12/5/2025 Friday

QQQ - SPY After initially looking for the gap up, the indexes have come back down a bit, back near the previous day close. With messy HTF structure, not really seeing a reason to look in this direction for an edge. Catalyst OKLO and SOFI are both offering public stock, essentially diluting investors to fund operations. Both are looking to open lower on this news. Though with such a large gap down for SOFI, I'm not sure if this can continue lower very cleanly after the open, but I wouldn't rule out more downside. OKLO - gapping down as well, but I'm not sure if HTF is ready to feel more downside. What is more possible in my opinion is that OKLO trades WITHIN the previous day range, which could offer some opportunity. SNOW Follow Up - Opening lower - Opening below the previous day low - Following through with yesterday's down move so far - Massive volume yesterday - Close at lows - Strong downside daily candle There could be a chance, depending on the setup, that SNOW puts in another significant move lower. This could be a spot where if it shows early respect against the VWAP, it could flush out aggressively from the open. Trading quickly from the open takes a lot of prior available information, and with SNOW I believe we have that, for all the reasons listed above. Want Market Support for the Idea.

1

0

12/4/2025 - Breakout Style?

The SPY and QQQ are now both above the previous day's high in the pre-market. We can see the price is responding well at the moment by being able to move higher aggressively and stay higher. The only thing I'm not seeing a lot of is great price structure. How is the price structure forming to show that this move can continue? Because last Tuesday we had a similar setup: - Gap up right at the previous day's high - Some trend into the open - Then solid price response from the open However, that day was filled with many fake long setups that actually became short setups, so is today going to be similar, or is there something truly different? 1. We have CLEARED the previous day's high today, versus last time we only opened at it. 2. We went from ranging in the pre-market to a sudden pop that—so far—we are able to hold. 3. Though we are gapping up above the previous day's high, the previous day closed strong, so this gap isn't that big, which could leave more room for intraday trading. Once the market opens, we're going to need more information on the price

1

0

12/1/2025 - Surprising Gap Down

Not exactly what I would've expected coming into today given the strong market and relatively quiet start to the week, but here we are, supposedly gapping down on "anxiety" around the 10am EST ISM report. Now over the weekend I mentioned how my thinking and trading would revolve around the VWAP, and today/early this week I'm going to be watching closely to see if that is really the case. There are some interesting upgrades/downgrades that I see that I will be watching. Mainly because I don't think there is that much volatility without news, and without volatility, trading is obviously more difficult. 1. AVGO - Morgan Stanley upgrade 2. MSTR - Revenue cuts Then we must be aware of 10am data. Maybe there is more volatility that comes thru with the release, so just keep your options open.

2

0

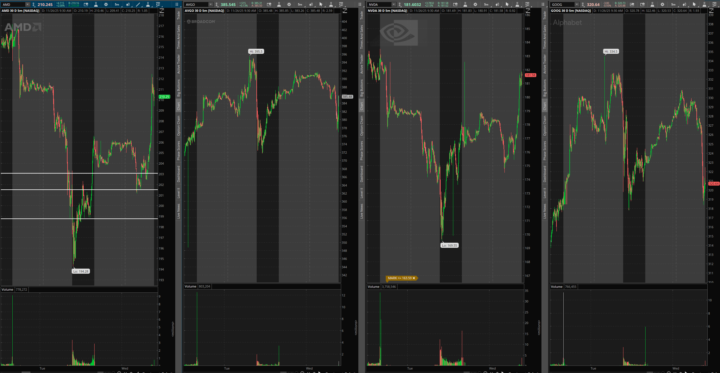

11/26/2025 GOOG vs Chips Continues

Still volatility around these names On close watch GOOG, AVGO, AMD, NVDA Not sure what exactly to expect, besides volatility

1

0

11/25/2025 - GOOG vs The Chips

GOOG yesterday came out and announced it had its own chips that were more cost-effective and performant for specific use cases. This sent GOOG up and the chips (besides AVGO) down. This creates a new, really interesting story for NVDA and AMD that is already bringing some volatility. Now, it may be time to say goodbye to the VIX inverse correlation and hello to the GOOG vs. chip correlation. However, there isn't that tight of a correlation at the moment, but rather some fear in these names. I'm not exactly sure at this time what is to come from these names, but at the very least, it will be where my attention goes today.

1

0

1-10 of 10

powered by

skool.com/jcow-capital-6336

Define Risk - Manage Risk - Take Risk

Join for growth

- Strategic Updates

- Market Outlook

- Daily Reviews

Suggested communities

Powered by