Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Christine

I help retirees and soon-to-be retirees build steady, beginner-friendly online income so they don’t outlive their retirement savings.

Memberships

NoteConference FasTrack

59 members • Free

The Five Minute Investor

142 members • Free

Your Third Journey

10 members • Free

Pinterest Skool

2k members • Free

Influencer Growth Lab

2k members • Free

Your First $5k Club w/ARLAN

17.1k members • Free

REVENUE REVOLUTION

4.2k members • Free

Pathway to Profits

569 members • Free

The Creators Community

4k members • Free

49 contributions to Retirement CASH FLOW

Side hustle income

Having affiliate income is fun. The first thing you can do is open an Amazon Affiliate account. After you are up and running you start to earn income from websites that you post about products that you like. The cool thing is when someone clicks your affiliate link the link takes them to Amazon, you are now active for 24 hours. Even if they do not buy your product, if they buy something else from amazon, you get a percentage of their purchase.

Distressed Property

When you think of distressed property always always think..."what if I just bought the Note to this property?" I'm holding a webinar on Advanced Note Investing Feb 18th and You're Invited! Register here https://us02web.zoom.us/webinar/register/WN_589lAwcVQMuCeFnCf-6EVA I constantly go to real estate meetups looking for something better than note investing and I have not found anything better in the last 18 years! Click this link to register Wednesday Feb 18th 8PM EST 7PM Puerto Rico

Save for Retirement-Save for Retirement-Save for Retirement-Save for Retirement

I'm sick of hearing that. "Build a nest egg that you can live on for the rest of your life" Yes you do need to put some money together for your first, second and third cash flowing asset. But no one talks about learning how to make more friggin money! And surely never talk about partnering with other people to buy investments as a team. Let me know what you think!

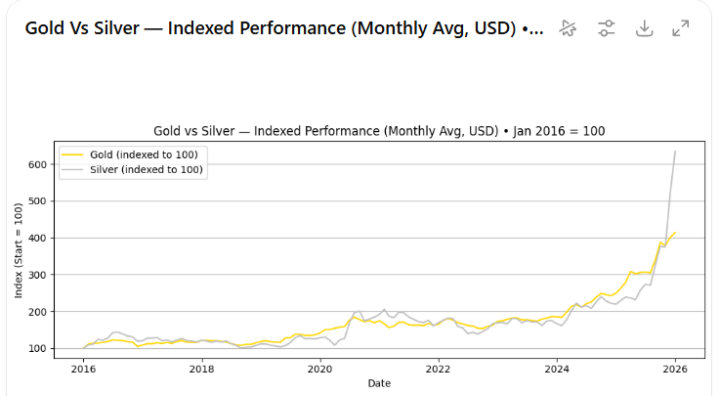

Thread on physical Silver

We have a very interesting thing happening in the silver market. You will want to pay close attention to this thread in the next few weeks. Please comment "I want to be notified" below. We will create a private classroom. This is Huge!

1-10 of 49

@chris-h-1972

Creating opportunities for simple, reliable online income to help retirees or those who want to retire early achieve stress-free financial success.

Active 1h ago

Joined Jun 27, 2025

USA

Powered by