Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Albert

Free swing‑trading school for 9–5 pros who want clear levels, rules, and less screen time using the No‑Chase Swing Method.

Swing trade U.S. stocks & crypto around your 9–5 in ~10 minutes a night with a rules-based no-chase method so you stop staring at charts.

Memberships

WavyWorld

44.8k members • Free

AI Automation Society

252.1k members • Free

Creator Accelerator

237 members • $80/month

148 contributions to Free Swing Trading Watchlist

How I’m Thinking About This “Irrational” Market (pulled from the Desk)

A lot of you have been DM’ing and commenting variations of: - “Is this the top?” - “Should I just go to cash?” - “Why does nothing make sense right now?” Rather than give you a one-liner, I wanted to show you exactly how I walked Desk members through this environment today. This is taken straight from our paid Trading Desk, but I’m sharing it here because: - The market is emotional and confusing for a lot of 9–5 traders right now - Seeing the process for how I frame risk, structure, and opportunity matters more than any one hot take Use this to slow down, zoom out, and make decisions from structure instead of fear. . . . . . MARKET CONTEXT UPDATE — HOW I’M THINKING ABOUT RISK RIGHT NOW S&P 500 vs US 100 I want to walk you through how I’m reading this market, not to predict what happens next — but to show how I frame risk, structure, and opportunity when conditions shift. __________________________________________________________________________________________ STEP 1: START WITH THE BROAD MARKET (S&P 500) Today’s session produced a clear bearish impulse on the daily candle.That matters — because impulse tells us who’s in control right now. - Sellers showed initiative, not just reaction. - This shifts my short-term mindset from “support first” to “where would supply matter?” What I’m watching: - Supply: 6945 – 7006 If price retraces here, I’m paying attention to seller behavior, not blindly shorting. - Demand:The most recent demand has already been partially mitigated. To me, that reduces its ability to act as strong support. - Next valid demand: 6524 – 6662This is where downside would begin to make structural sense, not emotional sense. Key point: I’m not bearish because price went down. I’m cautious because structure changed and prior demand weakened. __________________________________________________________________________________________ STEP 2: CHECK LEADERSHIP (US 100 / TECH) This is where the message gets clearer.

0

0

Update: 1 Celebration Founder Spot Re‑Opened

Quick update on the 100‑member milestone offer: All 5 Celebration Founder spots for The Swing Trading Desk were claimed during the 7‑day window… …but one person just canceled during their trial. That means 1 Celebration Founder spot has re‑opened at $35/month. After this is taken, the Desk is back to the regular $59/month for new members. What this last Celebration Founder spot gets (vs the free community) You keep everything you already get here in the free Skool plus: - Locked‑in $35/month instead of $59/month - Full access to The Swing Trading Desk, including: - A much more detailed No‑Chase Swing watchlist + key levels than what I post for free - My trade entries as I take them, so you can see exactly how I’m applying the method in real time - Discussion with other serious 9–5 traders using the same rules‑based process Free community = education, lighter watchlists, and general guidance. The Desk = the full implementation environment + my actual executions. Markets are messy right now, which is exactly when a rules‑based swing process matters most for 9–5 traders who can’t watch charts all day. How to grab the last spot If you want this final $35 Celebration Founder spot: 1. Send me a DM here in Skool with the word “FOUNDER”. 2. I’ll reply with the special $35/month signup link (public page shows $59). 3. You’ll still get a 7‑day free trial. If it’s not a fit, cancel within the first 7 days and you won’t be charged. Once this 1 re‑opened spot is taken: - The 100‑member celebration offer is fully closed, and - All new members are at the regular $59/month.

0

0

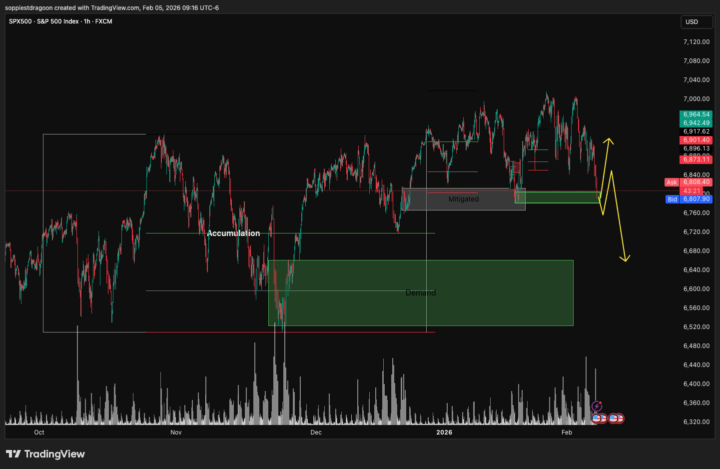

SPX 500 — NEUTRAL (DECISION ZONE)

HTF CONTEXT: The index is sitting at a major decision area where buyers must defend to keep the broader bullish structure intact. This is where markets either stabilize… or roll into a deeper retracement. WATCH WINDOW: Watching over the next few trading sessions for confirmation of strength or failure. STAND-ASIDE CONDITION: If buyers fail to show a meaningful response here, the odds shift toward a continued pullback — patience matters more than prediction.

0

0

🟠 BITCOIN (BTC) — HTF AWARENESS UPDATE

Context: Bitcoin has pulled back meaningfully from all-time highs and is now trading in a zone where long-term participants start paying attention. This is not a call for a bottom. It's a reminder to zoom out when volatility rises. WHAT I’M WATCHING (BIG PICTURE) • BTC is down ~40%+ from highs• Volatility has increased• Sentiment has shifted from euphoria → caution Historically, these conditions are where risk/reward begins to change, even if price continues lower. WHY THIS MATTERS Most people miss long-term opportunities not because price never gets there —but because fear shows up before preparation. When markets feel uncomfortable: - Retail reacts emotionally - Experienced participants slow down and plan This is a planning phase, not a prediction phase. IMPORTANT DISTINCTION This is not: - A trade setup - A timing call - A “buy here” post This is: - Higher-timeframe awareness - A reminder to think in probabilities, not headlines - A cue to start building a plan before decisions feel urgent FINAL THOUGHT If you’ve wanted Bitcoin exposure for a long time but never felt “comfortable,”this is usually what early opportunity zones feel like — unclear, volatile, and emotionally noisy. The goal isn’t to act impulsively.The goal is to be prepared when price comes to you. Full positioning frameworks, execution rules, and risk planning are shared inside the Desk.

0

0

Market Update

Software stocks sold off hard early today, but many bounced from their lows. That usually means sellers may be getting tired and buyers are starting to step in. This doesn’t confirm a bottom, but it does suggest things may be stabilizing — or setting up for a short-term bounce. At the same time, weakness looks like it’s rotating out of software and into chip and memory stocks, which have been strong recently. Even with all the volatility in tech, the broader market is holding up well. The equal-weight S&P is moving higher, showing strength outside of just a few big names. Earnings have been mixed, with more disappointments than surprises, and economic data today showed slowing growth but still-high inflation. Bottom line: tech is still messy, but early signs of buying in software mean it’s worth watching closely — not chasing.

0

0

1-10 of 148

@albert-wang-6506

9–5 pros: swing US stocks + BTC/ETH.

No‑Chase Method.

Timestamped setups BEFORE trigger.

No scalping, penny stocks, or alts.

Active 13m ago

Joined Oct 15, 2025