Write something

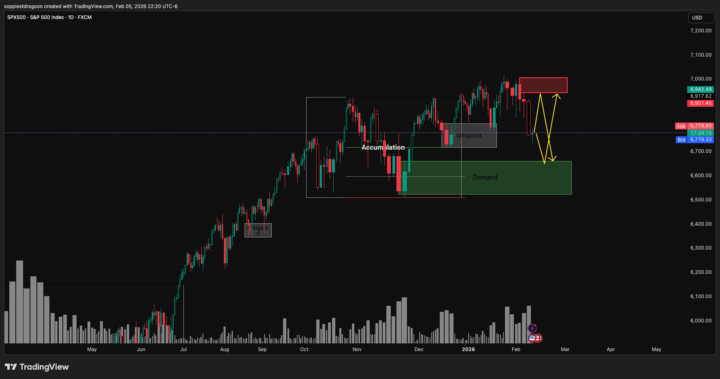

Win For The Method: Weekend S&P / US100 Plan Respected Perfectly

Quick win for the method: - This weekend we mapped out S&P 500 / US100 with: - - Bearish daily impulse - - Weakened demand - - 6945–7006 as key supply - - 6524–6662 as next valid demand Price did exactly what we planned: - Retraced into 6945–7006 supply - Showed lower‑time‑frame distribution + liquidity sweep + break of structure down I didn’t catch the trade live, but the No‑Chase Swing framework nailed the structure and zones. For you, that’s the real win: the process works. Full breakdown with charts and lessons is posted in the Market Analysis / Watchlist tab. Go study it, then post your “ideal execution” plan in Trade Reviews & Help if you want feedback.

0

0

How I’m Handling This Swing Environment (Read This)

Quick reality check: The last stretch of swings has been tough. A bunch of clean setups simply haven’t followed through. That doesn’t mean “nothing works.” It means we’re in one of those periods where the distribution is doing its job: clustering more losers and breakevens together. This is exactly where most traders blow up or quit. It’s also where professionals separate themselves. 1. Trading = probabilities + risk/reward Even with a real edge, you will have: - Strings of losers - Good trades that lose - Periods that feel brutal The edge only shows up over a large sample size. One month of pain doesn’t erase years of data. For context: over the last couple of years I’ve averaged over 100% annualized. That is not typical and it’s not a promise. I’m sharing it so you understand: even with strong long-term results, I still sit through patches like this. That’s part of how those returns happen. 2. What I’m doing right now Here’s exactly how I’m responding: - Sticking to the No‑Chase rules on entries, stops, and size - Keeping risk per trade tight and avoiding “make it back fast” behavior - Saying no to marginal setups instead of forcing action - Reviewing every trade to separate bad execution from normal variance This is how you treat trading like a high‑income business skill, not a hobby. 3. What this means for you If you’re frustrated, that’s normal. The goal isn’t zero drawdowns. The goal is to learn to operate like a pro through them: - Respect your stop - Protect your downside - Size like you expect to be here 5–10 years from now - Focus on process, not needing every call to work I’ll keep sharing the levels, the plans, and now more post‑trade breakdowns, so you can see how a trader thinks in these chapters, not just when everything rips. We’re not here for a straight line. We’re here to build a skill that can pay you for years. Drop a comment with any recent trade you want me to break down and I’ll walk through it.

Example: How I Sat Through a 20–30% Drawdown on AMD

I want to give you a real example from my own trading to put the recent volatility in perspective. AMD had a period where it sold off hard. A lot of people were calling it “advanced money destroyer” and wanted nothing to do with it. It was the classic “dip that keeps dipping.” Here’s what I did: - I had a clear thesis on AMD and believed in the long‑term story. - I started accumulating in my zone instead of trying to nail the exact bottom. - I ended up sitting through about a 20–30% drawdown on the position. That’s not fun. But it was planned: - The position was sized at roughly 2–3% risk on my total portfolio, - Which is a sizable position for me and how I like to risk, - But still within a range I was fully prepared to tolerate. In other words, it hurt, but it didn’t threaten my account or my sleep. I wasn’t guessing. I knew this was a high‑probability area for my system, not a guarantee. My job was to execute the plan I made beforehand, not react emotionally to every red candle. Fast forward: that AMD position is now up 100%+. To put that in perspective: a typical “average investor” might take around 7 years to double their money at normal market returns. This happened much faster not because I’m special, but because I: - Had a real thesis - Risked 2–3%, not 20–30% of my account - Sat through a 20–30% drawdown on the position without bailing - Let time and the thesis do their job The point is not “hold everything and it’ll come back.” The point is: - If you’re investing, you need a strong thesis, proper position sizing, and the patience to sit through drawdowns you’ve already signed up for. - If you’re trading, your edge only shows over a large sample if you keep following your rules through both wins and losing streaks. Sometimes the highest‑skill move is not a brand‑new trade. It’s calmly executing the plan you already made, with risk you can live with, and giving it enough time to work. Zoom out.

Trading Through Pain: A Note To Everyone Here

Quick note for everyone here, because I know a lot of you are feeling this. A lot of names have been selling off hard. Several of my recent calls have not worked out. I’m in drawdown too, and yes, it’s painful. But this is what trading actually looks like. Trading is a game of probabilities, risk‑to‑reward, and execution. Even with a real edge, you will have streaks where it feels like nothing works. The edge only shows up over a large sample size, not over a handful of trades. A few things to keep front and center: 1. Our goal is not “never lose.” Our goal is to outperform the market over time. Losses and drawdowns are the cost of playing that game. 2. Respect your stop more than your emotions.The cleanest way to be less emotional: - Decide your entry, stop, target, and position size before you enter. - Accept the dollar risk as the “ticket price” for that idea. - When price hits your stop or target, you execute. No debates, no hope, no moving lines. 3. You must own your own execution. I don’t know your position size. I don’t have your exact emotional tolerance.I personally have a high risk tolerance and can sit through bigger swings than most. That’s part of why I can make serious money swing trading. That does not mean you should size like I do. Your job is to trade your plan. 4. If you’re unsure, get feedback – but don’t outsource responsibility.If you’re doubtful on a position or a plan, post your chart and your idea. I’ll give you my honest take.But at the end of the day, you push the buttons. You own the P&L. 5. Ask yourself: are you trading this or investing in this? - If you’re investing and the fundamental thesis is strong or getting stronger, then dips are opportunities, not emergencies. - If you’re trading, then it’s simple: respect your stop loss, respect your take profit, and don’t turn a trade into a “long‑term hold” just because it’s red. Zoom out. One rough period does not define you as a trader. What defines you is whether you can stay grounded, follow a rules‑based process, and keep executing through both the wins and the drawdowns.

AMZN Trade WIN

used your Amazon analysis and it worked. Made about 3R on the trade. I took profits at liquidity instead of holding. The demand zone explanation really helped me see it better!!

1-7 of 7

powered by

skool.com/the-trading-desk-2388

Swing trade U.S. stocks & crypto around your 9–5 in ~10 minutes a night with a rules-based no-chase method so you stop staring at charts.

Suggested communities

Powered by