Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

13 contributions to (Free)The Creditprenuer Group

It's now official! Bilt cards start earning rewards on mortgage payments and so much more!

Bilt has announced that starting February 7th, 2026, you will start earning rewards when paying mortgage loans with your Bilt card. Many people have used Bilt to pay their mortgage loans even before this change is put into effect but it's good to know that Bilt is making it official. How many rewards will you earn on mortgage payments? Bilt has not confirmed how many rewards you will earn but it's most likely going to be that same amount that you earn on rent which is 1 point per $1. Bilt has also announced a few months ago a partnership with UWM so potentially UWM mortgages will earn more rewards than others. Again, these are all predictions, and nothing is confirmed yet by Bilt. Bilt is moving over to Cardless Bilt is ending its partnership with Wells Fargo and will be moving over to Cardless. Starting February 7, 2026, there will be new Bilt 2.0 cards which will be issued by Cardless. Three new Bilt credit cards coming Another thing confirmed but without much detail is that there will be 3 different types of the Bilt card. A basic ($0 annual fee), mid-tier ($95 annual fee), and luxury ($495 annual fee). But there is no word yet on exactly which benefits and features each card will come with. Existing Bilt cardholders Once the three new Bilt 2.0 cards will be released, the old Bilt cards will be discontinued. Existing cardholders will have the choice to convert their cards to any of the three new Bilt cards with only a soft pull on their credit. The transition will be seamless, and your credit card number will stay the same. You will also be able to transfer your balance to the new card. As of now the Bilt card is no longer available for new applicants. Due to these changes Bilt has pulled their card from being available for new applicants. The card is no longer available until February 7, 2026. 💯🙏🏽

Chase Partners with Nova Credit...How it will affect Underwriting, Approvals & More! #JeffFormanRepost 🔥

Nova Credit Solutions to be Utilized by Chase | Nova Credit Chase Bank vs. FICO: LLC Owners Use This New Rule to Get Funding

No, the President is not putting an end to FICO scores

However, the current administration has implemented and proposed several changes to the credit reporting and scoring landscape, including: - Accepting Alternative Credit Scoring Models: The Federal Housing Finance Agency (FHFA) has approved the use of new credit scores, VantageScore 4.0 and FICO 10T, for mortgages sold to Fannie Mae and Freddie Mac. These models consider additional data, like rent payments, which could help more Americans qualify for loans, especially those with limited credit history. - Changing Credit Reporting Requirements for Mortgages: Lenders will soon be able to use a "bi-merge" report pulling data from two credit bureaus instead of the traditional "tri-merge" report (three bureaus), potentially lowering costs for borrowers and fostering competition among credit reporting agencies. - Addressing Medical Debt on Credit Reports: The Trump administration is attempting to reverse a Biden-era rule that aimed to limit the impact of unpaid medical bills on consumers' credit history, according to The New York Times. The New York Times reports that a federal judge has blocked a rule intended to make it easier for many Americans to get loans by removing medical debt from credit reports. In addition to these government-related changes, it's worth noting that FICO, a private company, is also making changes to its scoring model, FICO 10T, which will incorporate "buy now, pay later" (BNPL) loan data starting in Fall 2025. This change reflects the increasing use of BNPL loans and could lead to shifts in credit scores for many consumers, according to Newsweek 💯🙏🏽

YALL I Finally launched my podcast🙌🏾🙌🏾🙌🏾 🏆🔥🐐

First episode out now LETS GOOOO! : https://youtu.be/XfXsw5DC84g?si=bBIkmiI_ieMXqSmj

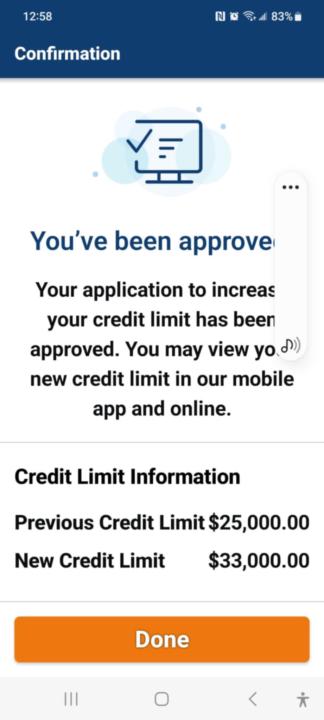

Navy Federal Credit Union CLI (Platinum Card)

NFCU had an app update on my phone, so I did it and went to see if I need to use my pin or fingerprint to access. Once in my account, I said let's see if they will increase my limit (all CRAs are frozen). BAM...$8K increase in less than 2 minutes, went from $25K to $33K! 🤑💯🙏🏽

1-10 of 13

@catrina-jackson-lewis-1152

Hello Everyone! Committed to growing daily. Striving to help others. Blessed and Grateful to be here!

Online now

Joined Oct 4, 2024

United States

Powered by