Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

The Real Estate Academy

3.4k members • Free

Wholesaling Real Estate

3.1k members • Free

Business Builders Club

3k members • Free

Owner Finance Academy

102 members • Free

RE

Real Estate Starters

29 members • Free

The Creative REI

144 members • Free

Real Estate Marketing Secrets

26 members • Free

Ground Breakers

137 members • Free

Real Estate Accelerator Lab

187 members • Free

1 contribution to Tradeline Secrets

Why I Don't Compete With "Funding Gurus" Anymore

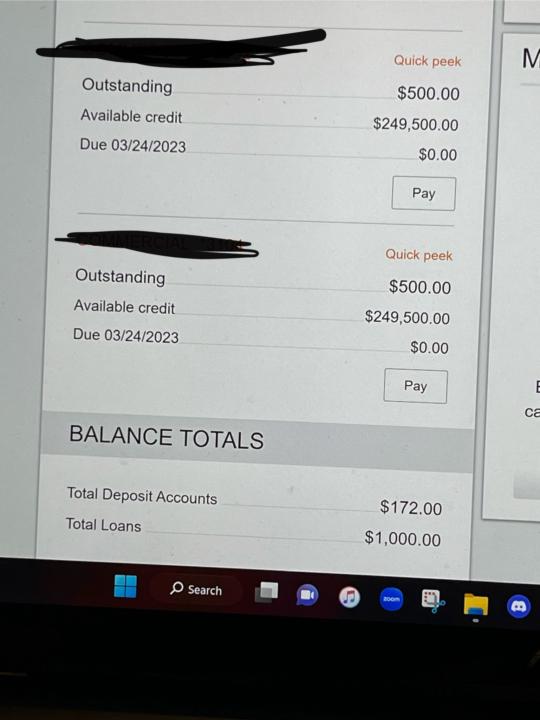

Same client. Two separate $250,000 business lines. That's $500,000 in straight cash buying power. Let me be clear about something: I'm not a credit card stacker. I'm a loan broker building a national syndicate. While most "funding gurus" are still teaching you how to get approved for a $5,000 Office Depot card... I'm placing clients into: - Six-figure business lines of credit - SBA acquisition loans through specialized partners - Commercial real estate financing - Business purpose mortgages Here's the difference in market positioning: The typical funding program sells you on business credit cards because that's all they know how to execute. I use 0% business credit as the entry point because of speed and accessibility—but that's just the beginning of what's possible when you understand the full lending landscape. My network includes: - SBA loan specialists who close acquisition deals - Commercial lenders who structure property financing - Private money contacts for deals banks won't touch - A growing syndicate of lending professionals across every major vertical Most "funding companies" teach the same recycled Paydex playbook because they've never actually worked in lending. I've been in this industry since 2016. I understand bank underwriting. I know what signals approval across personal credit, business credit, and institutional lending. This education isn't about credit cards. It's about understanding the entire funding ecosystem so you can access the right capital at the right time for the right purpose. - Need fast working capital? Business credit cards. - Need to acquire a business? SBA specialists in the network. - Need commercial property financing? I've got the referral. That's why VIP aren't just "credit stacking courses." They're designed to teach you how funding actually works across the spectrum—so you're not limited to one lane like every other program out there. The credit card stack is the hook. Still treating this like a credit card group? You're missing the point.

1-1 of 1

Active 1h ago

Joined Jan 25, 2026

Denver, CO.

Powered by