Write something

UNDERSTANDING INCOME STATEMENT AND BALANCE SHEET!

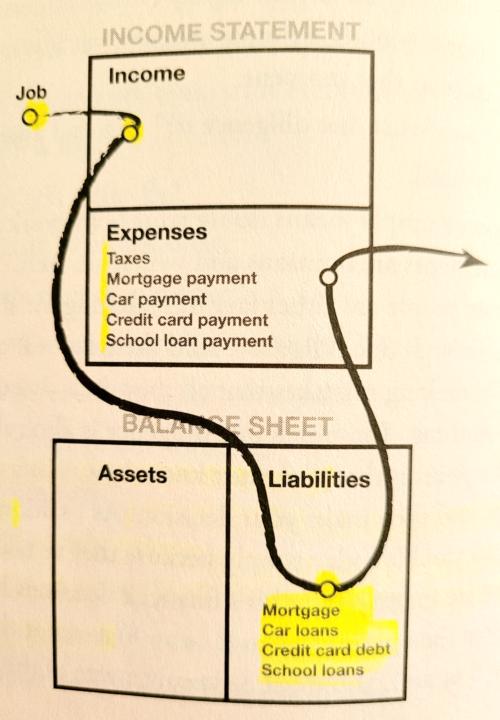

One of the most important things that you can do in achieving wealth is to understand an Income Statement and a Balance Sheet! An Income Statement shows Income and Expenses. A Balance Sheet shows Assets and Liabilities. This post is intended to help you understand reading an Income Statement and a Balance Sheet and creating your own personal balance sheet. By now you have learned the following: Income - Brings you $ Expenses - Costs you $ Assets - Put $ in your pocket Liabilities - Take $ out of your pocket At the top of the diagrams below is the Income Statement. At a basic level, it includes your Income and Expenses. On the bottom is the Balance Sheet, which includes Assets and Liabilities. Together, these make up what is called "cash flow". Please reference the two diagrams in this post below. The person in the first diagram, let's call her Mary, has a job and earns income. Before she gets her paycheck, the government has already taken out their cut of it in the form of taxes (often as high as 25%), meaning that her "bring home" money is that much less. Let's suppose that Mary owns a small house and a car for which she has a loans. She also has incurred some credit card debt from furnishing the house and car repairs. In the diagram, we see that she has some student loans from her time in college. These show up in her Balance Sheet as Liabilities. Remember that liabilities take $ out of your pocket. The taxes, plus her mortgage, car, loan, credit card debt, and school loans represent expenses that she must pay from her job income. Other things would also be in the Expenses block such as groceries, entertainment, clothing, internet, phone, and all other living expenses. Basically Mary's income is reduced, and deducted, and sucked out until it's replenished by her next paycheck. No wonder so many feel like they're living paycheck to paycheck. They are. Additionally, when Mary does her personal income tax returns on April 15th, she may find out that she owes the IRS even more money!

CHAT

I just uploaded a new video talking about the ETF (stock ticker CHAT). I love this ETF and explain why you might too! I'd love to hear if you have any questions or comments.https://www.skool.com/millionaire-investing-roadmaps-9340/classroom/80fbaceb?md=551fcbd57e5f4690afbe263645d6cb8c

1

0

DO YOU NEED HELP?

This post is for entrepreneurs, who need help with website design or digital marketing services for their brand. You can comment below, it's also okay to send a message

0

0

Weekend work!

When you start looking at weekends as workdays too (but for your OWN business), and spend time doing tasks that progress you to your personal goals....your knowledge and wealth will grow! Watch and see! By the way, the phone # is a Google Voice #. They're free and very helpful so you don't have to use your personal cell phone number!

CONTENTED LIFE

Hello everyone, I've been working remotely for a while now and it's going well. While I'm not rich, I make enough to live comfortably, get capital to invest, and also have enough time for myself and my family. Do you also have a side hustle that turned into a main job, or would you be interested in what I do as well?

1-13 of 13

skool.com/millionaire-investing-roadmaps-9340

Start on your journey to learn the historically proven and lucrative wealth-building techniques of investing! 💰

Powered by