Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Flip Flop Flipper Real-Estate

3.8k members • Free

Apex Real Estate

233 members • $127/m

Real Estate Wholesaling Empire

92 members • $97/m

Retirement CASH FLOW

460 members • Free

Movimiento FIRE™

10.5k members • Free

6 contributions to Retirement CASH FLOW

Wealth

Wealth is a mindset not a destination. I just spent 3 fun days with family in Atlantic City. Really enjoying gaming. Casinos have a brilliant way of messing with people's minds when it comes to gaming/gambling. They quickly remove the real currency we all work so hard to earn and convert currency to chips and slips of paper. Everyone knows that the house has a clear advantage in every wager we make in every game we play, but we still go. So I really paid attention to every emotion I was feeling in the potential losing money process and came to the notion that my attitude changed dramatically from day one to the second day. Day one, I was walking around with the mindset of scarcity. I started out with $400 and I really had a tight leash on whether I was up or down, above or below the $400 mark. But then day 2 I lost track. I was now focused on how large my bets were and stopped caring about that number. This is where the magic happened. I was focused on the deal not the number. It was then that I was treating the gambling game as I do my real estate game, focused on the deal. I was focused on the size of the potential return of each individual bet. Two completely different emotions! It dawned on me "wealth is a mindset not a destination" playing off of the saying "life is about the journey not the destination" My terrible analogy Ha! Have a great Memorial Day Weekend

What I did yesterday...

...was to look at, at least 50 properties on various websites in the areas we want to buy rental properties in. What that does is familiarizes me first with areas and neighborhoods I am interested in, and the variations of ask price vs potential income each property could produce. I am sticking with my tried and true formula I was taught 25 years ago. 1% of the purchase price must be the minimum amount of the monthly rent. Example purchase price $140,000 monthly gross rent must be a minimum of $1,400. You are saying yeah right! Where am I going to find a house for $140,000? Puerto Rico that's where! We are starting up a Weekly Webinar (RCF) on this topic as well as other educational investment topics so you can follow along with our progress evaluating various properties for both long and short term rentals and how we will source funding for these deals with very little money out of pocket. We will show you the tools we are using, mostly Artificial Intelegence for the due diligence evaluation process and finding truly good deals across the Island. It's all about "Retirement Cash Flow" People! We will show you our process of making offers that fit our criteria for cash flow. Drop a line below if you might find this a point of interest!

How many?

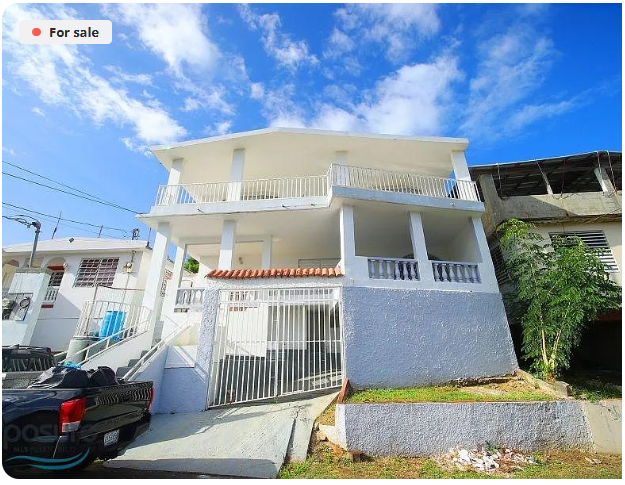

I wonder how many cash-out refinances we have done over the past 26 years as investors. We have a closing scheduled this month with our largest cash-out ever and we may purchase a multi-family or 2 in Puerto Rico. Prices down there seem to make more sense than here in the states, but Cash Flow is cash flow. We have stuck with this formula since day one. At least 1% of the purchase price has to be the rent amount. Our first investment was a 2 family here in Point Pleasant that we bought for $140,000 and the current rent then was $1,400 exactly 1%. At the time we thought $140,000 was a $h!t ton of money but the numbers didn't lie then and they don't lie now. The more houses you look at, the more chances you have of finding a real deal. In Puerto Rico, the numbers are more like 2% using conventional financing. The more we put down, the better the numbers. Check this one listing out This is just off Zillow, without having boots on the ground yet. This place is sweet, and their ask price is awesome! Let me know what you think in the comments below...

Pulling Equity

Am I missing anything here? Let's say you own 3 properties, each having $300k of equity and each having an existing mortgage that requires 2k each per month debt service. All you want to do is Always Lower your Monthly Expenses and get your hands on the $900k Tax Deferred or Tax Free. You could cash out refinance (through conventional financing or a *DSCR commercial loan) which would be a non taxable event. But you would be required to service the new mortgage with the new monthly payment/s. You could sell the 3 properties and utilize the benefit of a 1031 exchange, acquire some other property or properties. If the purchase price of the new property is at $900k you would not have debt to service which would significantly lower your monthly expenses and you would have a fresh property to depreciate. *Debt Service Coverage Ratio

1-6 of 6

@angel-madera-9006

Hi, lm born and raised in Philadelphia, I'm in the construction field

I also buy fixing and rent homes. looking to do more projects in Puerto Rico

Active 9h ago

Joined Dec 2, 2024

Dorado

Powered by