Write something

Restricted Use Account or All-Purpose Bank Account?

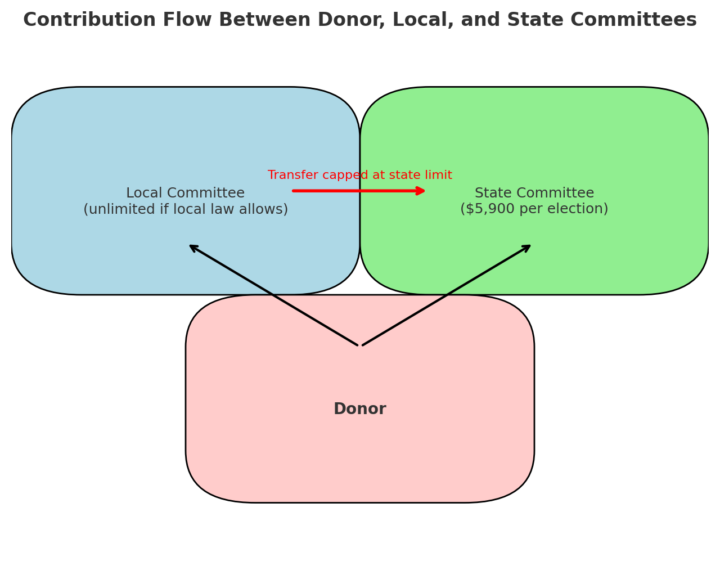

📌 Clarifying Restricted vs. All-Purpose Accounts (How They Really Work) When a committee has two accounts, the distinction is not about one being “more flexible” overall — each account is flexible in different ways. All-Purpose Account - Used to make contributions to both local and state candidates - Cannot accept any contributions over the state limit - All money in this account must always be under the current state limit(currently $9,800 per contributor) 👉 This makes the all-purpose account flexible in who it can give to, but limited in what it can accept. Restricted Use Account - Can accept all contributions, including over-the-limit contributions - Typically holds over-the-limit money - Commonly used for administrative and non-candidate expenses - Allows committees to preserve all-purpose funds for state candidates 👉 The restricted account is actually more flexible on intake, because it can receive unlimited contributions. How the Accounts Work Together - Over-the-limit contributions are deposited into restricted - Committees then transfer up to the state limit (currently $9,800) from restricted into all-purpose within the allowed timeframe - This ensures the all-purpose account always remains under the state limit 💡 Why this matters:Using the restricted account for admin expenses helps protect and maximize all-purpose funds so they are available when needed for state candidates. That’s why it’s common to see the restricted account depleted first — it’s strategic, not a mistake.

1

0

What to report for $100 or more for gifts, meal, or travel?

✅ $100+ Rule – If your committee spends $100 or more on a gift, meal, or travel: - You must explain the purpose in the Description of Payment field (not just use an expenditure code). - For gifts, include the date, description, and recipient’s name (or “undetermined recipient” if not yet known—then amend within 45 days). - For meals, include the date, number of attendees, and whether the candidate or authorized individual was present. 🚫 No freebies – Personal holiday gifts, thank-you baskets, or non-political items should not be bought with campaign funds.

1

0

Gifts to Local Elected Officials

The gift limit for local electeds is now $630. There are some very specific rules about gifts to family members that have to be assumed gifts to the elected. So be careful about trying to go around the rules by having the gift given to a spouse or child. See the attachment for more details.

1

0

Use of Campaign Funds for Legal Counsel?

Looks like you can use campaign funds for legal fees as long as the reason is politically connected. Here's a link to the campaign manual and the FPPC. As always, please consult with an attorney! These guidelines are nuanced! https://www.google.com/search?client=firefox-b-1-d&q=fppc+campaign+funds+on+a+slander+case

1

0

1-5 of 5

skool.com/treasury-training-program-9940

Experienced Compliance Support for California Campaign Committees & Treasurers

Powered by