Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Free Good Credit Now 101

497 members • Free

25 contributions to Free Good Credit Now 101

Motivation Your Environment Will Change Your Elevation

You cannot grow in the same environment that created your struggles If you are trying to improve your credit make more money build a business buy a home or elevate your life in 2026 Your circle matters Your habits matter Your education matters Some of you already made the right decision by joining this community Now it is time to use it Show up Ask questions Read the posts Apply the information Take small steps every day You are not behind You are just beginning And beginnings are powerful Let’s win together

How was your holiday?

I hope everyone had an amazing Thanksgiving filled with good food, good laughs, and good company! 🍁🤎How was your holiday? Did you rest? Did you eat too much? 😄 If you snapped a photo of your plate, your family, your decor, or even your outfit, drop it in the comments! 📸👇 I’d love to see how you spent the day and share the holiday joy with the community. Hope your weekend is off to a great start! 🧡

Did you know?

You’re legally allowed to dispute inaccurate information on your credit report and the bureaus must respond within 30 days. Common errors we see: ❌ Wrong balances ❌ Outdated late payments ❌ Accounts that aren’t yours ❌ Duplicate reporting 💡 Staying informed is the first step to financial freedom!

The #1 Credit Score Booster

Keep your credit card utilization under 30% zero if you can. This ONE move alone helps more than anything else in the beginner stage.

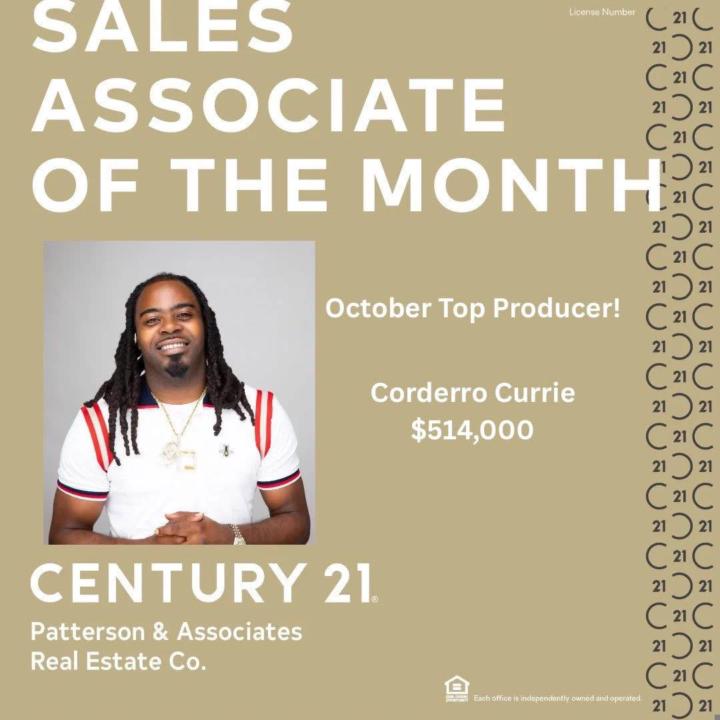

Execution Is the Key 🔑 Half Million In Sells In OCT

Family, listen…Everybody wants the results, but very few commit to the daily execution that makes those results possible. This last month alone I closed over half a million in real estate, all because I show up every single day and do the work. Not luck.Not talent.Not motivation.Execution. If you stay consistent, follow the plays, and take action daily, your breakthrough is guaranteed. Let’s win together. 🔥🏆

1-10 of 25

@evita-quaye-6745

wear many hats—Realtor, wife, mom, sister, friend—but my favorite is cheering people on.

Active 9d ago

Joined Sep 4, 2025

Powered by