Write something

✨ Why You Should Offer Buy Now, Pay Later (BNPL) in Your Business ✨

Listen—everybody can’t always drop a lump sum at once, and that’s okay. Offering Buy Now, Pay Later is a powerful tool because it gives your clients flexibility. Instead of losing a sale or turning someone away, you give them a way to move forward and still get the value from your service. That’s money in your pocket and results for them. And it doesn’t stop with credit repair. This can be applied across the board: mentorships, courses, coaching, products—you name it. BNPL makes those bigger payments feel doable, which means more closed deals and happier clients. ⚠️ But let me keep it real with my credit repair folks: If your client is planning to buy a home within the next 60–180 days, I don’t recommend BNPL at all. Mortgage lenders don’t like to see those accounts. It can complicate the approval process, slow things down, and possibly cost them that dream home. So yes—BNPL is a wonderful option, but like everything else in business, you gotta use it wisely. 👉🏾 Ready to set it up for yourself? Here’s my link: https://www.fanbasis.com/creator/referrals/LoLTjV

0

0

✨ Rich Risings, Billionaires! ✨New perk alert

✨ Rich Risings, Billionaires! ✨ One of the major benefits of being in this mentorship is the hands-on support you get from me. I don’t just drop game on building your business — I make sure your credit is being built up right alongside it. Here’s how it works: 👉🏾 Every member has the opportunity to have their credit personally audited by me. 👉🏾 I’ll create custom dispute letters tailored to your exact situation. 👉🏾 You’ll be able to submit those letters directly to the bureaus so your credit is actively improving while you’re building your empire. To get started, you must sign up with my required credit monitoring system. I’m attaching the link below. 🔗https://mandrillapp.com/track/click/31267418/myfreescorenow.com?p=eyJzIjoiZVpwT1NVeW9oem03cXdSekpiQTdkTDBka3prIiwidiI6MiwicCI6IntcInVcIjozMTI2NzQxOCxcInZcIjoyLFwidXJsXCI6XCJodHRwczpcXFwvXFxcL215ZnJlZXNjb3Jlbm93LmNvbVxcXC9lbnJvbGxcXFwvP0FJRD1MdXhlbGVnYWN5Q29uc3VsdGFudHMmUElEPTkzNTg2XCIsXCJpZFwiOlwiOTczODA5OWQ2MGNiNGE5Nzg4NzhhZDQ0NTYzZThlZDZcIixcInVybF9pZHNcIjpbXCI5YTYyZDU2Y2JjODBjODlhMGM3YjhmYjZkYTkzYjA1YzA3MTQ1YTRkXCJdLFwibXNnX3RzXCI6MTc1NDkzMTYwNX0ifQ If you’re already registered with this exact monitoring company and the link won’t let you enroll again, DM me right away so I can provide you with an alternative link. Once you’re set up, I’ll need you to send me the following info so I can pull your report: - Your login email/username - Password - Any PIN or secret questions - Last 4 digits of your SSN After that, I’ll send you your custom letters — either by DM or email, whichever you prefer — so you can start working on your credit today.

1

0

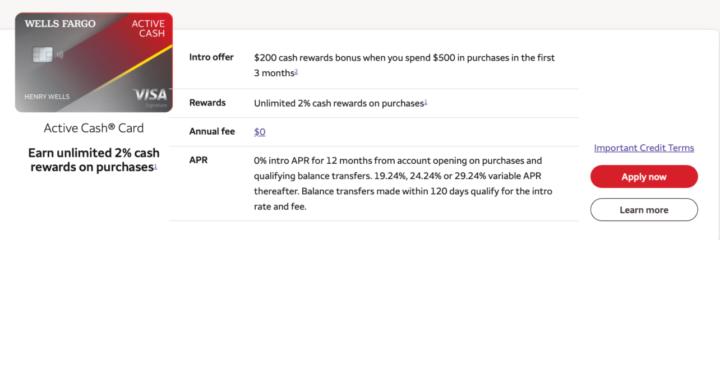

Easy 25k approval 👀

I know everyone wants to build their credit profiles and get funding💰 Go run this play and add another primary. Wells Fargo Active Cash Card ✅ - Pulls Transunion 😎 - 700+ credit score 🔥 - 2% Cash Back 💸 - No hard pull when prequalifying 🤯 ‼️Prequalify before you apply by clicking on the link ⬇️. You will get a hard inquiry after accepting offer.‼️ https://web.secure.wellsfargo.com/credit-cards/yourinfo/?sub_channel=WEB&vendor_code=WF&linkloc=FNPQ&lang=en Let me know if y'all want more gems like this? 🤝🏾

0

0

🔥 Mentorship Fam Check-In 🔥

Are you actively accepting clients right now for your credit repair biz? I’m seeing too many people sayin’ they low on funds, can’t pay upfront, whatever whatever… Let me put you on game. I got a way for you to get PAID 💰 ✅ No chargebacks ✅ Accept Afterpay, Klarna, Zip ✅ Clients get help now, you get paid now If you want this setup (no upfront cost), DROP A 🔥 IN THE COMMENTS I’ll DM you the link to sign up and start collecting payments without chasing folks down. Let’s stop leaving money on the table. It’s time to boss all the way up. 💼💸 #CreditBossMoves #MentorshipOnly #GetPaidNowNotLater #BossEmpireAcademy

1-30 of 193

skool.com/thebossempire

Join The #1 Online Credit Repair Academy Holding your hand to the 700s Club & Funding Your Business

Powered by