Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Free Swing Trading Watchlist

94 members • Free

264 contributions to Trading Growth Engine

Introduction

What’s up TGE crew 👋 I’m Jordan, checking in from Northern California. I’m here for one reason: I’m obsessed with the intersection of AI, automation, and trading discipline. I’m not chasing dopamine candles, I’m chasing repeatable systems that remove emotion from the equation. Background-wise, I’m a student with a heavy interest in psychology, behavioral patterns, and how humans consistently sabotage themselves in markets. That naturally pulled me toward AI-driven strategies, bots, and rule-based execution. Let the machine stay calm while the market throws tantrums. Trading-wise, I sit in the swing trader / system builder lane. I care more about edge, probability, and execution quality than prediction. If a strategy can’t be automated, stress-tested, and survive bad weeks, I’m not interested. What I like about trading: • Turning chaos into structure • Letting data tell the truth • Watching boring systems quietly outperform flashy guesses Here to learn, test, break things, rebuild them smarter, and collaborate with people who take this seriously without taking themselves too seriously. Looking forward to leveling up inside TGE 🚀 — Jordan 🐵📊

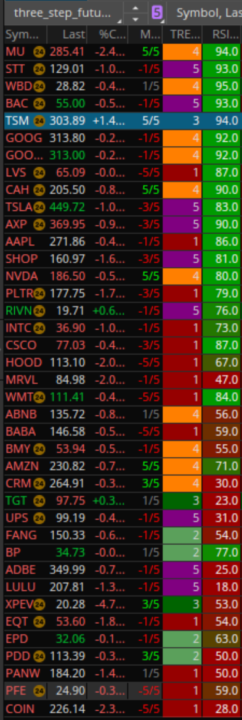

What are you trading today?

Last trading day of 2025 what tickers are ya'll looking at Gextron for? the last one I checked was DIS for calls Jan 16 118

1-10 of 264

@manj-dona-1959

We ( Shan & Dona) Help Entrepreneurs create their online brand assets. Let's build your brand!

Active 21h ago

Joined Nov 16, 2024

Thompson

Powered by