NEW INSTAGRAM ACCOUNT ALART

Hey everyone, I just created a brand new Instagram page after my last account got hacked and taken down by some scammers. It was a tough one, but we move stronger and better! I’ll really appreciate it if you can follow and engage with my new page 👉https://www.instagram.com/penguin.9813720/?utm_source=qr&r=nametag This page will be focused on digital marketing tips, online business growth, and ways to make consistent sales. Let’s grow together and make this week a winning one filled with new sales and success for all of us! Your support means a lot. Let’s make this new start go viral! 💪🔥

1

0

Steps to File Your Taxes

- Gather Documents: Collect W-2s, 1099s, and receipts for deductions. - Choose Filing Method: File yourself using software, hire a pro, or file on paper. - Fill Forms: Complete IRS Form 1040, and additional forms if needed. - Claim Deductions & Credits: Maximize refunds with deductions (e.g., student loans) and credits (e.g., child tax). - Double-Check: Review forms for errors. - Submit: File electronically for faster processing or mail paper forms. - Pay Taxes Owed: Pay by the deadline to avoid penalties. - Save Copies: Keep your return and documents for 3 years.

4

0

W9 & Direct Deposit

✅ Click the link below > Enter Your W9 & Direct Deposit Info to receive commissions ⏭️W9 & Direct Deposit 👈👈👈 https://forms.gle/PGjAVsMBzhAyN2Uq9

Tax Software Signup | Service Agreement

✅ Initial Price / Promotional Price to Get Started ✅ Annual Renewal is $105/year ⏭️ Tax Software Service Agreement 👈👈👈

Send a Picture / Headshot for Website

1. If you have already done this. Outstanding 2. If you still still need a webpage built Inbox Geno in Skool Chat with your picture

1-5 of 5

powered by

skool.com/gbc-university-6206

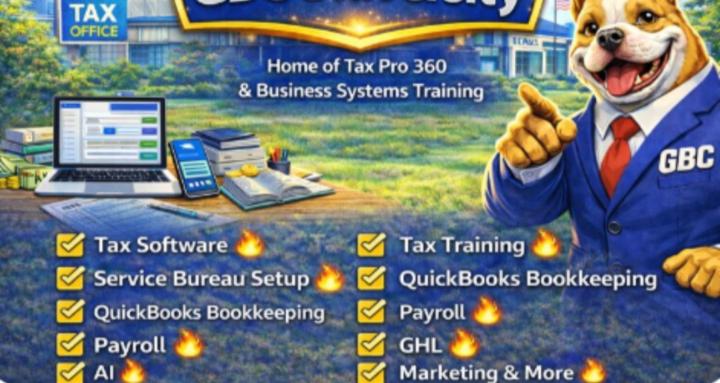

PTIN Setup🔥EFIN Setup 🔥 Service Bureau Setup🔥QuickBooks🔥Payroll🔥Go High Level🔥AI🔥Business🔥Course Builder🔥Marketing & More

Suggested communities

Powered by