Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Bitcoin

1.3k members • Free

Bitcoin Sovereigns

619 members • Free

4 contributions to Bitcoin

Precious Metals and Cryptocurrency

Gold, silver, and cryptocurrency can be part of a diversified portfolio, but they come with unique risks and should not replace traditional investments. Precious Metals and Crypto for Beginners | Simple Wealth Guide

🥈 Silver vs ₿ Bitcoin: Don't Fall Into The Switching Trap

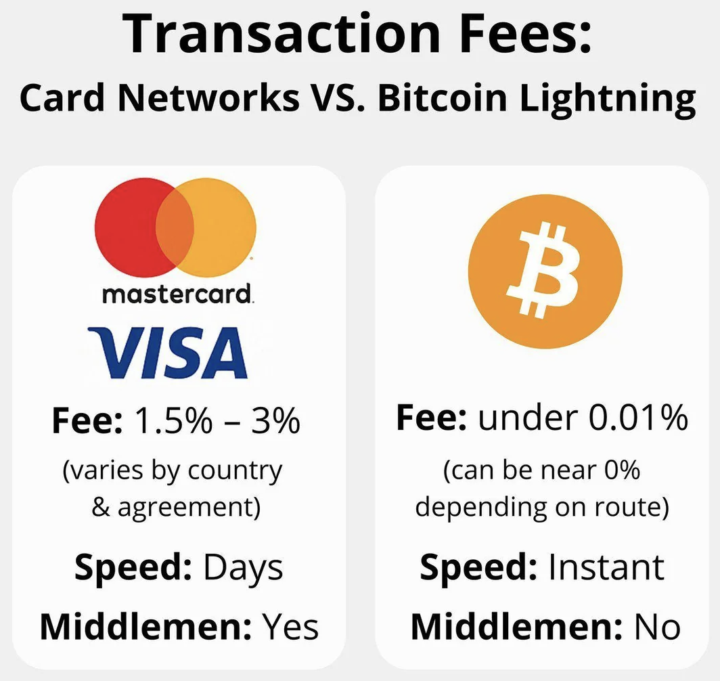

The Silver Opportunity ⚡ Silver can absolutely do well in the coming year. When fear rises and money gets debased, precious metals get a bid. I'm not here to trash silver – it has real utility and has protected wealth for thousands of years. But here's what you need to understand: Silver is not the end game. Bitcoin is. ⚠️ The Deadly Trap Most Investors Fall Into --------------------------------------------------------------------- Here's where people get wrecked. Jumping from one horse to another to chase short-term gains feels smart. You see silver pumping and think you're being tactical. You see Bitcoin dipping and think you're being disciplined. Until you fall off and get trampled. 🐎💥 Most people lose money not because they pick the wrong asset, but because they switch too often at exactly the worst time. They sell the bottom, chase the top, and end up with less than if they'd just stayed put. The wealth isn't made by those who jump around. It's made by those who ride the right horse all the way to the finish line. 💡 My Practical Take for 2025 ------------------------------------------------ If you want to put a small percentage of your emergency fund into silver? Fine. Do it smart: ✅ Physical bars only – no paper, no futures, no ETFs ✅ No leverage – own it outright ✅ No paper promises – if you can't hold it, you don't own it But make a rule right now: 📅 At the end of 2026, rotate back into Bitcoin. Promise yourself you will buy Bitcoin in November 2026 when it usually starts that slow grind higher and everyone is still asleep. Set a calendar reminder. Make it non-negotiable. Silver can be your trade. But don't let it become your prison. 🏆 Why Bitcoin Wins Long Term --------------------------------------------------- Let's get real about the fundamental difference: Silver's Limitations 🥈 - Requires third-party trust again - Storage costs and security risks - Verification requires expertise - Transport is expensive and risky - Settlement requires middlemen - You're back to trusting the same people who have lied time and time again

What’s causing the dip?

With today’s low prices it could be a great day to pick up some bitcoin! What is your thoughts on why the dip?

1-4 of 4

@carolin-myriel-2275

Astrologer helping you discover your role in Bitcoin to leave fiat behind ✨

On Nostr: npub1zak7gja67qka2vpwxcmskkq2qezm60gcw8dlpqda4x3pa0hxam9sdfxu8l

Active 6h ago

Joined Sep 14, 2025

New Zealand

Powered by