Write something

How to Read a Credit Report Like a Lender 🧠💳

When you read a credit report, you see history. When a lender reads it, they see risk. Here’s how to switch lenses. 1️⃣ Identity Section You see: name, address, job Lender sees: stability or chaos They look for: - Multiple name variations - Too many addresses in short time - Mismatched employers 💡 What it means: instability equals risk. Clean identity data lowers friction in approvals. 2️⃣ Trade Lines (This Is the Main Event) This is where lenders spend most of their time. They scan for: - Account age: older is safer - Limits vs balances: who can handle leverage - Payment patterns: not perfection, predictability 💡 Pro tip: One 30-day late hurts more than a small collection. Lenders hate broken patterns. 3️⃣ Utilization (The Silent Killer) You think: “I pay on time” Lender thinks: “They’re maxed out” They care about: - Individual card utilization - Overall utilization - Who is close to the limit Rule of thumb lenders love: - Under 30% is acceptable - Under 10% is elite - 0% can actually look inactive 😏 Yes. Too responsible can look suspicious. 4️⃣ Payment History (It’s Not About One Late) Lenders don’t panic over a late payment. They panic over patterns. They look for: - Repeated lates - Recent lates - Lates on high-limit accounts 💡 A late last month hurts way more than one from 4 years ago. 5️⃣ Inquiries (Velocity Matters) You see: “Just checking” Lender sees: desperation or strategy They ask: - How many inquiries - How recent - How clustered Multiple inquiries in a short window screams: “I need money now.” Spacing inquiries looks intentional. Intentional looks safe. 6️⃣ Account Mix They want to see you can manage: - Revolving credit - Installment loans But here’s the secret: They prefer clean revolvers over messy installment loans. A maxed card hurts more than a paid auto loan helps. 7️⃣ Derogatories (Severity Over Quantity) Lenders rank negatives like this: 1. Bankruptcies 2. Charge offs 3. Collections 4. Late payments

1

0

✈🏾💳 HOW TO TRAVEL FOR FREE (YES FREE FREE)

Not discounted Not kinda free Not “I only paid taxes” free I mean points + strategy = zero out of pocket 😮💨🔥 Let’s break it ALL the way down step by step. 🧠 STEP 1: UNDERSTAND THE GAME Airlines and hotels don’t make money off flights They make money off banks Banks give you points Airlines accept those points like cash You’re not hacking the system You’re finally using it correctly 💳 STEP 2: GET THE RIGHT TYPE OF CREDIT CARD Not any card A TRAVEL REWARDS CARD You want cards that give • 60k to 100k points for signing up • Points on everyday spending • Transfer partners (this is KEY) One card alone can cover • A round trip flight • Or 3 to 5 hotel nights That’s a vacation off one application 😭✈🏾 🔁 STEP 3: HIT THE BONUS WITHOUT SPENDING EXTRA This is where people mess up You do NOT spend new money You move EXISTING bills • Rent • Gas • Groceries • Phone bill • Insurance You were paying these anyway Now they’re paying YOU back in points 💰 ✈🏾 STEP 4: TRANSFER POINTS (THE REAL CHEAT CODE) This is where free travel is born Instead of booking directly You TRANSFER points to • Airlines • Hotels Example • 25k points transferred = $600 flight • 30k points = 4 nights hotel Same trip booked with cash $1,500+ Points booking $0 That’s robbery in your favor 😎 🏨 STEP 5: STACK FLIGHT + HOTEL POINTS Advanced move right here You use • Airline points for the flight • Hotel points for the stay Now your ONLY cost might be food And let’s be honest You were gonna eat anyway 😭🍽️ 🛋 STEP 6: FREE PERKS MOST PEOPLE IGNORE Travel cards often include • Free checked bags • Airport lounge access • Travel insurance • Trip delay coverage People pay hundreds for these You get them automatically just for having the card Luxury on autopilot ✨ 🚫 WHY MOST PEOPLE NEVER TRAVEL FREE They think • Saving is the strategy • Credit is bad • Points are confusing Truth is They just were never taught And nobody gets rich or well traveled by saving alone Credit gives speed. Strategy gives access.

2

0

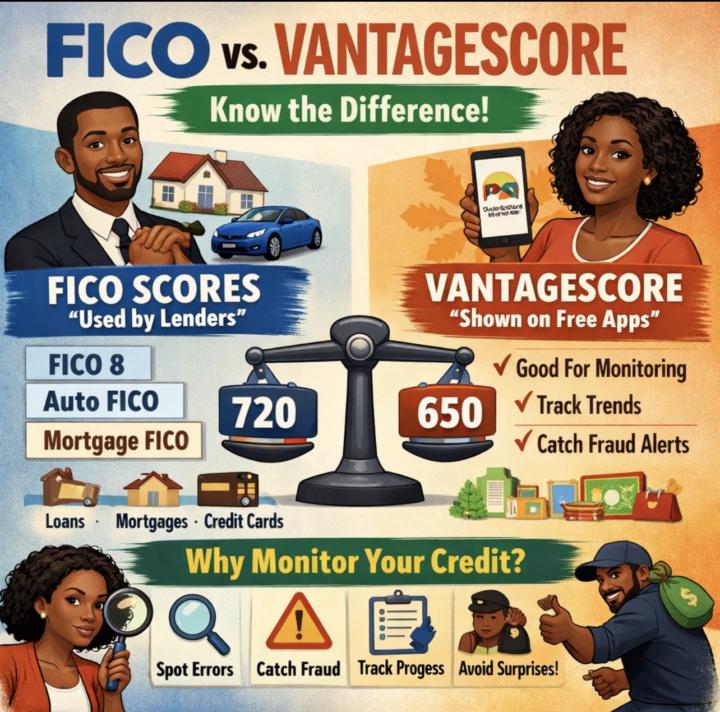

📊💳 Why You Don’t Have “One” Credit Score (And Why That’s Actually a Good Thing)

Let’s clear up one of the biggest credit myths real quick 👇🏾 You do NOT have one FICO score. You have a whole family of scores. Think Avengers, not solo movie 🎬 🧠 The FICO Score System (The Bank’s Favorite Child) Created by Fair Isaac Corporation, FICO scores are what most lenders actually use when approving: 🏡 Mortgages 🚗 Auto loans 💳 Credit cards 🏦 Business funding And here’s the twist… You don’t just have “a FICO.” You have multiple FICO versions + industry specific FICOs. 📌 Common FICO Versions You’ll Hear About: • FICO 7 (older lenders still use this) • FICO 8 (most common today) • FICO 9 (newer, treats medical debt better) Each version weighs things slightly differently. 🚘🏠 Industry Specific FICO Scores (The Specialist Doctors) These are tuned for risk in specific situations: 🚗 Auto FICO Scores Focus heavy on: • Past car loans • Late auto payments • Repossessions 🏡 Mortgage FICO Scores Way stricter on: • Long term history • Serious delinquencies • Stability 👉🏾 That’s why someone can have: FICO 8 = 720 Auto FICO = 680 Mortgage FICO = 650 Same person. Different risk lenses 👀 📉 Now Let’s Talk VantageScore (The Credit Karma Type Score) Built by VantageScore Solutions This is what most free apps show. ⚠️ Here’s the truth: Banks RARELY use VantageScore for lending decisions. It’s great for: ✅ Monitoring trends ✅ Catching fraud early ❌ Not what approvals are based on most times 🧨 Why Your Scores Don’t Match (And That’s Normal) Different models care about: • How recent your activity is • How collections are treated • Medical debt • Paid vs unpaid accounts So one score may jump while another barely moves. That’s not broken credit. That’s different math 🧮 👀 Why Monitoring Your Credit Is POWER Checking your credit isn’t about obsession. It’s about control. When you monitor: ✅ You catch fraud early ✅ You spot wrong balances ✅ You see surprise collections

0

0

💳 HOW TO BREAK DOWN DEBT WITHOUT BREAKING YOUR SPIRIT

Turning financial chaos into a controlled demolition Debt feels heavy because most people stare at the total number instead of the process. We are about to turn this monster into bite sized snacks. One crunch at a time. Let’s break it ALL the way down 👇🏾 🧠 STEP 1: FACE IT. ALL OF IT. NO BLINDFOLDS. You cannot beat what you refuse to look at. Grab a notebook, spreadsheet, or notes app and list every single debt: 📌 Creditor name 📌 Balance 📌 Interest rate (APR) 📌 Minimum payment 📌 Due date No judging. No shame. This is a debt audit, not a therapy session 😂 Why this matters 👉🏽 Debt loves darkness. Once you put it in the light, it starts getting nervous. 🔥 STEP 2: CHOOSE YOUR WEAPON (SNOWBALL VS AVALANCHE) ❄️ Debt Snowball (Momentum Method) Pay off the smallest balance first Gives fast wins and motivation Best if you need confidence boosts 🏔️ Debt Avalanche (Math Method) Pay off the highest interest first Saves the most money long term Best if you are emotionally disciplined ⚠️ Important rule You ONLY pick ONE method. Mixing methods is how debt survives. 💸 STEP 3: CREATE A “DEBT ATTACK NUMBER” This is where people mess up. Your minimum payments keep you in debt. Your attack number gets you OUT. 👉🏽 Calculate how much EXTRA you can throw at debt monthly by: • Cutting subscriptions • Reducing eating out • Pausing lifestyle upgrades • Temporarily being “financially boring” Even $300 extra monthly is dangerous to debt 😈 🗓️ STEP 4: AUTOMATE THE PAIN Willpower is unreliable. Automation is undefeated. ✅ Auto pay minimums on all debts ✅ Auto apply EXTRA money to your target debt ✅ Set reminders to review progress monthly If it requires motivation every month, it will eventually fail. 📉 STEP 5: KILL ONE DEBT AT A TIME When one debt is paid off: 💥 DO NOT celebrate by spending 💥 DO NOT relax You roll that payment into the next debt. This creates a payment snowball that grows like it’s been hitting the gym 🏋🏾♂️ 🧱 STEP 6: PROTECT YOUR PROGRESS Debt freedom collapses fast without protection.

1

0

Your Future Is Waiting on Your Credit 💳🔥

One day, you’re going to look back at this moment and realize… this was the turning point 🧠✨ Not when you “felt ready.” Not when life slowed down. Not when everything was perfect. But RIGHT NOW ⏳🔥 Every dream you have needs leverage 💼 Every upgrade costs money 💰 Every opportunity checks your credit 📊 And most people don’t fail because they’re lazy. They fail because their credit keeps them locked out 🚫🔒 Higher rates 😤 Denied approvals ❌ Limited options ⛔ Constant stress 😮💨 That’s not life. That’s a cage. This is one of the smartest ways I’ve found to start breaking out of it 🧨 You make small monthly payments 💵 They report to the credit bureaus 🏦 Your credit history strengthens 📈 Your score grows 🔥 Your options expand 🚀 Slow progress is still progress 🐢➡️🏎️ Momentum beats motivation 💪🏾 Consistency always wins 🏆 Start here ⬇️⬇️⬇️⬇️ https://creditstrong.referralrock.com/l/3UNDEFINE1812 If you’re serious about changing your future, don’t scroll past this ⚠️

2

0

1-30 of 34

skool.com/udiversity

Udiversity is where you stop surviving and start leveling up—learn the money game, fix your credit, and build the freedom no one taught you.

Powered by