A client receiving a 1098-T does not automatically mean they qualify for the American Opportunity Tax Credit (AOTC) or the full amount. ✅ AOTC is up to $2,500, but the full credit generally requires $4,000 of qualified education expenses paid out-of-pocket. Scholarships and grants can reduce qualified expenses and lower or eliminate the credit. 💡 Some clients qualify for part, some for none. Income limits apply too. 👉 Best practice: Collect the 1098-T (and supporting payment/expense documentation) and determine eligibility based on the full fact pattern. 📌 Quick Box Tip: If Box 5 ≥ Box 1, it often indicates scholarships/grants covered most/all tuition, which can reduce or eliminate AOTC eligibility in many cases, but it doesn’t automatically disqualify the student.

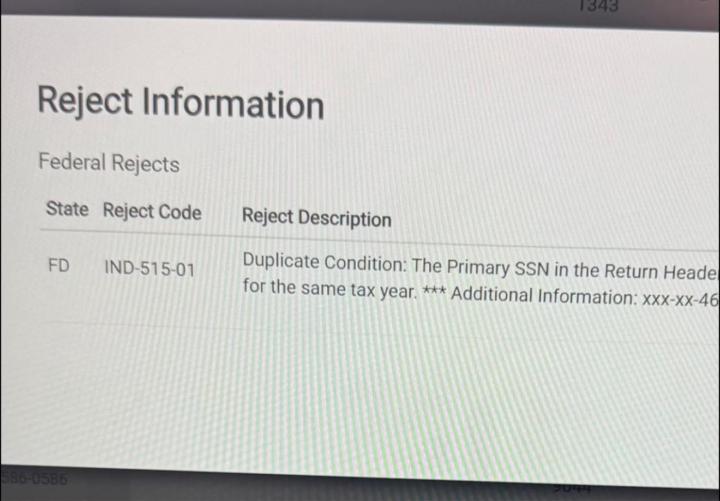

🚨 TAX PRO PSA: HUB TESTING PAUSED (READ BEFORE YOU PANIC) 👀💻

If you transmitted a return and it came back rejected ❌, take a breath. The IRS has paused HUB testing ⏸️ (HUB testing = the preseason system test between the IRS and tax software.) ✅ What this means Right now, the IRS system is not accepting transmissions. So what happens is: 🚫 IRS isn’t taking returns in 📤 Your software still attempted to send ↩️ IRS automatically kicked it back That’s a SYSTEM rejection 🖥️ Not a “your return is wrong” rejection. 🚫 What NOT to do - Do NOT start editing clean returns - Do NOT assume the client info is wrong - Do NOT stress yourself out trying to “fix” something that isn’t broken ✅ What to do instead - Wait for HUB testing to resume / the system to reopen 🔓 - Then retransmit ✅ ⏰ Timing issue. 🖥️ System issue. 💼 Not a preparer issues

3

0

🚨 Due Diligence Reality Check: Form 8867 Is Not Your Protection

Most tax pros think due diligence starts and ends with Form 8867. But here’s the hard truth: 8867 is just the starting point, not your shield. When preparers get hit with IRS penalties, it’s rarely because they forgot to attach a form. It’s because they couldn’t prove the client actually qualified. The IRS doesn’t hand you a perfect script of every question to ask. Beyond the basic worksheets, you are responsible for building the proof. ✅ What Due Diligence REALLY Requires Your job is to create a file that shows: - Qualifying questions based on tax law - Documented answers in the client’s file - Follow-up questions based on their responses and documents - Notes that show you caught issues, addressed inconsistencies, and resolved them ⚠️ There Is No “One-Size-Fits-All” Due Diligence File Every client situation is different. Your documentation should clearly show how and why the client qualifies for: - the credit(s) - the filing status - the dependent(s) - any claim that affects the refund What gets most tax pros fined isn’t always fraud. It’s thin documentation: - No written questions - No follow-up notes - Vague “yes/no” answers with no details - No explanation of mismatched info 🧾 Your Due Diligence File Should Tell a Story A clean file should read like this: “Here’s what the client said. Here’s what they provided. Here’s what didn’t add up. Here’s what I asked. Here’s what fixed it. Here’s why they qualify.” So if the IRS reviews the return, they can follow the logic without you in the room. 🛡️ Due Diligence Isn’t Busywork It’s your professional shield. If you haven’t reviewed how you document client qualification lately, do it now. Because when due diligence matters most… it’s already too late to recreate it.

EITC/ACTC refunds may be delayed until mid-February due to the PATH Act

Refunds for taxpayers claiming the Earned Income Tax Credit (EITC)orAdditional Child Tax Credit (ACTC)are legally delayed due to the Protecting Americans from Tax Hikes (PATH) Act of 2015. The IRS cannot issue these refunds before mid-February, even for those who file early. For the 2026 tax season (for the 2025 tax year), the IRS expects most EITC/ACTC-related refunds to be available by March 3, 2026, for those who choose direct deposit and have no other issues with their return.

5

0

1-30 of 42

powered by

skool.com/tax-bully-hub-1283

A hub for tax pros, credit experts, notaries & bookkeepers to grow, connect, and access tools, trainings, and templates to level up.

Suggested communities

Powered by