Write something

From my personal data...

Here is a bar chart illustrating my best and worst times to trade, Top 5 Most Profitable Times (in green) and the Top 5 Least Profitable Times (in red). Each bar represents the total profit for the corresponding time of day. - Activate: 9:30 AM to 10:45 AM - Deactivate: Outside of these hours. - So based on my best and worst times i should only be trading during these hours. - If I fail to stay within my own rules, I will be adding risk to my strategy based on true DATA. - I guess I should stop trading after 10:45am and do other things. Shark🦈

Tips for Passing Funded Programs

This video is about a year old so some of the pricing has changed, but the ideas are the same. Also, I didn't realize the correct mic wasn't being picked up until after it was all recorded, but I didn't feel like doing it again. That said, I'll be doing an updated version with more current information soon (which will be part of the Classroom Levels), at which time I'll remove this video. But for now, this is a good place to start. Enjoy! https://www.youtube.com/watch?v=PY33KuhN4CQ

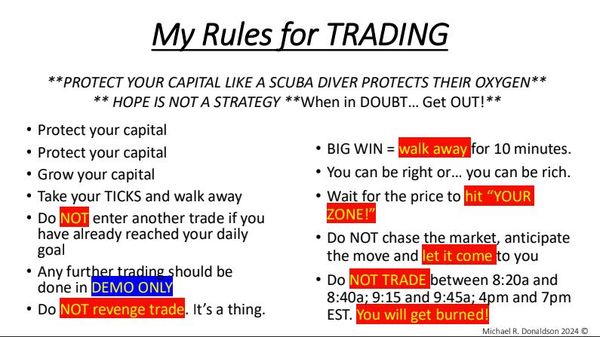

Advice from a pro Trader on in an Apex discussion on FB

From the same trader: Keep it simple. Hr only trades Dow or Gold, and rarely NQ. Dow 3 contracts/units at 20 ticks = $300 and done for the day. Gold 3 contracts/units at 10 ticks = $300 and done for the day. Single most important rule ? STOP WHEN YOU HIT YOUR DAILY!

MicroStrategy: A Potential NASDAQ Inclusion Story

MicroStrategy: A Potential NASDAQ Inclusion Story Hi everyone! Believe it or not, not based on my personal opinion, but because of an interesting article I came across. I wanted to share this with you, MicroStrategy's NASDAQ Prospects For context, MicroStrategy (MSTR), publicly traded on the NASDAQ, has seen a wild run in 2024. Its stock surged from lows of $13 to highs of $543, followed by retracements to $100 and a breakout above $200. Recently, it has found support around $350 per share, with a common resistance near $400. The big news? Analysts are speculating that MicroStrategy could be included in the NASDAQ 100 Index, which could trigger a $2.1 billion ETF buying spree. If included, MicroStrategy would become the 40th-largest holding in the index, with an estimated 0.47% weight. Why This Matters The NASDAQ 100 is a basket of the 100 most valuable publicly traded companies, similar to the S&P 500. Inclusion in such a prestigious index increases exposure and potential investor demand. - Announcement Date: An official announcement is expected on December 13th, with implementation the following week. - As of now, momentum is clearly in MicroStrategy’s favor. If Bitcoin remains strong around $100,000, it should support MicroStrategy. However, a significant Bitcoin drop below $90,000 could hurt its valuation. Broader Context and Comparisons For reference, SMCI is another company that faced hype, but its trajectory has been quite different. After hitting highs of $120, SMCI entered a strong descending pattern due to accounting issues and investigations. While it’s easy to draw parallels between MicroStrategy and SMCI, it’s essential to watch for unique factors like Bitcoin's influence on MSTR. Key Takeaways for Investors - If you’re bullish on MicroStrategy, take profits at overbought levels. - Remember, Bitcoin's historical corrections often exceed 50%. A similar pullback could drastically affect MicroStrategy. For those holding since lower levels like $150 or $200 per share, congratulations! Just ensure you’re setting your future self-up for success by locking in profits when appropriate.

1-9 of 9

skool.com/north-star-day-trading-9952

Dedicated to trading the Futures markets, educating and supporting traders.

Powered by