Write something

Term or Permanent

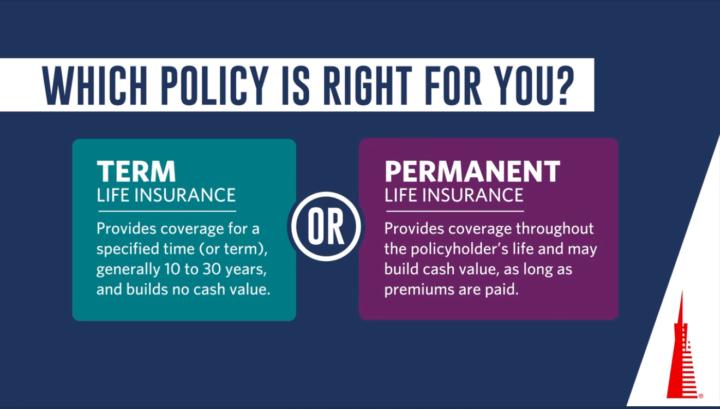

Choosing between Term and Permanent Life Insurance depends on your goals and stage in life. 🔹 Term Life Insurance is great if you want affordable coverage for a specific period — like while paying off a mortgage, raising children, or replacing income during your working years. It’s simple, budget-friendly protection when you need it most. 🔸 Permanent Life Insurance provides lifelong coverage and can build cash value over time. It’s often used for legacy planning, covering final expenses, or creating tax-advantaged savings you can use later in life. If you don’t currently have life insurance, ask yourself: Which type makes the most sense for your goals and budget — term or permanent? Schedule a time so chat with me on Zoom or answer a few questions to get a quote. https://calendly.com/kevinwfg908/life-insurance-zoom-consultation-2025

0

0

1-1 of 1