Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

The MHP Pros Mastermind

110 members • $99/month

AI Hot Lead Challenge

53 members • $21/m

Mobile Home Park Mastermind

648 members • Free

6 contributions to The MHP Pros Mastermind

Offer Considerations for homes "Owned" but without title

Looking at a park that has three POH but the seller does not have title to these homes. What are some things to consider, negotiate into the deal? -Ask seller to retain "ownership" and collect space rent until he can produce title? Have first right of refusal once title is obtained? Thanks- Jason

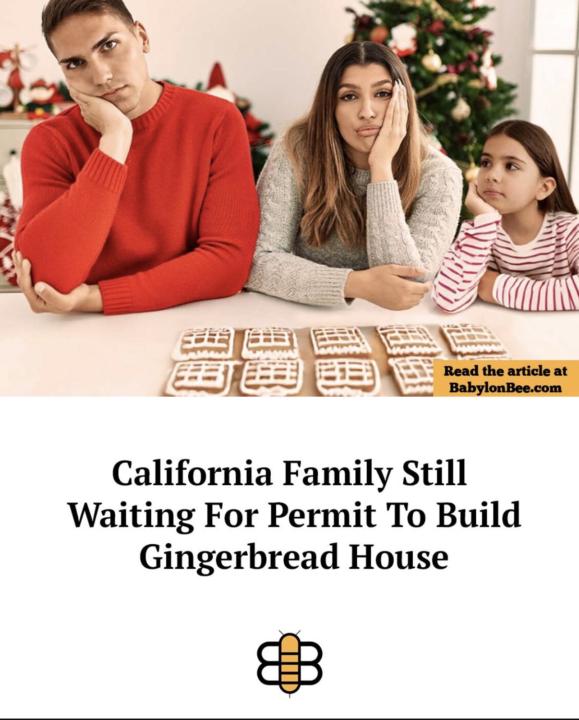

🤣 Sorry California

@Tyler David @Lucy Ocampo @Tracy Hicks @Joshua Cornist @Larry Gonzales Anyone else im missing? 😂

Quick LOI Structure Question — Would Appreciate Feedback

Hey everyone — I'm working on an LOI and want to include two offer options. Just looking for some quick input on how I'm structuring it. - Offer 1: Higher price (closer to seller’s ask), with more favorable terms for us — lower interest rate, lower down payment. - Offer 2: Lower price (closer to actual market value), more market-rate terms — higher interest rate and larger down payment. In either case, the way I have the offers written, Offer 1 gives the seller more monthly income and a higher purchase price... I’m wondering: Is there any real incentive for a seller to take Offer 2? Is a bigger down payment enough to incentivize or do I need to create more spread between the offers so that one gives them higher monthly income, and the other gives them more cash up front? Shorter balloon on Offer 2?

Anyone going to MHI in April?

Curious if @Ryan Narus and @Michael Pansolini (and anyone else) will be at MHI in April and, if so, will y’all be doing a meetup? Thoughts on MHI as a worthwhile event?

Laundry Room Access - How to restrict to residents only?

rehabbing our laundry facility and want to be able to monitor/ restrict access. any ideas about how to accomplish this?

1-6 of 6