Nov 7 • General discussion

Too Much Information Can Hurt Your Homebuying Decisions

There’s never been more information online — and that’s not always a good thing.

Today, homebuyers can Google anything about mortgages, rates, or “best loan programs.” But here’s the problem: when you don’t work in this business every day, it’s almost impossible to tell what applies to *you* and what doesn’t.

You’ll see posts about “how to avoid PMI,” “how to get the lowest rate,” or “why you should wait for rates to drop.” But most of that advice is written for clicks, not accuracy.

Every buyer’s situation is unique — income, debts, credit, goals, family needs, tax impact — and that changes everything. Reading a few online articles doesn’t replace years of experience or a real plan built for your life.

It’s like reading about surgery online and then trying to perform one on yourself. The information might be out there — but without context, it can do more harm than good.

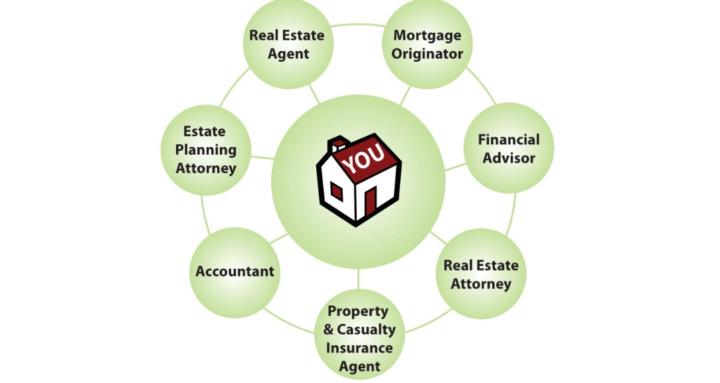

When you work with a trusted mortgage professional and a full team who looks at your whole picture, you get real advice — not random opinions.

If you want to buy a home, remember this: information is free, but wisdom is earned.

0

0 comments

skool.com/realestatewealth

Welcome to the Core7 Real Estate & Wealth Community – For people who want to buy a home, secure their finances, & build income online

Powered by