🛡️ Unlock Massive Tax Savings with Conservation Easements

Did you know you can protect the environment and save big on taxes? Conservation Easements are a little-known but incredibly powerful tax strategy. Let’s dive into the details 👇 What Is a Conservation Easement? It’s a legal agreement where you donate land or the development rights of land to protect natural resources. In exchange, you get a charitable tax deduction based on the land’s value—often up to 5X your donation! How It Works 1️⃣ Donate Land or Rights: Preserve land for forests, wildlife habitats, or open spaces by donating it or its development rights to a qualified conservation organization. 2️⃣ Claim the Deduction: You can deduct up to 50% of your adjusted gross income, with any excess carried forward for up to 15 years. 3️⃣ Tax Savings Example: • Donation Amount: $100K • Deduction: $500K (depending on valuation) • If in a 40% Tax Bracket: You save $200K that would’ve gone to the IRS! Legal and Compliance Considerations This strategy can deliver huge benefits, but compliance is key: 🔹 IRS Guidelines: • The easement must serve a legitimate conservation purpose (e.g., preserving natural habitats or historical landmarks). • The donation must be permanent and recorded with appropriate legal documentation. 🔹 Qualified Appraisals: • The land’s value must be appraised by a certified professional to avoid IRS scrutiny. 🔹 Legitimate Organizations Only: • Donations must go to a qualified conservation organization or government entity. 🔹 Syndicated Easements: • These allow multiple investors to participate but come with stricter IRS reporting requirements. Be cautious of inflated valuations. Why Consider Conservation Easements? ✔ Reduce Your Tax Liability ✔ Preserve Natural Resources ✔ Create a Legacy of Environmental Impact A Word of Caution ⚠️ The IRS monitors these transactions closely. That’s why working with experienced legal and financial professionals is critical to maximize your benefits while staying compliant. Let’s talk about turning tax savings into lasting impact!

How to Be Financially Smart During the Holidays 🎄💰

Hey everyone! The holiday season is around the corner, and with all the excitement, it’s easy to overspend or lose track of our finances. Here are some simple steps to help you stay financially smart during the holiday season while still enjoying every moment: 1️⃣ Set a Budget Early • Why: Having a clear budget prevents overspending and stress. • How: Decide how much you can realistically spend on gifts, travel, food, and any other holiday expenses. This is your “holiday cap” — commit to it! 2️⃣ Plan & Track Your Spending • Why: A planned approach ensures every dollar is intentional. • How: Make a list of people you want to buy gifts for, events you plan to attend, and even small extras. Use a simple app or even a notepad to track these expenses as you go. 3️⃣ Look for Deals in Advance • Why: Planning ahead can save you big bucks. • How: Watch out for deals and sales (not just on Black Friday or Cyber Monday). Sometimes discounts pop up unexpectedly — capitalize on them rather than waiting for the last minute. 4️⃣ Consider Non-Monetary Gifts • Why: Time, skills, or thoughtfulness can be more valuable than costly presents. • How: Offer a service, make something handmade, or give the gift of time. This approach is both personal and budget-friendly. 5️⃣ Think Beyond the Holiday Season • Why: Many people go overboard during the holidays and feel it financially for months after. • How: Ask yourself, “Is this purchase worth affecting my finances in the new year?” This mindset helps you prioritize lasting value over momentary excitement. 6️⃣ Avoid Using Credit Cards Unnecessarily • Why: Interest from credit card debt can quickly make your holiday spending costlier than you planned. • How: If possible, use cash or a debit card to limit spending to what you already have. If you do use credit, aim to pay off the balance immediately. Implement these strategies and enjoy a holiday season that’s as financially smart as it is joyful. Small adjustments can make a huge difference and help you start the new year with confidence and financial stability. Let’s keep each other accountable and share more tips in the comments!

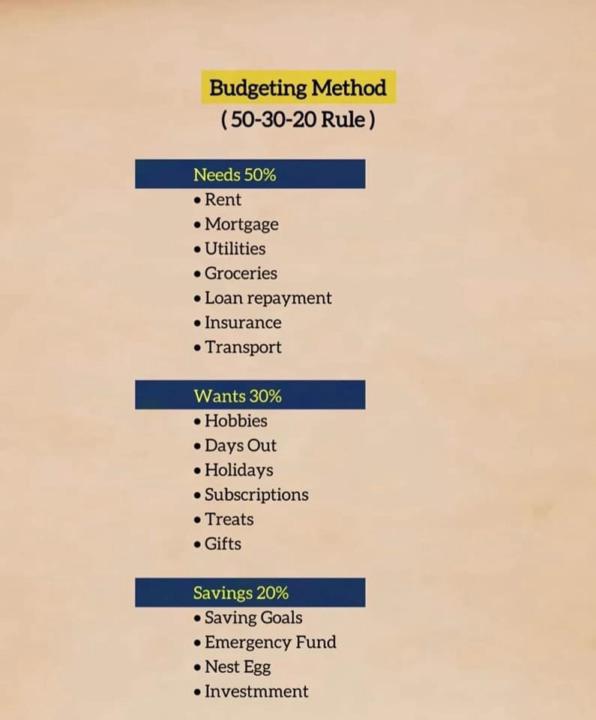

50-30-20 rule!

Here is a quick guide to the 50-30-20 rule! Hope it helps!!

💰 Welcome to the Budgeting Tips Community! 💰

Welcome to the Budgeting Tips channel! This space is designed for everyone looking to take control of their finances through effective budgeting strategies. Here, we focus on: - Practical Budgeting Techniques: Share and learn about various methods to create and maintain a budget that works for you. - Savings Strategies: Discover tips for cutting expenses and saving more money. - Tools and Resources: Discuss apps, spreadsheets, and other resources that can help simplify the budgeting process. - Community Ideas: We want to hear from you! Share your best budgeting tips, success stories, and creative ideas to inspire others on their financial journeys. Your experiences and insights can make a difference! Let’s work together to build a community that supports each other in achieving financial stability. Jump in and start sharing your thoughts!

1-4 of 4

skool.com/lwa

Legacy Wealth Academy empowers individuals and families by providing education and resources to develop long-term wealth-building skills.

Powered by