Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Wholesale Vacant Land

6.1k members • Free

Dispatcher University (Free)

15.4k members • Free

Real Estate Investing

5.5k members • Free

Wholesaling Real Estate

65.8k members • Free

37 contributions to Wholesaling Real Estate

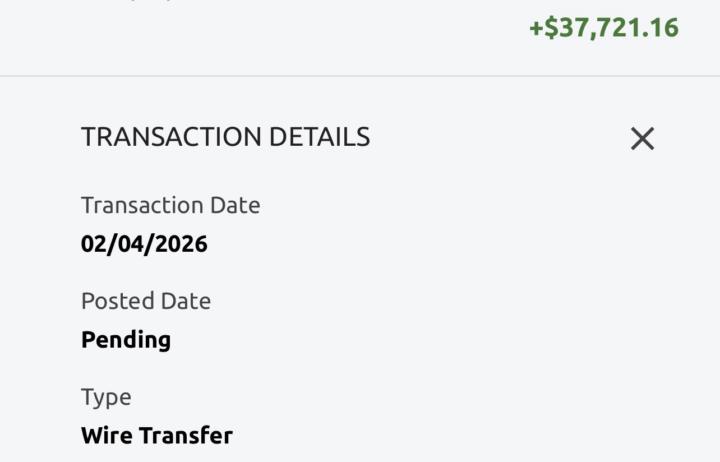

The Drought is OVER

Still processing this. 🤯 Closed a deal today $75k assignment JV’d. Feel like I’m finally at the starting line.

Jacksonville Metro

Anyone have vacant lots in Duval County FL ? Got a buyer trying to pick up 300 lots this year in this county and surrounding areas. Have a JV Buybox for other areas in TN, GA and FL if you’re wholesaling in those markets.

1 like • 6d

@Felicia Williams likewise ! Send me an email for better communication [email protected]

3 likes • 6d

@Maranda Ware let’s go Send me an email for better communication [email protected]

JV Buy box

Get a buy price in less than 24 hours from someone who has been in the game since 2022... Hedgefund Buyers, Local Fix n flip buyers, Buy n Hold Buyers, Land Buyers My primary markets where I'm doing the most and have the best relationships are here: TN (Knox, Chatt, Mem, Nash) GA (ATL & North GA) FL (Tampa) HEDGEFUND BUYERS3 beds 2 baths ideally - some markets okay for 3/1 Some markets are okay for a build year as low as 1950 other markets need to be a 1970 min build year. Lot size 1 acre max - Memphis: Up to $380K, (HIGH PRIORITY market) - Knoxville: Up to $465K, (HIGH PRIORITY market) - Nashville: Up to $500K, (HIGH PRIORITY market) - Atlanta: Up to $405K, (HIGH PRIORITY market) Other Active Markets: Phoenix ($485K), Denver ($550K), Birmingham ($360K), Indianapolis ($355K), Louisville ($370K), Kansas City ($405K), St Louis ($400K), Charlotte ($415K), Greensboro ($380K), Raleigh ($465K), Columbus ($375K), Oklahoma City ($325K), Dallas-Ft Worth ($400K) St. Louis (350 k) This hedgefund is typically buying at around a 8% cap rate - High priority markets can be as low as a 6 cap. Requirements: - No inground pools, No flood zones, No double yellow lines STANDARD FIX N FLIP CASH BUYERS: - Single-family homes - Built 1920+ (more flexible than hedgefund) - 3+bed/2+bath, 900-3,500 sqft - 65-78% ARV - repairs (Please do not ask what market buyers are paying 78% to ARV in...It varies on a deal by deal basis depending on several factors like; neighborhood, rehab level, etc)TN (Knox, Chatt, Mem, Nash) GA (ATL & North GA) FL (Tampa, Jacksonville) LAND BUYERS: - 5,000 sqft - 200 acres - Development potential preferred - General rule: 10% of exit value backed with recent sold vacant land comps (this can vary greatly) TN (Knox, Chatt, Mem, Nash) GA (ATL & North GA) FL (Tampa) Email deals to - [email protected]

2 likes • 6d

@Alexander Thomas I do - but there’s several Brian Lunsford’s lol Email me. [email protected]

Atlanta SFR Fixer Deal

Assignment Deal Under Contract XXXX Campbellton Rd SW, Atlanta, GA 30311 Price: $160,000 ARV: $276,000 3 Bed / 2 Bath Living area: 1,248 sq ft (per tax records) Lot: 24,829 sq ft Build: 1938 EMD: $5,000 COE: 2/18/25 Repair Est: $62,400 Pics: https://drive.google.com/drive/folders/1YzUXeZJmbrtZgQrUg31cjiljAf3dUan5?usp=sharing - Two-story home with gray siding and multiple windows. - Large open grassy lot with a distant house visible. - Driveway accommodates several vehicles. - Kitchen area under renovation with partial appliance removal. - Unfinished garage area with storage items; close to Tyler Perry Studios. Comps: 1485 Ryan St SW, Atlanta, GA 30310 Bedroom > 3 Bathroom >2 SqFt > 1267 Lot Size > 7840 SP > $283,400 1368 Wichita Dr SW, Atlanta, GA 30311 Bedroom > 3 Bathroom >2 SqFt > 1225 Lot Size > 9104 SP > $275,000 1599 Sandtown Rd, Atlanta, GA 30311 Bedroom > 3 Bathroom >2 SqFt > 1283 Lot Size > 13939 SP > $272,000 :zap: Dominate Your Market With a Daily Stream of Seller Leads: https://app.ispeedtolead.com/SELLERLEADS4U Access by appointment call or text Buyer responsible for his own due diligence Jesus 323-579-2654 [email protected]

Daily Marketing Check In! ✅

Make sure to comment below to check in if you’re marketing and getting deals today!!! 😤 This weekend is about grinding not chilling!

1-10 of 37

Active 3h ago

Joined Dec 10, 2024

Powered by