Write something

Welcome to Title 8 Academy - The School You Should’ve Had!

Before we get into what we teach, ask yourself a simple question: Why do nearly all ultra-wealthy people celebrities, athletes, CEOs, even Warren Buffett.. direct their pay into foundations, trusts, and private entities before it ever becomes “income”? Why do they legally pay a fraction of the taxes everyone else does? Why aren’t these structures taught in school, yet they’re standard practice behind every major legacy family in America? If the systems exist and they clearly work.. then the real question becomes: Why can’t you model what already works? Who said these strategies were reserved only for the elite? Title 8 Academy exists to remove the veil. We teach the financial, legal, and spiritual architecture that powerful families have used for generations: credit repair, large-scale funding, trust structuring, asset protection, business systems, equity principles, and the spiritual law that governs all earthly authority. Not theory. Not hype. Real, proven frameworks practiced quietly by the people everyone else admires. We’re building each part of this platform with intention. Founding Members who join now lock in the $33/year rate forever. When the full curriculum launches, new membership will begin at $33/month, but early members will never pay more, period! Bi-weekly calls begin soon as we start helping people rebuild their credit, reclaim their status, restructure their lives, and walk in the clarity God intended. “Confusion comes from the dark. Clarity comes from God..” Clarity is power and clarity is aligns highest potential. PLEASE don’t let me be the only one blabbing! When ur done lurking Introduce yourself below and share what you’re interested in! What are here for? Founding Members = lifetime access. This is where your restoration begins. https://www.skool.com/title-8-academy-1862/classroom/1d10b230

EVERYONE ENGRAIN THIS IN YOUR BRAIN!

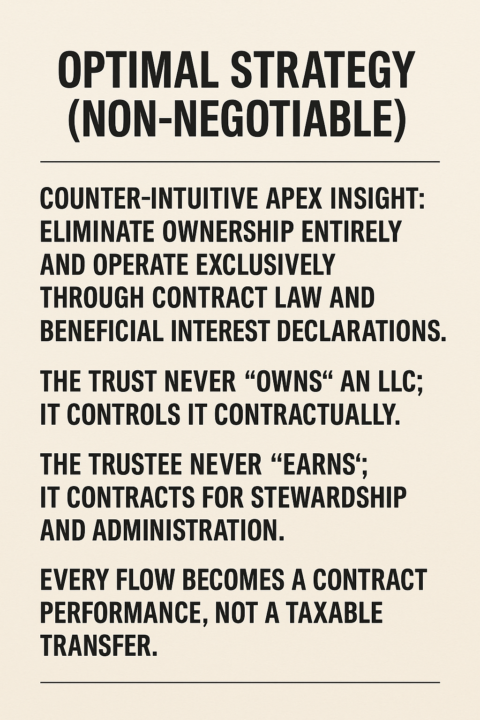

Repeat with me: I own nothing! "Own nothing, control everything." - John D. Rockefeller "The secret to success is to own nothing, but control everything." - Nelson Rockefeller "How we manage what we assume is ours is actually a test of your devotion to the One who it actually belongs." - Andy Stanley My body is a temple of the Holy Spirit. I work for the Church! My (sole proprietor) labor is not for hire. Boom 💥

2

0

🚀 Quick Update — A LOT Is Happening Behind the Scenes

Aloha Title 8 family! It might look quiet on the surface, but behind the scenes this thing is being built into a monster. Here’s the fast breakdown so you know exactly what’s coming: 🔥 New Course Structure incoming Credit Repair Dojo 800 (50% done, more drops next week) The “What Is Money?” Is going to be mind blowing 🤯 can’t wait to do that one with you all! Fully gamed out scripts and recordings for things like traffic ticket court to get that ticket dismissed never hitting your record. The Trustology (deep dive into the study of trusts) course will teach the different types of trust and how to use them. Very powerful elite knowledge! I’ll be dropping “My Private Library” my secret collection of priceless works in this feild and adjacent. (Over 80k worth of rare books and purchased curated materials) Crypto Course + Palau Digital Residency - How to operate crypto from a lawful sovereign standpoint using foreign trusts + my favorite tools, strategies & advanced tactics. This is the real roadmap we’re building and filming. 🔥 Big Wins in Motion • New onboarding system with face-to-camera welcome videos • Podcast with Actor Stephen Hill from Magnum P.I. — huge visibility boost •WE BUILT A CREDIT REPAIR/DISPUTE AGENCY FOR YOU GUYS!! 🔥”Title 8 Credit Repair Agency” built in-house (no outsourcing) • IATSE Union support — credit repair school contract incoming! • 508(c)(1)(a) established, 501(c) buildout in progress • Google Ad Grant ($10K/mo) coming once structure is complete This is the foundation that takes time — but once it clicks, Title 8 becomes unstoppable. 🔥 We Need Builders (Early Members Will Be Rewarded) This next phase requires hands. If you want to help build something that’s going to explode in size: • Moderators • Researchers • Credit dispute assistants • Testers • Editors • Community leaders If you want to volunteer or get involved, reach out. The people who help build in this early stage will be heavily rewarded when this platform scales!! LET ME SAY THAT AGAIN, ACTIVE MEMBER WILL BE REWARDED!

Lmk thoughts - Rough Draft Video This Is Going In The Status Correction Course

Arguably the most important status correction alongside mindset is claiming your powers of separation of church and state. The baptismal certificate has a lot more depth than most realize. Did you know you can legally use it in replacement of a birth certificate on a DS-11 Application for a passport! Understand why that’s possible. “My body is a Temple of the holy spirt” what about you?

“Ignorance of ignorance is that self-satisfied state…”

“Ignorance of ignorance, then, is that self-satisfied state of unawareness in which man, knowing nothing outside the limited area of his physical senses, bumptiously declares there is nothing more to know.” — Manly P. Hall, The Secret Teachings of All Ages One of the oldest maxims of law is Ignorantia juris non excusat — ignorance of the law excuses no one. Scripture echoes the same principle: “My people are destroyed for lack of knowledge.” (Hosea 4:6) Across the Mysteries, the courts, and the ancient scriptures, the message is identical: Ignorance is not innocence. Ignorance is bondage. And worse than being ignorant… is being ignorant of your own ignorance. For those who feel the pull toward deeper knowledge — of history, law, symbolism, sovereignty, metaphysics, and the hidden architecture of civilization — Manly P. Hall’s The Secret Teachings of All Ages is not optional reading. It is initiation. I’m dropping the book inside Skool for anyone ready to understand the world behind the world.

1-30 of 37

powered by

skool.com/title-8-academy-1862

The School You Should’ve Had! Why weren’t we ever taught about credit of finance basics in school? What is money 💰 anyway? Foundational Keys 🔑🧠✨📖

Suggested communities

Powered by