Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

CI

Complete Investing Skool

311 members • $9/month

SC

Simple Crypto Investing

21 members • $19/m

39 contributions to Complete Investing Skool

Reviews

I was hoping to leave your page a review today, as I’m relatively new to investing, I made a few mistakes in the beginning, since watching your videos and educating myself, I’ve adjusted my stocks, now I’m starting to gains (currently 12.5%). As there are so many so called “traders” on socials etc, it’s easy for good gen and solid advice to get lost in the noise. Just wanted to add credibility and success to your channel, and to help others decide for themselves which advice to follow. 👍

Most would sell‼️

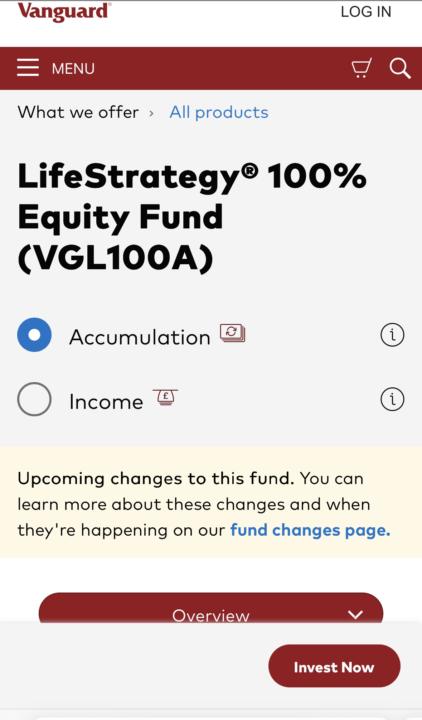

This is a common beginner mistake. And it’s a big one! I’ve invested into the Vangaurd LS 100 fund since 2019 for my 2 daughters. As you can see the returns over the last 5 years have been good. When you work it out - it has got average returns of 11.84% in that period. This is much better than a savings account. And better than leaving it in your current account. Like the £1.9T pounds sat in current accounts and cash ISAs here in the UK 🇬🇧 If you look at year 2 returns of the attached pic it’s -6.25%. This is important to get your head around - especially beginners… Because most people who started with this fund in that particular year. Would have stopped because of negative returns. To build wealth as an investor. Zoom out. Think long term. DCA into your chosen index fund or funds or whatever assets you prefer. It’s that simple! Yes you get average returns of 10% when you track the global stock market (like the S&P 500) - but no investment goes up in a straight line.

Money in the bank beats numbers on a screen!

Profit over vanity lads! Yes we can all watch this screen number climb but is it going to make a difference to our back pockets and essentially family? I’m sat here now writing this quick message from my home infra red sauna… was paid for this week with some shuffling and profit taking in BITTENSOR (TAO) whilst the market is jumping g around! My first real win and profit take I would say! Set goals around what your doing to spend it on! £5k for family emergency fund 10k down payment on elect years bills! 20k deposit on a purchase on a rental home (income product asset) What’s your first purchase going to be lads? Is it engrained in your exit strategy? If not make your top 5 purchases NOW

And then the wobble begins on SOLANA?? .

I’ve followed this guy for quite some time and seems credible and his posts about next moves do generally tend to play out but then he talks today about SOLANA already hot it’s peak potentially …. He mentions in May This year that he thinks Solana won’t perform well then today shares his thoughts again … Thoughts? 🫣

Did anyone WIN this week?

Did anyone take profits this week? I’ll won’t lie . My portfolio is around break even now . Yes I could have hit the sell and buy button last weekend through that CRAZY day last week BUT and Made considerable gains , BUT most people FROZE whilst watching it live coupled with the fact EXCHANGES also froze (did anyone else see this happen… IN CONTEXT I’ve been buying MORE Tao Over the last few months and managed to sell 25% of my portfolio in TAO this week . My Initial purchase average was $325 I SOLD OFF (not near the top ($480 )I admit , but actually 20% from lower than the top ($400) which I’m still Kicking myself about my HESITATION) … BUT having said that I still realised a 20% gain! **Since my sell off at $400 . TAO has dropped another 15% to circa $350 QUESTION; Do I buy back in the same amount of coins after creaming off the profit thus reducing my exposure For bigger context lads . My FIRST PLANNED sell off was going to be at $750 the previous all time high . So some could say I’m VERY early to the party… MAYBE …. This is something else that needs mastering too. I’ve learnt fast that sell offs MUST BE tied into check points such as ALT SEASON INDEX . rsi levels , maybe stochastic levels or EMA . As just going for a fictitious number might not reward us the best ? Just feel like last weekend COULD A , WOULD A , SHOULD a…. But didn’t sell My entire portfolio when it spiked ! Then CRAZILY dipped to all time lows…. Suppose this just was one of those freak events where you need to be ultra calm (I wasn’t ) , prepared for (I wasn’t ) and take action quickly (I didn’t) Maybe I just need grounding or a second opinion IF this makes sense!!! if I buy back now my coins ; they’ll be cheaper again ….. so I can pocket some more profit and lock in bigger gains potentially Or are you guys selling your coins incrementally at profit targets and NOT buying back in? Lots of rambling here and maybe needs deeper explanation…

1

0

1-10 of 39

Active 10d ago

Joined Dec 5, 2024

Powered by