Bitcoin Bear Flag Pattern Target Hit

This weekly chart of the total mark cap is extremely Bearish and the measured move on a weekly Bear Flag, puts it right down into the only Buy block on the chart, around $1.83T or 37% lower from here. We could certainly see a small bounce here before that, but I can't guarantee anything. And if this plays out the alt coins will bleed the most. Hopefully everyone has been following my advice to the risk and start getting out of positions. If you're planning to "HODL" then you could be in for a long recovery. While it's no fun taking losses... As I have been trying to teach you, it's better than riding it out all the way down, with an unknown 'bottom' price. For more specific thoughts on what to do now, daily updates via Signal chat, a LIVE weekly class, and members area... Check out my M3 Active Trader group here: www.moonstream.io/M3

0

0

Is Bullish Sentiment Back? (Critical Level to Watch)

Hello traders, Happy New Year! It's 2026 and as we know anything can happen in crypto. While technically we've entered into 'Bear Market' teritory, I'm seeing money flowing back into crypto and specifically some altcoins. What is our 'Line in the Sand'? I'm specifically watching the $3T Total Market cap level, which was the exact high of the 2021 bull cycle. Anything below that, and we're not likely to see new all time highs in anything, much less Bitcoin. But if we can start to see Daily and Weekly closes back abover $3T, then there's hope for at least a counter-trend rally this near.... And with all of the regulatiry approvals and tail winds in process now (Market Structure Bill and Clarity Act still have to be passed by Congress) - we could even see >> A new All Time High for Bitcoin in 2026. First things first.. For now, the first Domino to fall needs to be holding above the $3T level on TOTAL. For more detailed information and daily updates, check out our M3 Active Trader community at www.moonstream.io/m3 And I'll keep you posted! Trade smart, not often. Brett

0

0

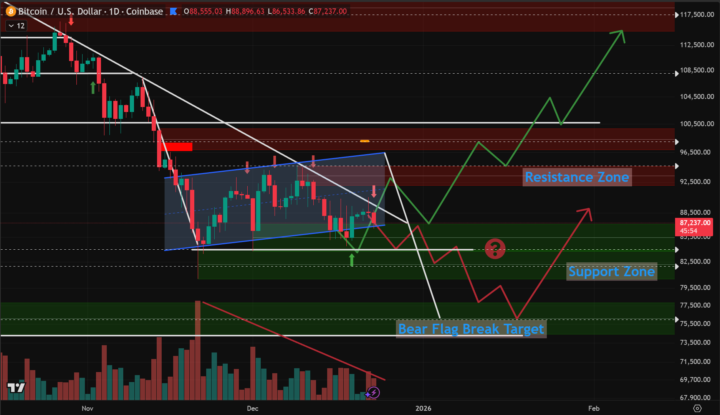

Bitcoin Continues to Decline (Bear Flag Danger)

Bitcoin continues to drift downward and is looking ready to break down below it's Bear Flag lower trend line support. The measured move from this from the flagpole down puts it down into the 75k zone as shown in the chart. Also on declining volume so this is looking weaker as we go. It's hard to say here and could go either way... Likely the markets will see end of your tax loss selling as well so I prepare for further downside and consider de-risking positions until further notice.

0

0

Tuesday Market Update 12-16-25

Bitcoin, SOL, Pendle, ZEC, and ETH continue to try and push higher. But in this video, I show how despite being overdue for a bounce soon -- We're already in a Bear market, and we'll be looking to sell into any counter-trend rallies here in the market. As a deeper correction is likely coming in the market soon. 2026 may well be a huge year with new legistlation and money waiting to re-enter once QE, liquidity and money printing come back. But history has shown that this only really helps with lower interest rates. https://app.screencast.com/dcGv5F51Gu3jR

0

0

AAVE Showing Signs of Upward Reversal

AAVE is a profitable and reputable DeFi protocol that's been around for some time and established. Their DeFi lending protocol earns real revenue, which is why its price has appreciated so much. Our signals have turned Green on the Weekly time frame showing a potential 85%+ move, to the top of the upward trending parallel channel as shown. But around $345 there is heavy sell pressure as we can see.

0

0

1-30 of 35

skool.com/moonstreamacademy

Moonstream Academy is a community of like-minded crypto enthusiasts wanting to share ideas, improve trading skills, and immerse in everything crypto.

Powered by