Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Critical Risk Accelerator

211 members • Free

Governance Risk and Compliance

41 members • Free

12 contributions to Governance Risk and Compliance

Governance Risk and Compliance Webinar

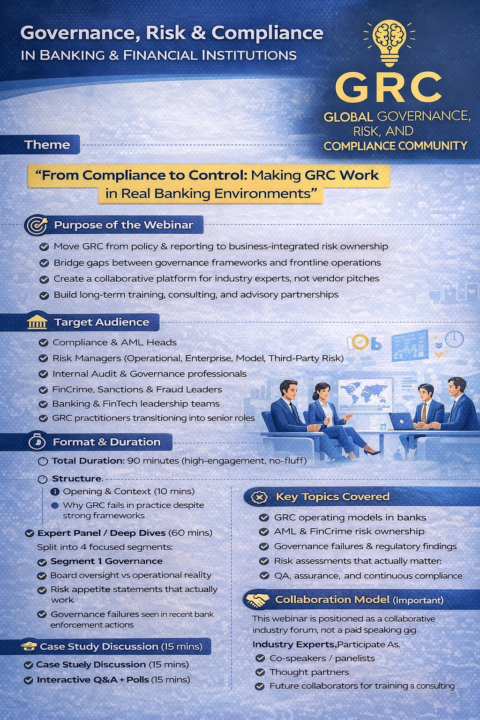

Webinar Title Governance, Risk & Compliance in Banking and Financial Institutions From Frameworks to Real Business Impact Presented By Skool Global Risk and Compliance Community Experts Webinar Objective To explore how Governance, Risk, and Compliance can be embedded into everyday business decisions within banks and financial institutions, moving beyond checklist compliance to practical risk ownership. We would like to invite all interested experts from the community if you would like to nominate yourself as panellist. We are planning to start this webinar for the month of Feb’26 @Mark Heaton will be part of the webinar & feel free to ping @Mark Heaton or me for panelists nomination and any other suggestions Key Topics Covered - Governance and board level risk oversight in financial institutions - Integrating Risk & Compliance AML and FinCrime risk into enterprise risk frameworks - Risk assessment approaches that influence real decisions - Common GRC breakdowns seen in regulatory findings - Strengthening compliance quality assurance and monitoring - Aligning GRC with business growth and product strategy Target Audience - Compliance and AML professionals - Risk and Governance teams - Internal Audit professionals - FinCrime and Sanctions specialists - Banking and FinTech leadership Format - Live interactive webinar - Industry expert discussions - Real world case study - Audience Q and A Duration 90 minutes Collaboration Opportunity We welcome industry experts and practitioners interested in co hosting speaking or collaborating on future training and consulting initiatives.

1

0

Change management

What do you understand change management to be? How do you run change management in your organisation?

ISO 9001:2026 megathread

This thread is for people to discuss the latest updates for the new revision coming to ISO 9001.

Continual improvement

So as this group grows, I need some help shaping how best to utilise the tools and features of this community. So I have a series of questions i would like you guys to answer. 1. Do we want to do social community zoom calls? If so how often should we do them? 2. Do we want to do themed topics, say weekly, monthly, etc. 3. Do we want to break down the discussion channels into their areas? Like ISO, Infosec, AML, etc. Of course if we make these changes we need to make sure we utilise them and keep them going. So happy to hear people ideas on how to utilise the full potential of this group and how everyone can help facilitate it happening.

0 likes • Dec '25

Hi @Mark Heaton it’s great to see a deliberate approach to shaping the community as it grows. 1️⃣ Social / community calls There is definite value in periodic live interactions, provided they remain focused and purposeful. A biweekly’s 45–60 minute session would be a good starting point—centred on open discussion, emerging issues, and member-led insights rather than formal presentations. Frequency can always be adjusted based on engagement. 2️⃣ Themed topics I strongly support this. Themed discussions help provide structure and continuity. A monthly theme, supported by weekly prompts or case-based questions, would encourage deeper participation without overwhelming members. 3️⃣ Discussion channels Breaking discussions into areas makes sense, but I would recommend a phased approach. Starting with a small number of core channels (e.g. AML/FinCrime, Information Security, Governance/ERM, Regulatory Change) will help maintain focus. Additional channels can be introduced once activity levels justify them. Sustaining engagement To ensure these initiatives remain active: - Encourage topic facilitators or champions from within the community - Anchor discussions around real-world scenarios and practical challenges - Summarise key insights from calls and discussions back into the platform - Foster a culture where thoughtful questions are as valuable as definitive answers I’d be happy to contribute to facilitating discussions, particularly around AML, FinCrime, and GRC integration, as the community continues to develop. This approach should help build a sustainable, practitioner-led forum that delivers long-term value.

Back up an running

Sorry everyone, you may have noticed a period of time when the group stopped functioning. My bank flagged the transaction that pays for this group and decided it was not real. I guess they stepped up security during the Christmas influx of transactions. Anyway thank you for your patience I’m glad we could get up and running again so quickly.

1 like • Dec '25

Hi @Mark Heaton Great question, Mark. This is actually a very common scenario. At a high level, the transaction was likely flagged due to a combination of contextual risk factors, not because anything was “wrong” in isolation. Around high-volume periods like Christmas, banks typically tighten controls and lower thresholds. Common triggers could include: - An unusual merchant or payment pattern compared to historical activity - A first-time or infrequent payment to a digital platform or subscription service - Cross-border elements or routing changes - Automated rules kicking in during heightened seasonal risk periods In many cases, it’s less about suspicion and more about uncertainty + automation. Once the context is validated, things usually move quickly — which seems to be what happened here. It’s a good real-world reminder of how risk-based controls operate in practice, especially when volumes spike.

1-10 of 12

@hemanth-kumar-6047

AML | FinCrime | Compliance Leader | Founder – AML Custodians 14+ years in AML, FinCrime Operations, Quality, and Training across globally

Active 19h ago

Joined Dec 16, 2025

Hyderabad