Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Owned by Christopher

Memberships

SEO Maven

8 members • Free

Unboring Ads & Funnels

944 members • Free

Community F.I.R.E. Mojo

1.5k members • Free

Dr. Mike's Chess Academy

1.3k members • Free

HYROS Ads Hall Of Justice

4.5k members • Free

WavyWorld

40.6k members • Free

Community Builders - Free

8.3k members • Free

FF

Fans and Fortunes

189 members • Free

HighLevel Vault

1.9k members • $997/y

4 contributions to Solomon Trading

Orderflow Quiz

Let's see who's paying attention ;) 1. For every buyer there must be a _______. 2. Why is this important?

Bob Got Me In

I've been buddies with Bob Beckett for more than 20 years. He's a real close friend - he even went to my wedding. I always felt I could rely on him. But, when he began to tell me about how well he was doing with trading money, my first thought was that it couldn't be true. I thought - scam... forex infomercials... scam! So, he started sending me lots of pictures - proof of his trading success. Not only that, he showed me how many of his students were also doing really well and earning lots of money. That got me interested enough to want to learn about trading, but then, I made a big mistake - a mistake I don't want you to make. I tried to learn from free videos on YouTube. Bob offered to be my teacher, to help me understand the difficult parts of trading. But, being too stubborn, I said I'd learn it myself. I watched video after video, trying to learn as much as I could, hoping to figure out how to be successful in trading. But the more videos I watched, the more confused I got. Every video would give different advice, and none provided a complete solution. In the end, I found myself going in circles, wasting time on free videos that didn't teach me how to earn money like Bob. And don't get me started on those videos promising 'fantastic' tips in just 5-10 minutes. I encourage you, don't do like I did. Value your time. Successful people don’t try to figure out difficult things on their own. They find people who have already successfully done those things and ask them for help. They learn from others to move forward more quickly. If you think your time is valuable and want to learn, let's talk. I'll tell you how Bob and his team are personally training students, helping them to earn enough money to quit their regular jobs. If you're doubtful, just like I was, I'll show you recent pictures of our students' successes, just like Bob showed me.

#1 thing new traders must know

Sound off! Still trying to wrap your brain around trading? Not sure where to start? These are common questions I've been hearing... Bob once said, "Structure is the most important thing you can learn starting out." Later, you'll need to know risk management, but when you're first starting out you need to understand how price flows INSIDE structure. Why? Because it allows you to determine higher timeframe direction and lower timeframe entries for your trades. If you could take a minute and let us know.... On a scale of 1-10, how would you rate your current understanding of structure?

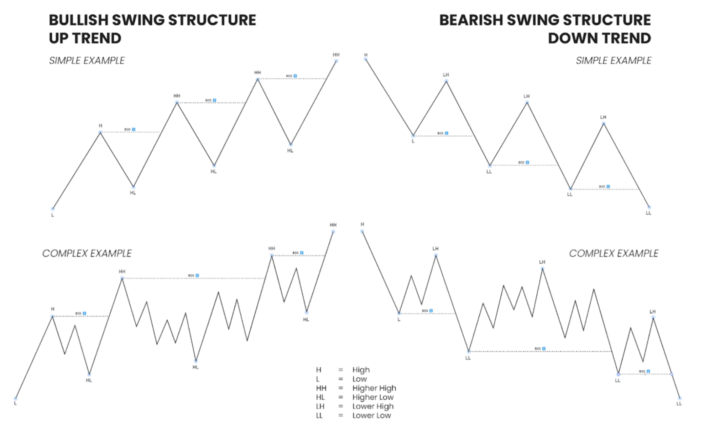

Structure 101

Yesterday, I noticed a lot of students commented they didn't quite understand market structure. We go into market structure in far more depth in our high-level coaching programs, but attached is a basic illustration of price structure. Trends are caused by smart money which is banks, institutions, and very large funds. Remember *they* not us move markets with their massive positions. Uptrends are created because they protect their positions at the lows. And in downtrends they are protecting their positions at the highs. (Slightly more advanced note below) There's simple structures, but the market also creates more complex structures. In order to navigate complex structures remember a HH and LL qualifies a HL and LH. There's no HL or LH without a HH or LL respectively. Let the market show directional strength with a break of structure. Creating a new HH/LL before marking a swing point as your new HL/LL. I hope this helps! Let me know if you have any questions.

1-4 of 4

Active 3d ago

Joined Nov 21, 2023

Powered by