Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

LetsGetFunded PRO

326 members • $63/m

LetsGetFunded Inner Circle

1.1k members • $97/m

LetsGetFunded Starter (Free)

17.2k members • Free

23 contributions to LetsGetFunded Starter (Free)

Are you ready to expedite funding your business?

Are you ready to Supercharge your credit? Enjoy daily calls that can help propel you forward. FREE CREDIT REPAIR UPON ENTRY! Join us in the “Inner Circle”. Get on the fast track to business funding. Let’s Get Funded! https://www.skool.com/100k/about?ref=2c24e4c2909a456d8c58afea89d5f752

Beware of The "FREE Money via Grants" Posts

I have been helping business obtain capital for 20 years and have seen so many people fall into the dream of free money. If people are asking for money upfront, and they aren't the ones providing the money, beware. If truly seeking legitimate grants, go directly to the source to find out how to qualify and apply. Grants.gov is a good source to start. https://www.grants.gov/learn-grants/grant-fraud/grant-scam-fraud-alerts Be wary of unsolicited grant offers, promises of easy money, or requests for upfront fees, as these are common grant writing scams designed to steal personal info or money; legitimate grants always involve a formal application process, usually through official sites like Grants.gov, and never require payment to receive funds. Watch for fake government agencies, vague descriptions, or pressure for quick decisions, and always verify the funding source and application details directly with the purported organization. Some Top Recurring "Real" Grants for Small Businesses - The Amber Grant ($10,000–$35,000): WomensNet gives out at least $30,000 every month ($10k to a woman-owned business) plus annual grants of $25,000. - NASE Growth Grants ($4,000): Provided by the National Association for the Self-Employed to members (requires 90-day membership) to help with marketing, hiring, or expansion. - Freed Fellowship ($500+): A monthly $500 grant for U.S.-based small business owners, with eligibility for a $2,500 end-of-year grant. - Venmo Small Business Grant ($20,000): Available to businesses with annual revenue under $50,000 and 10 or fewer employees. - HerRise MicroGrant ($1,000): Monthly grant for women-of-color-owned businesses. - Awesome Foundation Grant ($1,000): Monthly grants for various projects, including, but not limited to, startups.

2

0

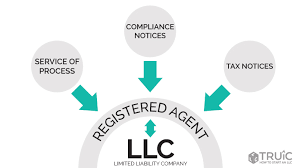

Being Your Own Resident Agent for Your Business Entity

I see many of my clients acting as the “Resident Agent" (RA) for their own businesses. Yes, it is cheaper as most RA services cost $10 per month or so. But I don’t believe most people know what responsibilities they are actually getting themselves into. Did you know as a resident agent, you have to be onsite at the resident agent address from 8am- 5pm every work day or be subject to penalties? Resident agents are the official point of contact for businesses and receive due process paperwork, such as lawsuits (service of process) and important state notices, which they are legally required to forward to the business entity to ensure proper notification and compliance. This includes legal documents, tax notices, and annual report reminders, ensuring the business stays informed and avoids penalties like default judgments or suspension. If a resident agent isn't available to accept due process paperwork, the business risks missing critical legal notices, leading to default judgements in lawsuits they never knew about, potential business suspension, or even dissolution, as plaintiffs can seek alternate service methods, bypassing the entity entirely and making defense impossible. States provide procedures, like “substitute service” or court motions, for plaintiffs to complete service when the agent is unreachable, meaning the business loses its chance to respond. What They Receive: - Service of process: Summons, complaints, subpoenas for lawsuits. - State Correspondence: Annual report forms, renewal notices, tax notices, and other official government communications. - Why It's Important: - Legal Compliance: States require them to ensure businesses can be officially contacted. - Due Process: Ensures businesses aren't blindsided by legal action, upholding fairness. - Timely Action: Enables the business to respond to legal or regulatory issues promptly. - Key Requirements for Agents - Must have a physical street address (not a P.O. Box) in the state. - Must be available during normal business hours. -

1

0

Moving Forward with Lets Get Funded!

Hi Everyone, I'm Dominique Hickson, 66years of age and ready to get funding to start a new Airbnb Business. It is never to late to live your best life! So with the help of the good Lord, I'm ready to learn what I need to know about getting funded and be committed to do the work! There have been challenges along the way; like maneuvering through the internet has not been easy, but I'm still going. Some progress include obtaining my LLC, EIN, DUNS #, Virtual Business Address, Business Bank Account, Business Email, Business Phone Number. There is no turning back now!! I'm learning about the business and the funding in order to create a strong foundation to build on! Meet you at the TOP!!

0 likes • 16d

@Dominique Hickson Are you ready to expedite business funding? Calls every day that can help propel you forward. FREE CREDIT REPAIR UPON ENTRY! Join us in the “Inner Circle”. Get on the fast track to business funding. Let’s Get Funded! https://www.skool.com/100k/about?ref=388020e1932a41bc89d72f691110f1ec

Credit repair and build

Hello , I’m self employed owner operator truck driver. Looking get my credit reported and build funding to over $300k personal and over $500k business.

1-10 of 23

@dan-ollman-4226

20 Years Experience as a Business Credit and Funding Coach. Help business owners establish funding tied to their entity and EIN#, not your SSN.

Active 16h ago

Joined Nov 28, 2025

Powered by