Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Owned by Alejandro

Memberships

The Disciplined Man Blueprint

66 members • Free

Skoolers

179.4k members • Free

Growth Lab By ROAS.co 🧪📈💰

25 members • $997/m

Shot Callers Inner Circle

233 members • Free

Selling Online / Prime Mover

33.6k members • Free

Sales & Leadership Academy

533 members • $97/m

reTHINK RICH Academy ELITE

319 members • $29/m

IG Growth Funnel

267 members • Free

Digital Scaling Community

638 members • Free

3 contributions to Deal Boss Project-Real Estate

Why Do People Want to Become Real Estate Investors?

Real estate investing isn't just about buying properties. It's about changing your life. It’s a chance to take control, build a future, and make money work for you. Here’s why so many people choose this path: 1. Freedom Through Passive Income Who wouldn’t want to earn money without lifting a finger? Real estate gives you the opportunity to generate passive income, letting you collect rent checks month after month. Imagine waking up to cash flowing into your account, giving you the freedom to live life on your terms. 2. Creating True Wealth Real estate isn't just a get-rich-quick scheme; it’s a long-term wealth builder. As your properties grow in value, so does your net worth. This isn't just about today. It’s about building a legacy that lasts for generations, a nest egg that grows whether you’re working or relaxing. 3. Tax Breaks That Add Up Let’s face it: taxes suck. But real estate gives you a way to legally reduce your tax burden. You can write off things like maintenance costs, property taxes, and even the depreciation on your properties. That’s more money in your pocket to reinvest and build even more wealth. 4. Take Control of Your Destiny In real estate, YOU make the decisions. You get to choose which properties to buy, how to finance them, and what to do with them. You’re not at the mercy of someone else’s rules—you’re in charge of your financial future, and that power is empowering. 5. A Shield Against Inflation When the cost of everything else goes up, your real estate investment often keeps pace. Property values and rents tend to rise with inflation, protecting your wealth from eroding. In times of economic uncertainty, real estate acts as a safe haven for your money. 6. Long-Term Peace of Mind Real estate can be the anchor in your financial portfolio. With proper management, your investments can provide you with stability, something that’s hard to find in the volatile stock market. It’s the foundation of a secure future, where you don’t have to worry about outliving your savings.

Poll

6 members have voted

3 likes • Mar 7

I am called to house the homeless, specifically homeless that have a disability, 4/10 people that are homeless have a disability and they have been left alone from parent/guardians passing away. I am going to build multi-unit properties to help train and empower people with disabilities to live independenlty with support. Currently I am special education teacher building my wholesale business, and with many mistkes and failures, I am continuing to grow and persevere and empower others around me. DO NOT GIVE UP! Life is an Adventure especially when you have an eternal mindset.

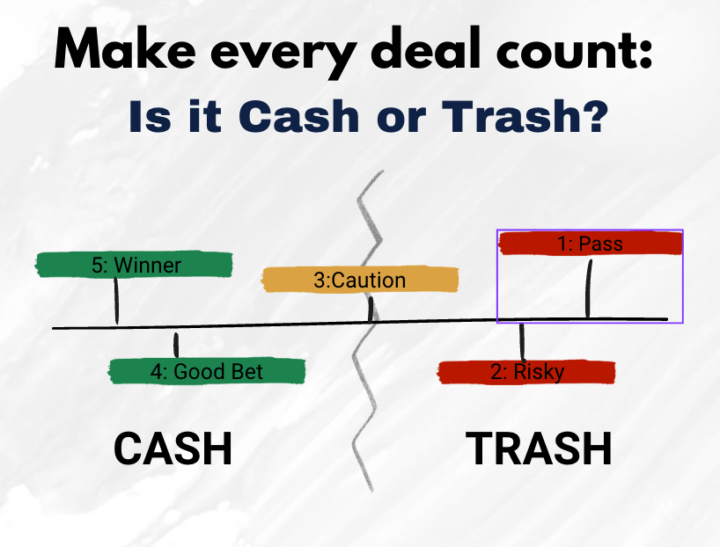

Make every deal count: Cash or Trash

Early on, I realized that chasing every real estate deal was a giant waste of time. I needed a system and a way to quickly decide whether a deal was worth pursuing or just dead weight. That’s when I came up with the CASH or TRASH Method. My team was full of go-getters, but most of them had zero real estate background. I needed a process so simple that even a newbie could jump in and make smart decisions. The solution? A 5-STEP SYSTEM that cuts through the noise. 1️⃣ I get all the key documents such as loan statements, payoff info, title searches and etc. This gives me the hard facts. 2️⃣ I set a baseline by running a quick comp and checking the property’s details. 3️⃣I look at market trends and buyer activity to see if there's real demand. 4️⃣ I plug everything into my deal analyzer, which shows the complete picture: acquisition cost, repairs, holding costs, and more. 5️⃣ I score the deal from 1 to 5. If it's a 5 or 4, we move forward; 3, we use caution; and anything lower, we cut it loose. The beauty of the CASH or TRASH METHOD is that it removes guesswork and makes sure every deal aligns with our profit goals. It saved my time, boosted our ROI, and made real estate accessible to anyone on my team. That’s why I built it, because smart decisions in real estate shouldn’t require years of experience. It’s all about having the right process, and that’s how you win. If you want to chat about this or just need a little clarification, feel free to reach out!

🚨 The Shocking Truth About "Hot" Real Estate Markets

(What 99% of Investors Get Dead Wrong) Think you need to invest in major markets to find the best deals? Think again. Our latest Market Study Report just revealed something that's going to make a lot of investors uncomfortable... Some of the highest-scoring markets for profitable deals aren't where you'd expect: • Mason County, IL (population: 485) → Score: 99 • Iron County, MI (population: 482) → Score: 99 • Knox County, TX (population: 1,164) → Score: 99 Meanwhile, "hot markets" everyone's chasing? • Los Angeles County (population: 10M+) → Score: 24 • Miami-Dade (population: 2.7M) → Score: 33 • Phoenix Metro (population: 4.9M) → Score: 30 🤔 Why This Matters: Remember 2008? While Miami crashed 50%, cities like Midland, TX barely felt it. During COVID? While San Francisco emptied out, small markets in Connecticut and Rhode Island saw values soar. Here's the uncomfortable truth: Following the crowd to "hot markets" isn't just wrong... It's exactly why most investors struggle to find profitable deals. 💡 The Real Estate Success Secret Nobody Talks About: Real estate isn't national – it's hyperlocal. Every ZIP code has its own: • Deal flow dynamics • Profit margins • Buyer activity • Market momentum The data shows: The biggest opportunities often hide in smaller markets where: ✓ Competition is lower ✓ Margins are higher ✓ Deals are more plentiful 🎯 The Smart Play: Stop following the herd. Start following the data. Look at these surprising stats from our latest report: See the TOP Markets HERE What surprised you most about where your market ranked? Drop your thoughts below 👇 #RealEstateInvesting #MarketAnalysis #InvestorEducation #MarketDomination

Poll

42 members have voted

1-3 of 3

@alejandro-carbajal-1381

I want to live my life to be able to say "I have fought the good fight, I have finished the race, I have kept the faith."

Active 1d ago

Joined Feb 19, 2025

Jefferson Park

Powered by