Write something

Collectibles Market Check-In: Munikis Zero & Early 2026 Signals

Quick pulse check for anyone watching the early-year Japanese releases. The Munikis Zero booster is starting to get talked about like a long-term vault hold. Friendly reminder: not every new box is built for the safe. Here’s the clean read right now: • Japan retail is landing around $75–$85 equivalent • U.S. preorder windows are sitting $100–$115 • No generational mascot, no evergreen chase, no true alt-art “anchor” that historically keeps sealed elevated • Early availability suggests supply is not constrained at launch • Hype is real, but it looks like launch hype, not deep structural collector demand (yet) Translation: This shapes up as a short-term flip or selective singles play, not a “seal it and forget it” product. If you can source close to Japan retail, there’s a margin window. If you’re paying U.S. preorder prices, you’re mostly buying someone else’s margin. As always: Buy smart. Flip clean. Don’t let FOMO write your strategy. (And yes—if sealed holds above JP baseline 30–60 days post-release, the thesis updates. That’s how disciplined collecting works.) #PokemonTCG #MunikisZero #TCGInvesting #SealedVsSingles #CardMarket #TCGFlipping #CollectiblesMarket #JapaneseTCG #TCGStrategy #NoFOMO

0

0

The War Is Over: How to Reclaim Pokémon Without Fighting Anyone

The War Is Over: How to Reclaim Pokémon Without Fighting Anyone If you feel exhausted by the Pokémon hobby, you are not alone. If opening Instagram feels like checking the stock market, you are not crazy. And if it feels like you are constantly losing to bots, scalpers, and rising prices, it’s because you are competing in a system that was never built for collectors. This stopped being “just about toys” a long time ago. The hobby didn’t just get popular. It became liquid. But this isn’t a rant against scalpers or a call to boycott local game stores. It’s an explanation of the invisible machine draining the joy out of collecting and a way to step out of it without fighting louder. The Uncomfortable Truth: Everyone Is a Culprit We like to point to “scalpers” as the villain. But the reality is a closed loop. Pokémon became easy to convert into cash in an economy where many people are under pressure. Once that happened, the hobby stopped being a playground and started behaving like a market. Collectors panic-buy because they fear missing out. Flippers hoard because scarcity creates leverage. Retailers restrict because abuse is real. Platforms amplify hype because anxiety drives engagement. Everyone plays a role. Everyone absorbs the damage. You cannot defeat scalpers because you are not fighting individuals. You are fighting incentives. So the way out is not speed. It’s patience. The Strategy: Time Arbitrage Scalpers operate on velocity. They need to buy fast and sell fast. They rely on thin margins and constant rotation. Collectors operate on duration. You don’t need the card today. You just need it eventually. That difference is your advantage. 1. The 30–90 Day Rule (The Quiet Window) Release day is where leverage is highest and prices peak. Buying then means paying a patience tax. Between 30 and 90 days after release, hype fades, inventory loosens, and urgency collapses. This is the quiet window. Waiting is not losing. Waiting is leverage. 2. Buy What Isn’t Optimized for Flipping

1

0

A hindsight note on Lorcana Trading Cards and what actually survives once the noise clears...

When One Piece TCG took off, it wasn’t hype. It was structure. A massive IP finally got a serious modern card game, early distribution was uneven, competitive demand showed up fast, and collectors followed players. By the time most people realized what was happening, the easy entries were gone. I initially looked at Lorcana through that same lens. With distance now, here’s the more accurate read. Lorcana is not One Piece in scarcity mechanics. Ravensburger prints to demand. That’s intentional. It keeps the game alive, but it also means most cards will never become rare just by aging. That doesn’t kill the thesis. It changes where the value concentrates. Lorcana is resolving like a mature Disney collector ecosystem, not a grinder TCG. In markets like that, supply isn’t the limiter: prestige, condition, and provenance are. Here’s what actually holds as the IP matures: 1) “First” matters — but only the right kind of first Not “any Elsa.” Not “any Mickey.” The earliest appearance of an iconic character in its highest-end treatment available at the time is the anchor. Ten years from now, nobody cares how playable it was. They care that it was the debut. 2) In a print-to-demand world, condition is the scarcity Raw cards are abundant. That’s reality. The scarcity shifts to Gem Mint populations. I’m not stacking raw First Chapter foils. I’m watching population reports and targeting cards where tens of thousands exist raw, but very few survive at PSA 10 / BGS 9.5+. Near-mint is meaningless when the print run is massive. 3) Wave matters more than people think Early print waves almost always differ, text cleanups, color corrections, minor layout fixes. It happens in every long-running TCG. The true “alpha” Lorcana pieces are not just Set 1, but specific early-wave variants the market hasn’t fully separated yet. 4) Promos are not one category Attendance promos are noise. Merit-based promos are signal. Cards earned via wins, championships, judge programs, or limited qualification have provenance that cannot be reprinted. Retail product can be reissued. Earned history cannot.

1

0

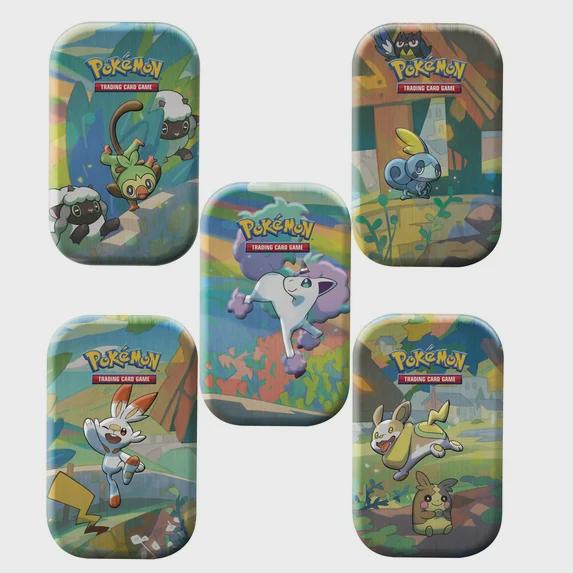

Stop Buying These “Cute but Low-Yield” Pokémon Products

Mini Tins are one of the most misunderstood items in the hobby. Mini Tins are everywhere. They’re colorful, nostalgic, affordable, and constantly restocked. And that’s exactly why so many collectors misunderstand what they are and what they are not. This is not an anti–Mini Tin rant. It is a structural critique of why they consistently underperform as sealed items, when they actually make sense to buy, and where people quietly lose money. Let’s separate hype from math. First, the distinction that clears up most arguments: Mini Tins are not bad products. They are low-yield products for sealed holding. Those are very different statements. Most frustration comes from applying investor logic to a product designed for ripping packs and entry-level buyers. Galar Pals Mini Tins As sealed items, these lack every driver that creates long-term premium. No exclusive promos. Pack selection changes by print wave. They’ve been reprinted across multiple retailers. There is no visible scarcity signal. Artwork alone does not create demand, and inconsistent contents make sealed performance unreliable. The nuance most people miss is that this same inconsistency is why some collectors hunt them. Certain print runs sold through CVS, Aldi, and Five Below have quietly contained packs like Evolving Skies, Cosmic Eclipse, or Team Up long after those sets went out of print. The reality is simple. Bad for sealed holding. Fine, and sometimes excellent, for ripping. Only attractive if you understand batch variance. Kanto Friends Mini Tins These sell because Kanto sells, not because the product structure supports appreciation. The promos are reprints, not exclusives. Pack composition shifts between waves. Production volume is high, with no retirement signal. Collectors often confuse character recognition with collector demand. They are not the same thing. As a result. Poor sealed performance. Acceptable price-per-pack for opening. No rational reason to hoard long-term. Paldea Friends Mini Tins

1

0

Gardevoir ex #228/198 (SV Base Full Art)

If you’re hearing “under-the-radar” about Gardevoir ex #228/198 (the Full Art Ultra Rare from Scarlet & Violet Base), the data mostly supports it, with one big caveat: low pop does not automatically mean future breakout. What the market data actually shows: Raw price is genuinely low at market price~$4 (give or take with condition and seller). PSA 10 is “cost-anchored.” Recent tracked PSA 10 sales land in the low-to-mid $30s, with examples at $32–$40 on PriceCharting’s completed sales log. PSA’s own auction price page shows a most recent PSA 10 price of $32. Why that matters: this is not priced like a hype chase. It’s priced like “nice card, cheap slab.” Population (this is the strongest part of the “under-the-radar” argument) PSA pop report for SV Base shows for Gardevoir ex Full Art 228/198: Total pop: 975 PSA 10 pop: 489 Now compare that to Gardevoir ex #245/198 (the set’s main chase card): PSA 10 pop: 6,200 Takeaway: PSA 10 supply for #245 is roughly 12–13× higher than #228. That gap is real, and it’s the best evidence that #228 isn’t “overgraded into oblivion” the way many modern chases are. Why it’s “overshadowed” (and why that’s relevant) Collectors are currently paying for: Illustration-style backgrounds big chase narratives “main card” status in the set Full Art Ultra Rares like #228 are often treated as “secondary” even when the Pokémon is top-tier popular. That keeps demand muted and helps explain the lower price relative to the pop. Should you buy it? Yes, if your goal is a low-stress, low-entry PSA 10 slab of a popular Pokémon and you’re fine with slow growth (or no growth). The price is close to grading economics, and the PSA 10 pop is objectively lower than the chase alternative. No, if you’re expecting a fast spike. Low pop + low demand can stay flat for a long time. Watchouts (important in FB groups) Don’t confuse #228 Full Art with #245 chase. Sellers sometimes “accidentally” blur the two in titles. Avoid proxy/custom listings: keywords like custom, proxy, orica, metal, gold card, fan art.

1

0

1-13 of 13

powered by

skool.com/the-hype-detox-community-5288

A community for collectors and investors who want clarity, real value, and smarter decisions without hype or misinformation. Learn collecting skills.

Suggested communities

Powered by