Write something

Hotel in Alentejo for sale

3 Star Hotel in Alentejo, for sale a rare Investment & Hospitality Opportunity in the Heart of Alentejo Step into the elegance of a 16th-century palace, surrounded by historic gardens, ancient stables, and timeless charm. Welcome to This amazing 3. Star Hotel, in Alentejo — a boutique heritage hotel where history, comfort, and modern hospitality come together. Now available for acquisition at €3.9 million, this is a unique opportunity to own one of Alentejo’s most iconic hospitality properties. Why This Hotel Is an Outstanding Investment 1. Prime Location Walking distance to restaurants, shops, and historical monuments. Strategic position for tourism growth in Alentejo, close to UNESCO cities Évora and Elvas. 2. Distinctive Historic Value A noble residence converted into a boutique hotel with preserved stables and gardens. Unique architectural character, offering guests a true “stay in history” experience. 3. Proven Guest Satisfaction Rated 9.0/10 overall by guests. Location score: 9.5/10 — one of the best in Alentejo. Strong reputation for cleanliness, service, and authentic atmosphere. 4. Facilities That Drive Revenue Outdoor swimming pool and sun terrace. Breakfast service highly rated (buffet, continental, gluten-free). Family rooms, pet-friendly policy, WiFi, and accessibility features. Attractive to couples, families, cultural tourists, and international visitors. 5. Growing Tourism Market Alentejo is one of Portugal’s fastest-rising tourism regions, attracting both local and international travelers. Increasing demand for boutique and authentic hospitality experiences. Strong potential for year-round occupancy driven by cultural tourism, gastronomy, and events. Asking Price 💶 €3.9 Million — full ownership of the property, brand, and business operations. This represents not only a hotel acquisition but also the opportunity to expand services (events, gastronomy, wellness, boutique packages) and grow returns in a booming market. Key Investor Messages

1

0

Exclusive Investment Opportunities

I’m building a select list of investors who want to receive business and real estate opportunities first-hand – before they reach the wider market. If you’d like to be added to this exclusive investment listing, simply send me a private message here on LinkedIn. Let’s connect and explore the next great opportunities together. Carlo Ferreira #InvestmentOpportunities#RealEstateInvesting#BusinessOpportunities#InvestInPortugal#RealEstateOpportunities#PrivateInvestors#WealthBuilding#GlobalInvestors#ExclusiveDeals#InvestmentNetwork

0

0

Investment Opportunity in Algarve

Total Investment: €2,500,000 👉 This is a unique opportunity to enjoy Portugal while generating solid returns from a secure real estate asset. If this sounds interesting, send me a message for more details.

1

0

Recommended Brokers Available in Portugal (2025)

Absolutely! Here's a refined overview of the best online brokers available in Portugal where you can buy REITs—or the Portuguese equivalent, SIGIs (Sociedades de Investimento e Gestão Imobiliária): Recommended Brokers Available in Portugal (2025) According to recent rankings from BrokerChooser and Invezz, these are the top brokerages available to Portuguese investors: Interactive Brokers – Ranked #1 with extremely low fees, broad global market access, and advanced research tools . MEXEM – Noted for low stock/ETF fees, multilingual support, and a wide selection of instruments . Trading 212 – Commission-free trading for stocks and ETFs, very easy account setup, strong mobile platform . XTB – Offers a broad range of CFDs, forex, commodities; free and fast account opening . Saxo – Excellent platform and research capabilities, with a broad product portfolio . DEGIRO – Known for low fees, intuitive interface, access to many global markets; especially suitable for long-term investors . Lightyear, CapTrader, Alpaca, Tradier – Also available, each with their own strengths in fees, APIs, or niche features . Investing in SIGIs (Portuguese REITs) Portugal's equivalent to REITs—SIGIs—are publicly traded, investment-focused real estate companies. Key examples include: Olimpo Real Estate Portugal (MLORE) — a SIGI listed on Euronext Lisbon (Euronext Access) . Merlin Properties (MRL) — a Spanish REIT listed on Euronext Lisbon, often discussed by Portuguese investors . What is a SIGI? A SIGI is legally required to hold a high proportion of real estate assets and distribute a majority of taxable income as dividends (usually 75–90%) . These entities must be traded on regulated markets (like Euronext Lisbon); they have specific rules about leverage, free float, and reinvestment of proceeds . Which Broker Should You Choose? Here's a quick breakdown to help align your choice with your needs: Your Priorities Recommended Broker Why it Fits Lowest possible fees & professional tools Interactive Brokers Deep global access, top research tools, very competitive rates

1

0

How to Buy REITs

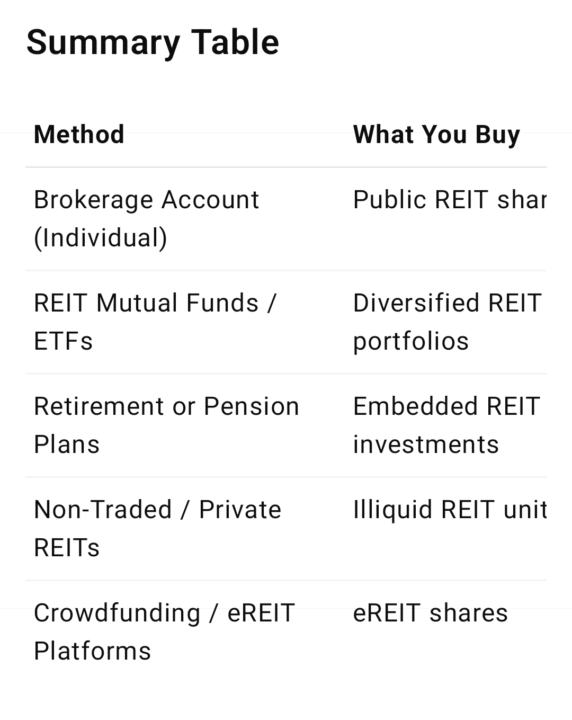

👉 Are you looking to buy REITs in Portugal/Europe specifically, or are you open to buying US-listed REITs (like those on the NYSE/NASDAQ) through an online broker? This makes a big difference, because: In Portugal/Europe, there are new REIT-like vehicles called SIGIs (Sociedades de Investimento e Gestão Imobiliária), which function similarly to REITs but follow Portuguese rules. If you want global or US REITs, many Portuguese/European brokers (e.g., DEGIRO, Interactive Brokers, XTB) give you access to ETFs and individual REIT stocks abroad. If you're looking to invest in Real Estate Investment Trusts (REITs), there are several effective ways to do so—both directly through the stock market and indirectly via funds. Here's a breakdown: 1. Via Brokerage Accounts Most publicly traded REITs are listed on stock exchanges like the NYSE or NASDAQ. You can buy shares just like you would any other stock. It’s a straightforward process: open a brokerage account, search for REIT symbols, and place your order. Major platforms such as Fidelity, Schwab, or Vanguard provide access to both individual REITs and REIT-focused ETFs or mutual funds. Investing in REITs like this offers high liquidity and doesn't require large capital—the shares often trade under $100. 2. Through Mutual Funds or ETFs REIT mutual funds and exchange-traded funds pool investments from multiple investors to provide diversified exposure. This is a great option for getting broad exposure across different property types or geographies with a single trade. 3. Through Retirement or Pension Plans Many retirement accounts like IRAs, 401(k)s, or pension funds include REITs (or REIT funds) as part of their asset allocations. 4. Non-Traded (Public) and Private REITs Non-traded REITs are not listed on exchanges and are often accessed via brokers or financial advisors. They typically carry higher upfront fees (around 9–10%) and may have liquidity restrictions. Private REITs and specialized options (such as SM REITs in India) offer alternative models but may require higher minimum investments and are less liquid.

1

0

1-9 of 9

powered by

skool.com/global-partner-network-3184

Great real estate deals in Portugal. Invest, buy, holiday & earn referral commissions with Carlo International.

Suggested communities

Powered by