Write something

Affidavit of Truth for Credit

An Affidavit of Truth can be a valuable tool in the credit repair process by providing a legally binding statement that affirms the accuracy of specific information. When used to challenge inaccuracies on your credit report, a properly executed affidavit serves as formal notification to the credit bureaus, requiring them to investigate and verify the disputed items. By including an affidavit in your disputes, you can reduce the chances of receiving stall letters from credit bureaus. Once notarized, the document certifies your true identity and supports the validity of your claims. This added level of credibility and formality encourages credit bureaus and creditors to address and resolve disputes more efficiently. Below are a variety of Affidavit of Truth templates for your review. Selecting the right template ensures that your affidavit is thorough and effective, enhancing the success of your credit repair efforts.

0

0

Stall letters response guide

🚨 M2 Stall Letters Alert! 🚨Hello M2🐐 Family, We frequently get asked about this, so we want to ensure you can recognize a stall letter for what it is—a common tactic used by credit bureaus. Stay persistent and consistent in your efforts! To help prevent these delays, make sure to: - Include verifiable identification documents and proof of address. - Provide a notarized Letter of Affidavit. - Send your documents via certified mail with a return receipt. Keep pushing forward! 💪

0

0

CFPB complaint filing guide

🚨 How to File a CFPB Complaint Video 🚨If you need help filing a CFPB complaint, this video is a great resource. Just remember to select your own reason for "What this complaint is about," since the video doesn’t provide step-by-step instructions for every option. Track Your Complaint: - How to Track: Use the tracking number from the confirmation email to log into the CFPB portal. - Updates: You'll receive email notifications about your complaint's progress, including when the company responds. Company Response: - Timeline: Companies have 15 days for an initial response and may take up to 60 days for a final resolution. - Viewing the Response: Log in to the CFPB portal to check the company’s response. Video Link ⬇️:Watch Here CFPB Website ⬇️:Visit Here

0

0

CFPB Complaints for Chargeoffs

✅ Remove Charge-Offs/Collections Using CFPB Complaints Are your dispute results continuously coming back as "verified"?You've tried every hack, sent countless letters, and exhausted all online dispute methods... Now it's time to escalate your approach by filing a complaint with the CFPB! 🔍 Did You Know?Charge-off accounts typically stay with the original creditor, who holds all the account details. This makes it easier for them to verify the debt, which is why other dispute methods may have failed. While claiming "this account isn’t mine" can sometimes work, it’s not always effective. 💥 Take Action to Remove Charge-Offs with CFPB Complaints: 1. Visit: consumerfinance.gov 2. File a Complaint:Select Credit reporting or other personal consumer reports (background checks, employment, or tenant screening).Choose Credit reporting as the issue.Report improper use of your report (shared without consent or unknown credit inquiries). 3. Answer Honestly:Have you tried resolving this with the company? → YESDid you request information from the company? → YESDid the company provide this information? → NO 🚀 Achieve a 60% Success Rate! Don’t wait—start your complaint today and take control of your credit!

0

0

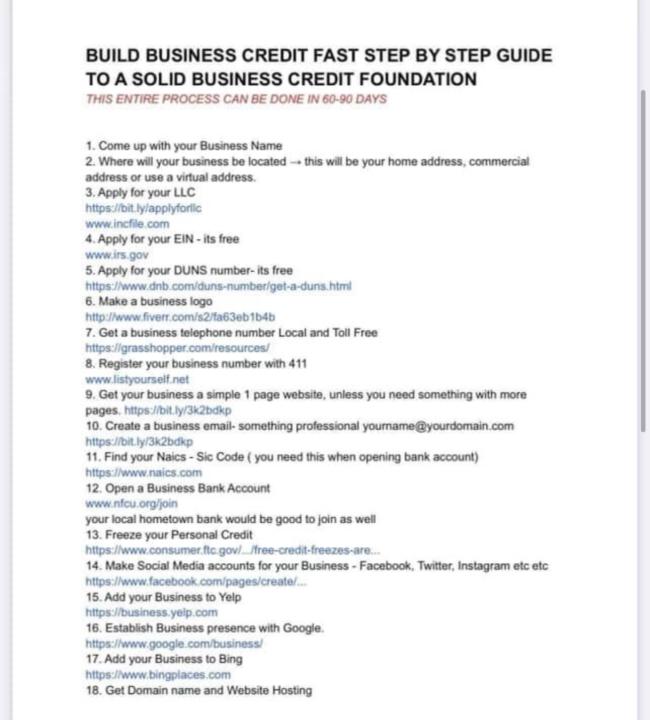

Build Business Credit

Key Steps to Building Business Credit: 1. Business Setup: 2. Register Your Business: 3. Business Bank Account: 4. Establish Vendor Accounts (Tier 1): 5. Apply for Tier 1 Business Accounts: 6. Apply for Tier 2 Business Accounts: 7. Establish Corporate Credit Cards (No Personal Guarantee): 8. Maintain Good Credit Practices: 9. Additional Credit Options: 10. Avoid Certain Cards: - It’s advised to avoid Capital One and Discover business credit cards as they report utilization on your personal credit report. By following these steps, you can systematically build business credit for your company without relying on your personal credit. Let me know if you'd like more details on any specific parts of the process!

0

0

1-30 of 36

skool.com/genesis-wealth-creation-1104

"Build wealth and business with Biblical principles and credit repair strategies for financial freedom!"

Powered by