Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

CI

Complete Investing Skool

311 members • $9/month

SC

Simple Crypto Investing

21 members • $19/m

5 contributions to Complete Investing Skool

Complete Investing – Newsletter #2

When No One Is Watching The funny thing about markets — especially crypto — is this: When it’s boring, that’s when the money is made.When it’s quiet, opportunities multiply.When nobody cares… that’s when you should care the most. And at this moment in time… No one cares about crypto. Literally no one. Your mates at work? Not interested. Family? Think it’s dead again and are probably worried your obsessed with crypto. Retail? Gone. Most people are focused on TikTok reels, AI stocks, and complaining about the cost of living. But this is exactly how every cycle starts. It feels lonely. It feels pointless. It feels slow. But behind the scenes — the big players are positioning. They’re accumulating in silence. They’re building the rails for the next 5 years while the average person waits for confirmation. This newsletter is your reminder: If you wait until it feels safe… you’re already late. This skool is all about long term investing. As you may or may not know my favourite way to invest is with low cost index funds. But because of how high inflation is, I’m a strong believer in going high risk with crypto to hedge against inflation. If you are risk averse, stick with low cost index funds. This newsletter will be mainly focused on crypto for the next few months. At least until me and some of the active members in here are able to take profits. MARKET UPDATE 2025 felt like a failure for most investors. Prices stagnated. Altcoins bled. Bitcoin ran early and then went sideways. Liquidity dried up. Retail disappeared. But here’s what I believe to be the truth: Nothing was wrong with crypto.Liquidity simply didn’t arrive yet. Crypto is the furthest out on the risk curve, so when liquidity tightens… crypto gets slapped the hardest. This wasn’t a fundamental problem. It was a macro liquidity problem. And liquidity droughts always end the same way: With a flood. Governments must inject $7–8 trillion over the next 12 months just to service global debt interest. Not to stimulate growth. Not to pump markets. Just to avoid collapse.

Crypto Set To EXPLODE 🚀

Getting Rich With Crypto Is Really Simple I’m not a crypto bro. I’m not an 18-year-old TikTok trader talking about 100X gains. I’m also not here to hype coins, promise shortcuts, or pretend the markets are easy. But after 24 years of investing I am convinced of one thing: Crypto gives everyday investors one of the biggest wealth opportunities we’ve seen in decades. Not because it’s a lottery ticket. Not because you’ll get rich overnight. And definitely not because you need to gamble on the next meme coin. It’s simple because the strategy is simple: • Buy quality assets (the ones solving real problems and with real adoption). • Invest consistently, just like you would in stocks or index funds. • Hold through the noise, because the timelines for real innovation are measured in years, not days. • Avoid chasing hype, influencers, or overnight success stories. • Focus on asymmetric upside, where the potential reward massively outweighs the risk. That’s it. Not flashy. Not sexy. Not social-media friendly. But it’s how real wealth is built — slowly, steadily, and with conviction. Crypto isn’t perfect. It’s volatile. It’s early. It’s still misunderstood. But that’s exactly why the opportunity exists. Most investors won’t take the time to understand what’s happening. Those who do can position themselves years ahead of the crowd. This isn’t advice — just my perspective as someone who’s seen multiple cycles across markets. And the best part? You don’t need to be a genius, a full-time trader, or a tech expert. You just need a plan — and the patience to stick with it. This is the topic of my next video on YouTube @completeinvesting - this will be published tonight @1715. Get it watched and let me know if you agree with my thoughts for crypto in 2026 👍📈

Complete Investing – Newsletter #1

INVESTING IS NOT OPTIONAL ANYMORE Welcome to Complete Investing. This community exists for one reason: To help you build real financial freedom in the world we’re actually living in today. That means we won’t just talk about crypto.We won’t just talk about stocks.And we won’t just talk about index funds. Or any other investment like commodities for example. We’ll cover: - investing across assets - money mindset - and the macro picture that shapes everything in the background Because if you ignore any one of those, your plan is incomplete. Investing Is Not Optional (Especially in the UK) Let’s start with a brutal truth. If you’re living in the UK in 2026 and not investing, you are quietly moving backwards. - Wages don’t keep up with inflation - Cash loses purchasing power every year - The state pension alone is not a plan - imagine waking up at 65 or even 70 and thinking f*** - is that it! I’m sick of seeing people I care about struggling in retirement. People I care about. That’s why I’m so passionate about this skool and my YouTube channel @completeinvesting. This isn’t pessimism.It’s reality. Most people remain earners all their lives. Very few people become owners. And ownership is where freedom lives. The good news? Despite the fact that tax is too high, the current government isnt the best (etc etc), the UK is an excellent place to invest if you play the game properly: - ISAs - Pensions - Global markets - Long-term compounding But none of that matters without one thing… THE HABIT MATTERS MORE THAN THE ASSET People argue all the time (on social media, down the pub, wherever) about: - crypto vs stocks - index funds vs individual shares - gold vs property Here’s the truth most people miss: The asset matters less than the habit. The most powerful investing behaviour is simple: - invest consistently - over a long period of time - regardless of market conditions That’s why I talk so much about dollar-cost averaging (DCA). Not because it’s exciting.Not because it sounds clever. But because it removes emotion, removes timing stress and you don’t have to be an expert. Investing isn’t easy (it requires serious patience and discipline) but it is simple.

1 like • 6d

@Peter Duffy Apologies for the late reply Pete, must of gotten side tracked when reading it a few days ago. Fantastic news letter mate, some top tier information packed into this one. I wouldn’t mind getting into property myself. I’ve had a goal for a little while now of having 3 x houses mortgage free, not including my own before 60 as a little retirement idea. Well that was until I found crypto. I will have to catch up with you one time and have a little chat about what works best for yourself. Hope all you boys have an incredible 2026

Practice What You Preach

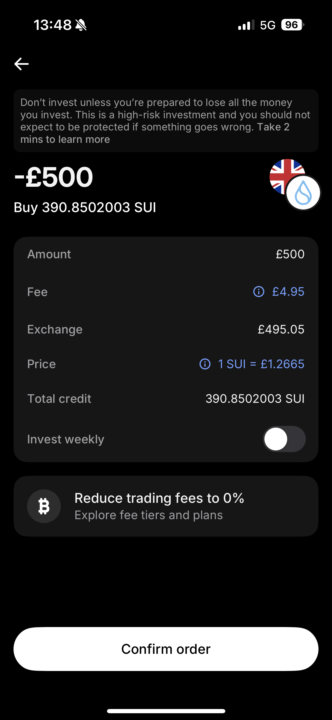

I’m always preaching about how important investing is. I’m always preaching about how important it is to DCA into assets (that you understand and believe in) and to think long term. I’m always preaching about doing everything you can to get spare money to invest. Like doing overtime. Or maybe getting a second job… This applies to crypto, individual stocks, index investing, gold - whatever assets or assets you choose to invest into… Not easy I know! But I do practice what I preach… At the start of 2022 I didn’t have any spare money. So I worked 6-7 days every week so I could invest into crypto each month - this has meant I’ve been able to DCA into assets every single month since June 2022… My spare money was getting tight towards the end of 2025 - due to a higher than expected tax bill and refurb work on some of my rental properties… So I worked in between Christmas and new year. It was brutal but it was worth it… Mainly because the overtime money I got will mean I can DCA into crypto over the next 6 months.

Last group call for my crypto group

Just had our last group call for my crypto group. That group call has really helped me as an investor (crypto investor) - because of the support from the lads in the crypto group... The members of my crypto group (all top lads!!) are now in this group.. They are active members - they know there stuff - they support each other - and have helped me loads.... This will continue in this group every month... You will now get weekly newsletter, monthly group call and more 1-1 support. Let's smash 2026 as investors! @Matthew Thompson @Philip Coser @Mark Franco Spiller If we can get more active members like the lads above - this group will really go from strength to strength..

1-5 of 5

Active 3d ago

Joined Jan 4, 2026

Powered by