Activity

Mon

Wed

Fri

Sun

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

What is this?

Less

More

Memberships

The Bossy Collective

69 members • $49/m

4 contributions to The Bossy Collective

Hello Millionaires💕

“Your name is already in rooms you haven’t entered yet.” While you’re doubting, there’s someone watching your grind. Stay faithful in the preparation. Stay consistent in the quiet. You don’t need a viral moment—you need endurance. What’s for you won’t miss you. Drop “IT’S ALREADY MINE” if you believe your time is coming.

Nav Acoount

Hey I’m new to using the nav banking and I’m just confused on how the whole process goes I linked Chase business account and I’m still confused can someone shred some light #help

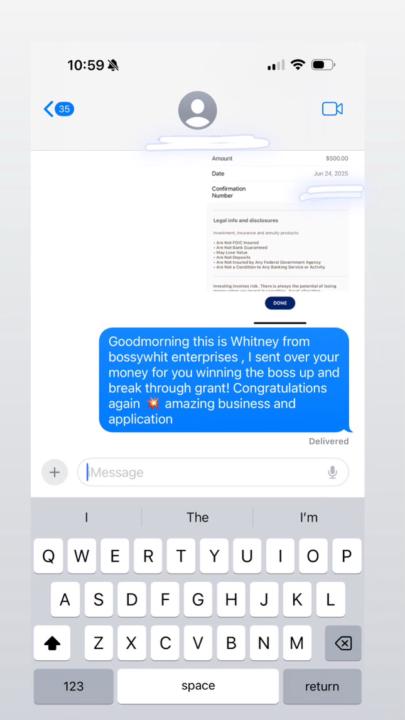

Grant WINNER

EVERYONE congratulate @Dolla Mitchell on winning the bossup and breakthrough grant and today is payout dayyyy! Your appllication was an A+ and I love your drive behind your business. Did you know that this grant is ONLY open to people in this skool community? we have 77 members. Will you be next months winner???

Hello Millionaires!

🚀 Want $30K in business credit without using your SSN? Apply with lenders who offer no-PG (personal guarantee) cards once your business credit is strong. Two examples: Sam’s Club Business Mastercard (reports to D&B). Divvy Smart Credit (great for startups). 👉 Drop 🔥 if you’d like me to list more no-PG lenders. List to drop- No-PG Business Credit Roadmap Goal: Build 5–10 strong trade lines → graduate into $10k–$50k no-PG approvals. Step 1 – Foundation (Day 1–30) ✅ Set up a fundable business profile: - LLC, EIN, business bank account - Business phone #, email, domain - Business address (not home if possible) - List with 411 Directory 👉 Without this, no lender takes you seriously. Step 2 – Starter Vendors (Net-30 Accounts) Apply for vendors that: Approve new businesses Report to D&B, Experian, Equifax Top Starter Vendors: - Uline (office/shipping supplies) - Quill (office supplies) - Grainger (industrial supplies) - Summa Office Supplies (easy approval) - Crown Office Supplies ⚡ Tip: Order small items monthly ($50–$100), pay before due date Step 3 – Mid-Tier Vendors (Net-30 / Net-55) Once 3–4 starter accounts report (30–60 days): - Staples Business Advantage - Office Depot / OfficeMax - Lowe’s Business Account - Home Depot Commercial Account These usually grow into $5k–$15k limits. Step 4 – Fuel & Fleet Cards (No PG) Great for easy approvals + building stronger reports: - WEX Fleet Card - Shell Small Business Card - BP Business Solutions - ExxonMobil Fleet - Chevron/Texaco Business ⚡ Fuel cards report high limits, which boosts your profile quickly. Step 5 – Retail & Store Cards (No PG) With 5–7 trade lines + PAYDEX 80+: - Amazon Business Line of Credit - Dell Business Credit - Apple Business Account - Best Buy Business These accounts often start around $2k–$10k. Step 6 – High-Limit No-PG Cards & LOCs Now your business credit profile is strong enough for major players:

1-4 of 4

@fantacia-bishop-1164

Hey My Name Is Fantacia I’m The Owner Of ValourMinks which is my lash business I’m looking to further my learning and business Ig:@fantaciaaa_

Active 9d ago

Joined Sep 4, 2025

Chicago

Powered by