Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Traders' Mindset

1.4k members • Free

InvestCEO with Kyle Henris

41.2k members • Free

17 contributions to InvestCEO with Kyle Henris

📢 Funded Accounts Q&A Session | Apex 90% Off Sale

This Wednesday, I’ll be hosting a Q&A Session on Trading with Funded Accounts, centered around Apex Trader Funding. I’ll be open to your questions on topics like: ✅ What’s needed to get started with funded accounts ✅ Passing Evaluation Accounts ✅ Converting Evaluations into Performance Accounts ✅ Managing Performance Accounts for long-term success Session Details: - 📅 Date: Wednesday, January 28th - 🕒 Time: 3:00 PM Eastern - 🔗 Skool Meeting Link: https://www.skool.com/live/BPtXJZgNZkK - 🎥 Recording: Session will be recorded and available afterwards 💡 Mark your calendar and join in. Bring your questions! 🚨 **APEX 90% OFF SALE | Ends February 4th** 🚨 https://www.skool.com/investceo-with-kyle-henris-4723/apex-90-off-sale-ends-february-4th?p=a3707d82

QUESTION ABOUT EVALS

SO IF IM CORRECT THE RULE ABOUT EVALS IS THAT ALL POSITIONS MUST BE CLOSED BY 4PM RIGHT SO HERE IN CENTRAL TIME ZONE WOULD IT BE 3PM BECAUSE I AM WORRIED I MESSED UP MY EVAL BECAUSE I DID A TRADE BUT MADE SURE IT WAS CLOSED BY 3:30 BUT DIDNT REALIZE IT SHOULD HAVE BEEN CLOSED BY 3PM HUH?

🚨EDIT: Comment "Algo" for the REPLAY. Algo Trading DEMO🚨

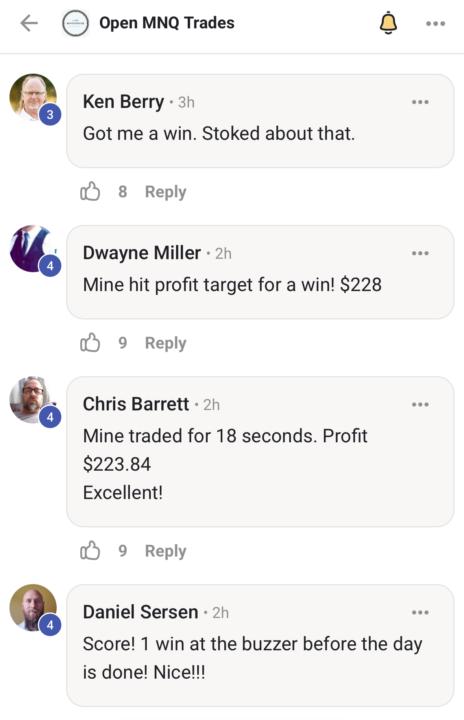

Have a special session for anyone interested in learning more about AI and automated day trading! Will be doing it at 12pm EST this Friday in place of the normal Fast Track session. I’ll be breaking down this weeks trading days through automation, including how the people in the screenshots below are using it. One of the things I love most about new technology like this, is most of these people (admittedly) would probably not have had a winning day today without it. They would have either been too busy, or made emotional or technical errors to mess it up. ✅ If you want to attend the session just comment “ALGO” below or reply to the email I send 👇

3 $50k PA's from this strategy

I saw one of Kyle's FB advertisements around mid December and slowly started to check it out and go through the course. I have experience with stocks and a little day trading 20 years ago but I'm brand new to day trading futures and now I'm seriously into it. I've not mastered the superman strategy or anything remotely close to it but I do get it and did use what I learned from this FREE course to pass 3 $50k Evals with Apex! And yes I did hang my funding certificate on my office wall. LOL! now I'm stuck not wanting to trade my PA accounts until I get better at bar reply. I definitely need more direction. I kind of didn't want to post this because it seams a little to good to be true but I'm a real person who just randomly found this course and it could not have worked any better for me. Kyle deserves a lot of credit for putting this great material out there for nothing. Thanks again Kyle!

5 likes • 24d

YES HE DOES HE NEEDS TO BE TRULY RECOGNIZED FOR HIS COMPASSION FOR PEOPLE LIKE ME WHO HAVE NO WAY TO EARN A LIVING BECAUSE I HAVE 3 AUTISTIC KIDS THAT DAYCARE WILL NOT WATCH BECAUSE THEY ARE NON VERBAL AND i HAVE MANY SPEECH THERAPY ABA THERAPY AND OT THERAPY APPOINTMENTS EVERY WEEK THERE IS NO WAY ANYONE WOULD HIRE ME WITH MY SCHEDULE SO FINDING THIS IS TRULY A GODSEND SO IM ON MY FIRST EVALUATION BECAUSE I PAID FOR WEALTHCHARTS THE FIRST TIME AND DIDNT UNDERSTAND HOW TO USE THE CYHARTS THAT WELL SO NOW IM ON TRADOVATE AND IM TRYING TO IMPLEMENT THE STRATEGIES AND PRAY TO GOD I DONT FAIL

QUESTION

YALL I SCREWED UP AND PAID FOR AN EVALUATION ACCOUNT WITH WEALTHCHARTS INSTEAD OF TRADOVATE. IS THERE ANYWAY THAT I CAN USE THAT ACCOUNT ON TRADINGVIEW INSTEAD?

1-10 of 17

Active 5d ago

Joined May 2, 2025

Powered by