Drop Your Goals Below

I want to hear from y’all. Drop your goals in the comments so I can see what you’re working on right now. Whether it’s Fixing your credit Buying a home Getting approved for funding Starting or scaling a business Post it below. This helps me know how to guide you better inside the community. Clarity creates results. Let’s get focused.

To everybody that’s been going hard, stay consistent. Your breakthrough is coming.

It’s 2026. Growth doesn’t always make noise. You don’t see a tree grow every day, but one day it’s standing tall. Same with you. People won’t see the nights you stayed down, the sacrifices, the discipline, or the patience. Just remember this When you’re coming up, stay down. And when you finally come up, stay down even harder. That’s how you stay up. That’s how you last. Keep working. Keep believing. Stay solid.

Decision Day

Nothing changes without a decision Credit will not fix itself Funding will not fall from the sky Houses do not buy themselves Businesses do not build themselves You either stay in the lobby Or you move into execution Comment CREDIT Comment FUNDING Comment LLC Comment HOUSE Pick one Take action Let’s work

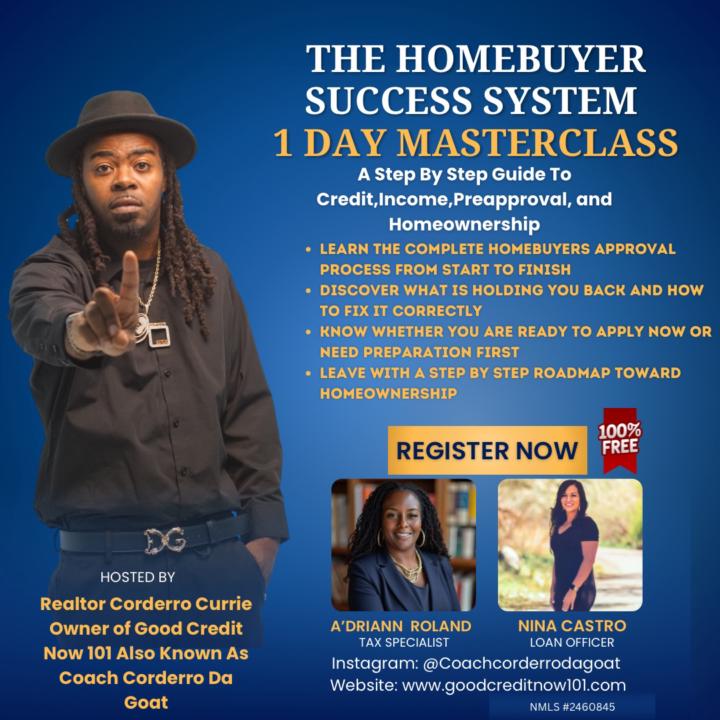

Homeownership requires clarity, not guesswork.

I’m hosting a FREE Homebuyer Success System live on Zoom for anyone in this community who wants to buy a home but isn’t sure where they stand. We’ll be breaking down Credit preparation for home approval Income and tax documentation lenders require Down payment assistance programs How to know if you are ready to apply now or need preparation first You’ll also hear directly from A loan officer covering approval and down payment options A tax specialist explaining how to prepare income correctly for homeownership And I’ll be walking you through the full roadmap from renter to homeowner as a Realtor and credit expert. This is a live weekly session, not a replay. If buying a home is part of your plan, this is where you should be. 👉 Register using the link below and secure your spot. https://api.leadconnectorhq.com/widget/form/CkmGqfyXylTBu4a0mRGE?notrack=true

PROTECT YOUR FOCUS

Everything does not deserve your time or your energy. Too many people are exhausted because they are trying to save everyone else while ignoring themselves. If you keep giving from an empty place, you will burn out. Refuel first. Strengthen your mindset. Build your discipline. Sharpen your vision. This is a season of growth, not distractions. Stay focused on your goals. Stay committed to your plan. Stay disciplined when it gets uncomfortable. Stop comparing your chapter 1 to someone else’s chapter 20. Your journey is yours. Move at your pace, but never stop moving forward. Block out the noise. Lock in on your purpose. Show up every single day. Dream bigger. Think higher. Execute smarter. The results will come if you stay consistent. Let’s level up together.

1-30 of 76

skool.com/free-good-credit-now-101-3232

Free class on credit and real estate. Learn the basics here then join Good Credit Now 101 University for the big plays. 👉 Join The University!!!

Powered by