Write something

We Are Moving!

I am closing this Skool Community to move to a new platform. January 2nd, will be your last date to access the Skool platform, but all the existing content will be available on the new FREE platform for early adopters. In addition, we will be adding new resources to overcome mindset blocks and to really get you where you want to go in 2025. I am moving this community to a new platform in 2025 to be more streamlined and easy to use. If you would like to get early access, please sign up below. Sign Up Here --> https://forms.gle/wKHcX2NFjLuSvrbd8 We'll see you there! Happy New Year! Manoj V.

2

0

Happy New Years Folks!

Happy New Years folks! This community will be dissolving soon. I will be hosting the content and community on my personal site. I want you to have continued access, as we build together. If you would like free access, please use the link below. SIGN UP FORM: https://forms.gle/wKHcX2NFjLuSvrbd8

4

0

No Wealth Mastery Call Today!

Hi Everyone, there will be no wealth mastery call today. I will be re-evaluating whether I continue this community in another platform come 2025. Let's connect again in 2025. Still to come in 2025: - New Years Intention Setting Masterclass - Crucial Conversations Continued - Psychology of Wealth Continued. Best and Happy New Years, Manoj

1

0

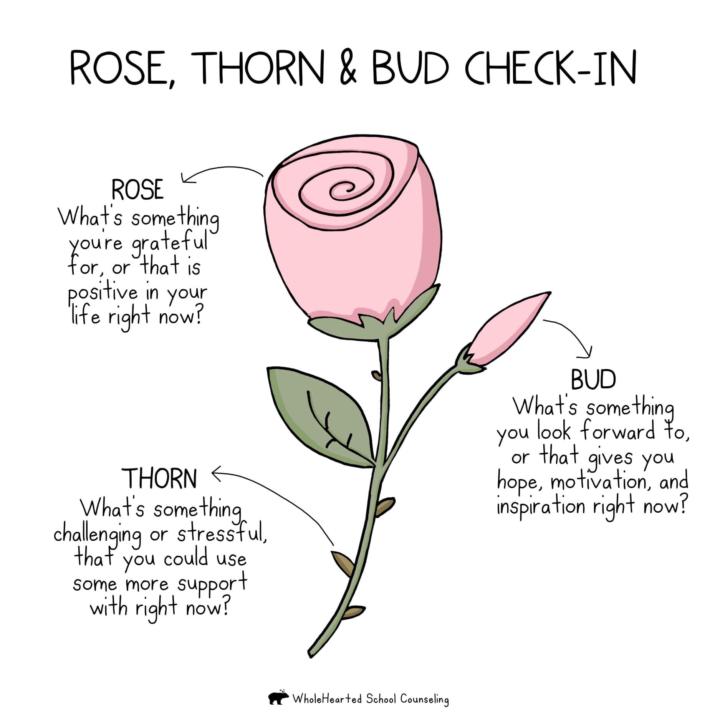

💕Relationships & Love Class Today 6pm EST

Today’s Relationships and Love Class we will focus on a game called Rose, Thorn, Bud , which will help us dive deep into the areas that are not working, which areas need improvement, and how we will keep growing the areas that are working. Between now and today’s class , Lets re-imagine 2025… What personal / business / family relationships, friendships, and romantic interests are you keeping, cultivating, removing or adjusting? 📅 Zoom Meeting Info — https://us02web.zoom.us/j/82741079734?pwd=JKlYFuLmh5o6JRMETkAcWfvst7Uq68.1 Meeting ID: 827 4107 9734 Passcode: 329734 See you there, Manoj

Wealth Mastery Call at 6PM Today! (12/16/2024)

Today’s Wealth Mastery Call is at 6pm Today (Monday, 12/16/2024). See you there ⏰ Best, Manoj ——— Here’s a quick summary of the book “Psychology of Money” by Morgan Housel. 1. Money Is About Behavior, Not Knowledge Managing money isn’t about how much you know but how you behave. Emotional discipline and consistency matter more than technical knowledge. For example, most financial mistakes happen because of greed, fear, or impatience—not lack of expertise. Focus on habits and emotional control over chasing financial hacks. 2. The Power of Compounding Housel highlights how compounding, especially over long periods, is the most powerful force in building wealth. He uses Warren Buffett as an example: Buffett’s fortune comes not just from smart investments but from starting early and staying consistent. Patience and time are the keys to unlocking compounding’s exponential growth. 3. Wealth Is What You Don’t See People often confuse wealth with material displays of success (cars, houses, etc.), but real wealth is the freedom and options that money provides. It’s about having financial security and choices, not showing off your lifestyle. Build invisible wealth—focus on savings, investments, and long-term stability rather than outward appearances. 4. Tail Risks and Resilience Success often comes from avoiding catastrophic failures rather than making perfect moves. Housel stresses the importance of financial resilience, such as having an emergency fund or a diversified portfolio, to withstand unexpected events. Plan for the worst-case scenario to ensure long-term financial survival. 5. Define Your Own Success Everyone’s financial goals are different. Housel warns against copying others’ strategies or definitions of success, as your unique values and priorities should guide your decisions. Comparison is the thief of joy—and financial security. Define wealth and success on your terms, and stick to your financial plan.

1-25 of 25

skool.com/max-potential-unleashed-6265

✅ Take Life to the Next Level !

✅ Rapidly Rewire Your Subconscious Mind (Hypnosis, NLP, & More)

✅ Classes: Money, Love, Habits, Success

Powered by