Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

millionaireME

58 members • Free

9 contributions to millionaireME

⏱️ millionaireME Minute: The Two Questions That Determine Whether We Win or Lose at Life

Happy Sunday, friends — just 32 days left in 2025. A perfect day for reflection, renewal, and a little intentional course-correction. Here’s your millionaireME Minute, inspired by Nick Saban — a man who distills success down to two brutally simple questions: 1. Can you do what you don’t want to do? Champions aren’t built on vibes or motivation. They’re built on obedience to the unglamorous. - Showing up to the gym when the couch is whispering. - Getting to work early when you’d rather coast. - Going to church when comfort says “stay home.” - Sitting down with your budget when you’d rather ignore reality. - Choosing the walk, the prayer, the reading, the reps…even when it’s inconvenient. The people who become who they’re meant to be learn to push through the resistance. 2. Can you NOT do the things that harm you, hinder your goals, and/or hurt the people whom you love? This one’s sneaky — because it lives in the shadows of our habits. - Not spending out of boredom or stress. - Not overeating late at night. - Not checking your phone every spare second. - Not skipping the priorities that matter to the people you love. - Not indulging the tiny compromises that become big regrets. Your life is shaped as much by what you avoid as by what you pursue. Put together, these two questions create the quiet excellence Saban is famous for: Do the good you resist. Resist the harm that tempts you. Repeat. Your turn — for these final 32 days, which “hard yes” or “smart no” will make the biggest difference in your life? millionaireME | Happy • Healthy • Wealthy • Wise 🐷 🚀

The millionaireME Minute | The Seeds of Wealth by Justin Ford 🌱

Greetings! It’s Wednesday, November 19, 2025. There are 42 days left in the year. We all want abundance—more peace, more margin, more time, more money. But Justin Ford’s “The Seeds of Wealth” reminds us that before anything grows, it must be planted. Wealth—like agriculture—isn’t magic. It’s a system. And systems reward the people who understand seasons, soil, and stewardship. 1. Every Harvest Begins With a Seed Ford’s central point is simple: small, consistent actions yield outsized results. In financial terms, this means: • Automatic savings → grows roots • Debt reduction → pulls weeds • Investing regularly → waters the soil •. Skill-building → enriches the land Application: Pick ONE seed today: 1% more savings, one less subscription, one extra walk, or one intentional act of generosity. Seeds compound. ⸻ 2. The Soil You Plant In Matters Ford stresses the importance of environment—your mindset, habits, and relationships. Rocky soil = impulse, comparison, chaos. Rich soil = patience, gratitude, structure. Application: Create fertile soil by mastering your rhythms: •. Weekly money review •. A written plan •. A small “friction tax” against impulse purchases •. Accountability (your millionaireME community) ⸻ 3. Weather Happens—Plan for It No farmer expects perfect weather. Investors shouldn’t either. Markets wobble. Life surprises. Ford’s wisdom? Prepare before the storm. Application: •. Build your emergency fund •. Diversify investments •. Stay consistent when it rains •. Don’t harvest too early—let compounding do its work ⸻ 4. Harvest Is for Sharing, Not Hoarding One of Ford’s most beautiful points: wealth grows best when it circulates. Generosity, service, family stewardship—these are the fertilizers that multiply both joy and financial well-being. Application: Plan your giving like you plan your spending: intentionally, not accidentally. ⸻ 5. The Farmer Doesn’t Chase the Crop—He Tends the Process This is Justin Ford’s deep magic: wealth is less about outcomes and more about daily faithfulness.

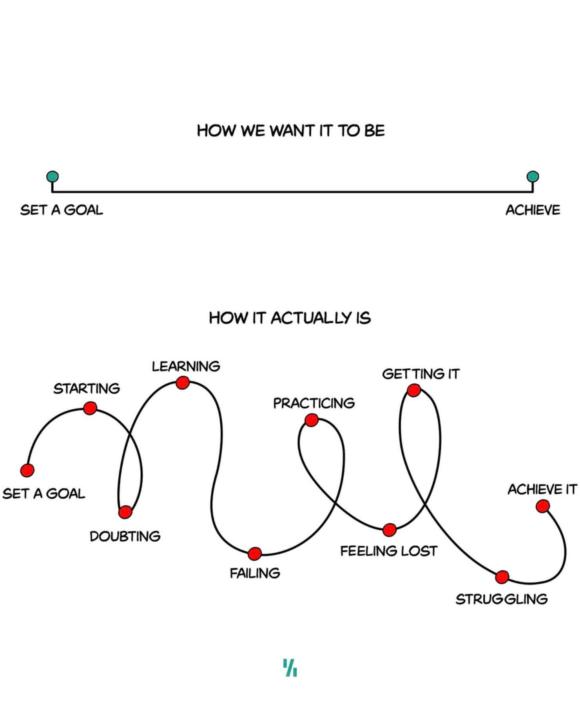

⏱️ millionaireME Minute: The Real Path to Goals 🎯

Greetings! It’s Tuesday, September 23rd, 2025. There are 99 days left in the year. As in “I got 99 problems but wealth and wellness ain’t among them.” We all want our goals to look like a straight line: Set a goal → Achieve it. But reality looks more like this: doubting, learning, failing, practicing, struggling, feeling lost… and only then, finally, achieving. The difference isn’t in the path—it’s in the persistence. The key? Grit. The refusal to quit, even when the journey feels like two steps forward, one step back. 💰 In wealth: Saving for an emergency fund feels slow until one day it’s there—protecting you. 🏋️ In wellness: Building strength is weeks of sore muscles before that weight finally moves. Every stumble is part of the process. Every detour builds resilience. 👉 Your call to action: Don’t mistake the messy middle for failure. It’s proof you’re still in the game. Stay gritty. Stay in it. Your breakthrough may be just one more rep, deposit, or decision away. You got this! ⸻ millionaireME: Happy • Healthy • Wealthy • Wise 🐷 🪽

⏱️ millionaireME Minute: The Power of Walking 🌟

Good morning. It’s Thursday, September 25th, 2025. There are 97 days left in the year. Of all the choices in the realm of exercise, walking stands alone as the most impactful—physically, mentally, and spiritually. Physically Walking strengthens the heart, boosts circulation, lowers blood pressure, aids digestion, and helps maintain a healthy weight. Unlike high-impact exercise, it’s sustainable across decades of life. You don’t need fancy equipment, just a good pair of shoes—and ideally, some open sky. Mentally Walking clears the fog. Studies show it reduces anxiety, enhances memory, sparks creativity, and even combats depression. When you’re moving forward physically, your mind often follows—finding clarity, solutions, and perspective you can’t reach sitting still. Spiritually From Genesis to Revelation, “walking” is shorthand for life with God. Enoch walked with God. Abraham was told to walk before Him. Micah 6:8 calls us to “walk humbly with your God.” Walking isn’t just a way to get from here to there—it’s a picture of daily companionship, obedience, and transformation. And why outdoors? Because nature always has been—and is—the first, best, ultimate cathedral. A mountain trail, a park path, even your neighborhood sidewalk becomes holy ground when you realize you’re walking with Him. The fresh air lifts your spirit, sunlight fuels your body, and nature whispers reminders of God’s presence. 👉 Call to Action: This week, carve out time to walk. Not just to exercise, but to connect. Walk with intention—breathe deeply, listen closely, and talk with a friend or God as you move. It could be the simplest, most powerful step you take toward health, wealth, and wisdom. 🚶♂️💡🙏 #millionaireME #UnleashYourInnerTBA #WealthAndWellness ⸻ millionaireME | Happy • Healthy • Wealthy • Wise 🐷 🪽

⏱️ millionaireME Minute: Financial Advice I Wish I’d Received in My 20’s 🐷🪽

Greetings! It’s Thursday, September 18th, 2025. There are 104 days left in the year. One day, my dad looked me in the eye and said something that’s stuck with me ever since: “Enough about wealth management. I want to hear what you have to say about wealth creation.” At the time, I was already deep in the world of managing money—allocations, risk profiles, market cycles. But his words hit me like a splash of cold water. Managing money matters, but, without a doubt, creating wealth in the first place is the foundation. If I could go back to my 20’s with what I know now, my mind would run straight to these simple but powerful truths: 1. Live below your means—don’t flex for people who don’t pay your bills. 2. Start investing early—compound interest is your silent millionaire-maker. 3. Save before you spend—not the other way around. 4. Build an emergency fund—life happens, be ready. 5. Learn a high-income skill—it opens doors that a degree alone cannot. 6. Avoid lifestyle inflation—just because you earn more doesn’t mean you should spend more. 7. Budgeting isn’t boring—being broke is. 8. Focus on assets, not liabilities. 9. Side hustles matter—they teach you business and add income. 10. Your 20s are for building, not balling. But alas—we can’t turn back time, can we? On the bright side, though, as the proverb reminds us: “The best time to plant a tree was 20 years ago. The second-best time is now.” 🌳 And, lucky us, thanks to my dad’s good question that got the wheels turning, we aren’t without an answer. Or hope. For we have the ultimate strategy and community in the way of millionaireME! So whether you’re 20, 40, or 60, the same truth applies: start creating wealth (and, while at it, wellness!) today. 👉 What financial advice do you wish someone had given you in your 20’s? #millionaireME #WealthWisdom #UnleashYourInnerTBA #Happy #Healthy #Wealthy #Wise 🐷🪽

1-9 of 9

@bill-winfrey-3418

NC; do team & leadership dev; m to Nancy 39y; 2 kids; a sm non profit; like to travel, write, guitar, exercise

Active 19d ago

Joined Mar 11, 2025

Powered by