Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Darius

Build freedom. Crush debt fast, invest automatically, and own assets that pay you back. Simple systems. Real results.

Memberships

Creator Circle

642 members • Free

Self-Directed Millionaire

2 members • Free

The Real Estate Academy

3.4k members • Free

Real Estate For Real Beginners

607 members • Free

the skool CLASSIFIEDS

1.3k members • Free

Visionary Skool

14 members • $99/m

Who Do You Think You Are?!

39 members • Free

PROJECT MISFIT

20 members • Free

SigmaStartup

63 members • Free

19 contributions to Bitcoin

Precious Metals and Cryptocurrency

Gold, silver, and cryptocurrency can be part of a diversified portfolio, but they come with unique risks and should not replace traditional investments. Precious Metals and Crypto for Beginners | Simple Wealth Guide

Money Printer go BRRRR

Whenever the FED lowers interest rates, the banks print more money. And whenever the banks print more money, bitcoin price goes up. And right now the FED is being threatened to lower the interest rates 😆 https://youtu.be/RFTGjDR72i4?si=H99ja8Vl-UFKssoJ

1 like • Dec '25

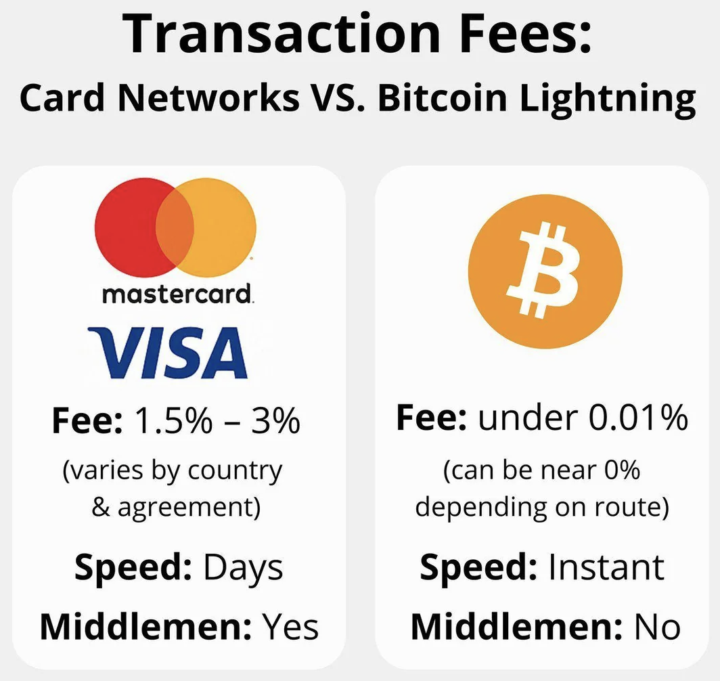

Don't Compare - Stack Layers Let's say Visa, BTC lighting, XRP You tap a Visa card. The merchant settles instantly. Behind the scenes, value moves via blockchain rails. Lightning for small payments. XRP-style rails for global settlement. Same experience for the user. Radically better infrastructure underneath. That’s why serious capital doesn’t pick one. It builds exposure across all three layers.

The Stock-to-Flow model suggests a target price of $500,000 for the 2024-2028 period, indicating a potential for significant appreciation due to Bitcoin's scarcity.

Bitcoin is currently trading at $106,327, experiencing a slight decline of 3.03% from the previous close. The 14-day RSI stands at 45, indicating a neutral market sentiment. The 200-week moving average is at $35,000, and the realized price is $40,000, suggesting that the average investor is at a profit. On-chain metrics show a miner net flow of -5,000 BTC, indicating miners are sending more BTC to exchanges than they are mining. The exchange reserve ratio is 12%, with 65% of BTC remaining unmoved for over a year, reflecting strong long-term holding behavior. ETF inflows over the past 30 days are 5,000 BTC, and hash rate stability is at 1.05, indicating a stable network. BTC velocity is at 0.3, and the inflation differential is 2%, suggesting a moderate inflationary environment.

1-10 of 19

@darius-ellis-8326

Investor & Author | Founder @ Fully Vested | Helping people master money & invest for freedom.

Active 2d ago

Joined Oct 10, 2025

ENTP

Arizona

Powered by