Write something

Gold and silver are rallying

https://river.com/content/1-27-2026-newsletter?utm_campaign=River%20Intelligence&utm_medium=email&_hsenc=p2ANqtz-9L_XIeCUZoFPSiRBS6OLXCdHb0BeDl26ziU3s9oTfdRxlkHT3Wq6xNV2YikKEi9kpnjYP_72eGle7jdUWBWniJ6su-Lw&_hsmi=400650480&utm_content=400650480&utm_source=hs_email

1

0

Fed’s Powell suggests tightening program could end soon

https://www.cnbc.com/2025/10/14/feds-powell-suggests-tightening-program-could-end-soon-offers-no-guidance-on-rates.html

0

0

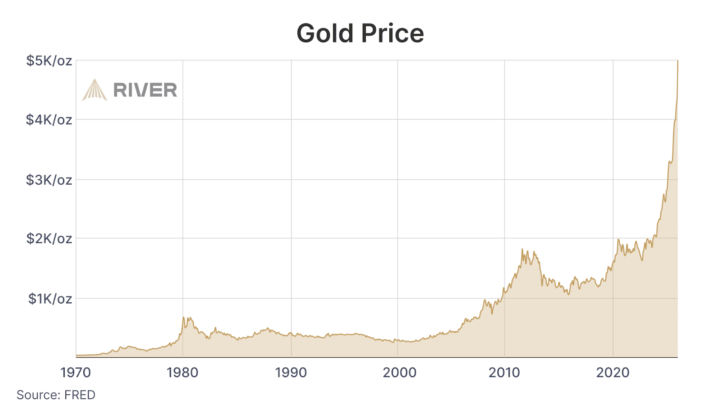

Ray Dalio says today is like the early 1970s and investors should hold more gold (and Bitcoin) than usual

https://www.cnbc.com/2025/10/07/ray-dalio-says-today-is-like-the-early-1970s-and-investors-should-hold-more-gold-than-usual.html He's a boomer so he also means the better digital scare version which is Bitcoin!!!

0

0

Everything is about to go up!!

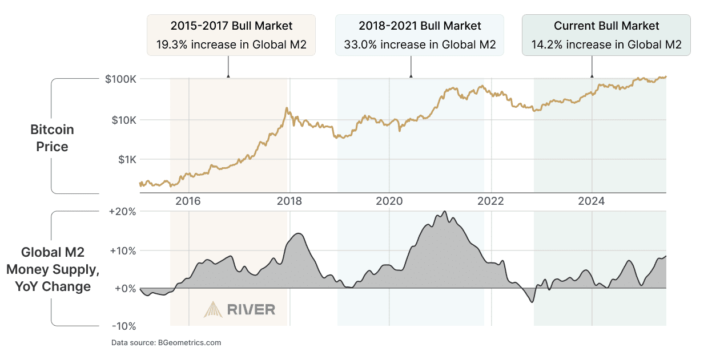

Two weeks ago the Federal Reserve cut interest rates and signaled that money printing will increase in the near future. This means the prices of nearly everything will rise. From groceries, to stocks, to bitcoin. Below you can see how bitcoin has historically reacted to these periods of money supply expansion. The Fed’s recent and upcoming rate cuts are not a guarantee of continued strong performance for bitcoin. Afterall, bitcoin tends to do what people least expect. Still, it is likely that we are entering a period of easy money. People usually think of Federal Reserve intervention as an emergency tool used only during economic downturns like the Great Financial Crisis of 2008 and the COVID pandemic. In reality, this easy money policy has been the status quo. Today, the money supply is increasing at a rate of $1 trillion per year, even when there isn’t a recession or crisis happening. At the same time, everything becomes more expensive. What’s driving house and stock prices isn’t the economy, it’s money printing. It’s impossible to know how long this will go on for, because politicians and bankers have no reason to change a system that works for them. But you can change your own future; take back control, save, rebuild, and uplift others.

0

0

France goes rogue, Bitcoin pumps on Fed rate cut

https://cointelegraph.com/news/france-rogue-bitcoin-pumps-fed-cut-global-express The E.U. is trying to keep the fiat ponzi going of course but we all know how this will end eventually

1

0

1-5 of 5

powered by

skool.com/satoshi-starters-9754

Bitcoin for Beginners & FIRE (Financial Independence, Retire Early): Using Bitcoin with stocks for generational wealth!!

Suggested communities

Powered by