Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Ready, Set, Own

16 members • Free

7 contributions to Ready, Set, Own

Everyone becomes an expert!

So you have decided that you’re going to buy a home and now all of a sudden, everyone comes out of the woodwork telling you what you should and what you shouldn’t do. This will happen every single time regardless of how many times you’ve been through the process. Everyone has something to say and likely each, and every opinion has some validity that was true for them at that time. The key here is making sure that you have the right team of professionals in place for you and you’re asking around, asking all the questions. And in the end, go with your gut! You’re the expert because you know what YOU want!

2

0

What's Your Ideal Home?

Buyers with a plan find the right home faster. When you know your must-haves, like-to-haves, and don’t-wants, the search becomes more focused. You’ll waste less time on homes that don’t fit, and you’ll recognize the perfect home the moment it comes up. Here's an example: Buyer’s Home Planning List ✅ Must Have (Non-negotiables) These are the essentials that the home must meet. If these aren’t present, the home is not a fit. - Home Style & Design: (e.g., single-story, two-story, modern, traditional, open-concept, accessible layout) - Bedrooms & Bathrooms: Minimum number (e.g., 4 bedrooms, 3 baths) - Square Footage: Minimum interior living space (e.g., 2,200+ sq. ft.) - Lot/Outdoor Space: Yard size, privacy, fenced yard, or space for pool/outdoor living - Location: - Safety & Noise: Low-traffic street, no major road behind property - Amenities: Garage size (2-3 car), laundry room, home office space - Condition: Move-in ready (no major repairs needed) 💡 Like to Have (Nice extras, but not deal breakers) These are desirable features that would enhance the home but aren’t mandatory. - Finishes: Upgraded kitchen (granite/quartz, newer appliances), modern bathrooms - Special Features: Fireplace, vaulted ceilings, walk-in closets, pantry, bonus/loft room - Outdoor: Covered patio, built-in BBQ, pool/spa, landscaped yard - Energy Efficiency: Solar panels, dual-pane windows, smart home systems - Community Amenities: Gated community, clubhouse, pool, lake, or gym - Views: City lights, hills, lakefront, golf course - Convenience: Proximity to shopping, freeway access, hospitals - Future Growth: Room for ADU, expansion, or rental opportunity 🚫 Don’t Want (Deal breakers) These are features or conditions that would immediately eliminate a property from consideration. - Location Issues: - Layout/Design: Choppy or closed floor plan, low ceilings, small bedrooms - Condition: Major deferred maintenance, outdated systems (roof, plumbing, electrical) - HOA Concerns: Very high fees, restrictive rules, poorly managed association - Lot Issues: Steep hillside, limited parking, no yard or outdoor space - Style Preferences: Don’t want a condo/townhome, split-level, or certain architectural styles - Other: No garage, poor natural light, strong odors (pets, smoke)

1 like • Sep '25

Having a plan is so important and taking the time to work through these items is crucial. Doing this can build confidence so when you are in escrow on your new home you know you are making the right decision! Maybe think about where you are living today to get some ideas and thoughts flowing. What is it that you really like about where you live now and what is that you never want to deal with again?

Mortgage Rates

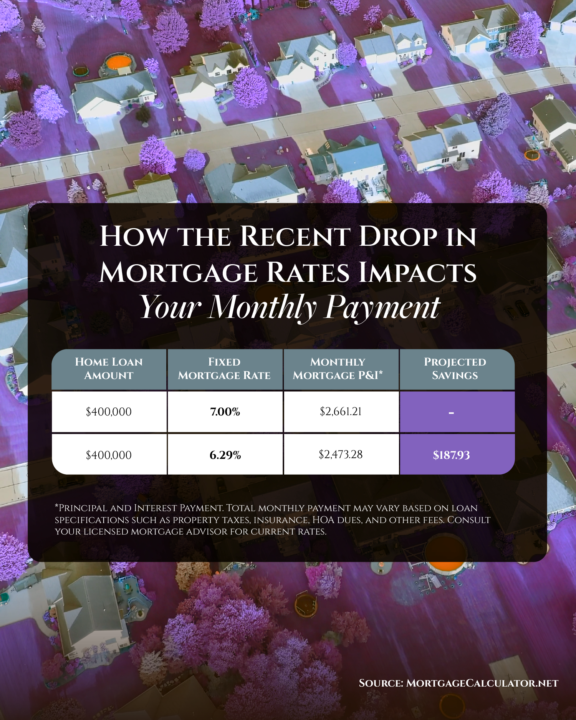

Mortgage rates just had their biggest one-day drop in over a year. They fell to the lowest they've been since last October. And that shift matters. Compared to when rates were at 7% earlier this year, that could mean your future monthly payment is now about $200 lower. Or, on the other hand, this interest rate drop will increase the purchase power that you qualify for or what you feel comfortable with.

1

0

The Top 3 Regrets First-time Buyers Have

1. Total Cost of Ownership (Not Just the Mortgage) - Many buyers focus only on their monthly mortgage payment and forget about property taxes, insurance, HOA dues, utilities, maintenance, and repair costs. - This often leads to “payment shock” when the first full month of bills arrives. 2. Neighborhood & Lifestyle Fit - They fall in love with the house but don’t fully vet the neighborhood—commute times, noise, school ratings, future development plans, or even how walkable it is. - After moving in, they realize the community doesn’t match their lifestyle. 3. Room to Grow / Resale Value - Buyers sometimes choose the “perfect starter home” without considering future needs (kids, pets, home office, multi-generational living). - They also regret not thinking about resale factors—like floorplan appeal, upgrades, or location—that will impact their ability to sell down the road. 👉 In short: money, lifestyle, and future planning are the big 3 blind spots.

0 likes • Sep '25

I believe it is super important to look from two angles here. Let's talk about all the great things that homeownership is (this is what we call the 'READY' part at Ready, Set, Own!); Sense of pride in the American Dream, building financial wealth, fixing the budget with the fixed cost of the mortgage, tax write-offs/benefits, payment will go down in the future, I can paint when I want and how I want, and the reasons go on and on! But let's be realistic here, we must flip this coin over and look at the other side of homeownership (This is the 'SET" portion). Hopefully no one has bought a home and didn't know what their actual monthly payment is before they closed on the home, but I have seen some crazy things where the lender just does a horrendous job in taking care of their buyer, so it is out there. What about monthly maintenance costs where currently you just call the landlord, what if you have to move for work, what if I like to move often, these are all valid questions that must be discussed. And commute times, this absolutely has to be looked at as well as spending some time in the neighborhood while you are in escrow. I always tell my clients to go walk the dog through the neighborhood on the weekend to see it when the neighbors are out. Maybe even a drive through on Friday or Saturday night when you are on your way home from a late night out yourself just to see what is going on before you find out after you live there. If you have looked into buying a home and stopped as you didn't feel that it was the right time for some reason in your gut and your realtor or lender is not having these kind of conversations with you then you need a new team. Buying a home is the biggest purchase we make in our lives and we have to be having these conversations or we are doing a disservice to our clients. Plus, it's just the right thing to do!

Even Small Changes Can Be Big

Over the past few weeks, mortgage rates hit their lowest point of the year – and it was big news. So, what you need to know if you’re buying a home is, whenever these shifts happen (whether they’re now or later), even a small change in rates can make a big difference in your monthly payment. While major drops in mortgage rates aren’t projected for the rest of 2025, smaller declines are still expected – depending on where the economy goes from here. If you want to see what the math looks like at another home loan amount or mortgage rate, let us know and we can run the numbers for you, so you can plan ahead.

1

0

1-7 of 7

@glenn-hemry-8292

Been in the mortgage business 24 years. Buying a home is all about knowing what you are doing and why.

Active 31d ago

Joined Aug 11, 2025

Orange County, CA

Powered by