Write something

STRIQ - College Station

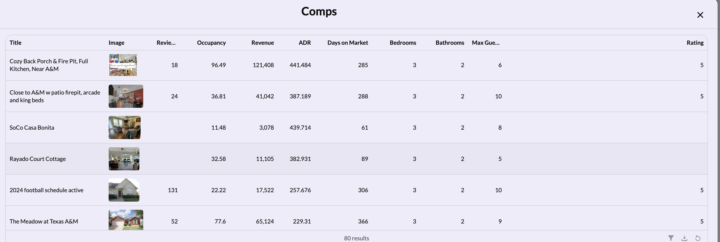

The picture is a screenshot of STRIQ & the top property is actually my property. It definitely is not making $121,408 (I wish!). Since this is so drastically off, how can I make sure the data is correct?

Mortgage/Loan Question:

I am wanting to buy a primary residence with my boyfriend (he’s a realtor with 1099 income & has one LTR). I own a private practice of dietitians (scorp) & have the 1 STR (not currently in an LLC, but it’s on the list of things to do). I own two single family residences (currently in my own name). One is a full time STR & the other one is currently my primary residence, but will become an STR when I move out. Boyfriend will also LTR his residence once we move. I’m having trouble qualifying for a mortgage due to the DTI restrictions without long term residential leases on both properties. Who are some lenders that take into account (1) STR income (yes, it is shown on my tax return) & (2) STR projections for my primary residence. I met with Parker (Matt''s recommendation) but wanted to have a few options. Thanks in advance!

2025 conferences

I am curious what conferences everyone is attending in 2025. I would love to meet some others from this group.

From the Trenches: Real Freedom Requires Real Resilience

Hey friends, Today I want to share something that isn't in most real estate courses. The path to freedom through entrepreneurship and investing isn't linear—it's filled with moments that test every ounce of your resolve. This past year, I hit what felt like rock bottom. After being unexpectedly fired in Aug 2024 due to my "side hustle," I found myself juggling substantial debt while simultaneously trying to keep my startup alive with just $10-15K in the bank. There were moments I genuinely didn't know how I would make payroll or support my family. Here's what I learned that might help you: **When one door closes, scout the entire building** When my $1M funding fell through, I was devastated. But that "no" eventually led to an opportunity to list $40-50M in commercial properties—potentially generating more income than the funding I originally sought. The rejection I initially viewed as catastrophic actually opened a far better door. **Your network becomes your lifeline** The relationships I had nurtured for years suddenly became the bridge over troubled waters. Previous clients stepped up with opportunities I never would have accessed without our established trust. **Strategic real estate investments provide runway during turbulence** What's wild is that this spring, summer and fall, my STR properties have become part of my financial lifeline. My seaside property during spring/summer rental months and my College Station property during fall football season are helping keep me afloat in this difficult season. They're not fully replacing my income, but they're helping maintain cash flow while I continue building wealth through appreciation, debt pay down, and tax advantages. The very investments I took significant risk on are now providing the stability I desperately need. **Financial setbacks can be spiritual and strategic resets** Being financially "zeroed out" forced me to rebuild with intention. I had to question every expense, evaluate every opportunity with fresh eyes, and eliminate financial habits that weren't serving my greater vision. I believe God sometimes empties our vessel completely to prepare us for something greater.

1-14 of 14

skool.com/freedominvestoracademy

We're a faith-based community helping investors achieve true freedom - financial freedom through real estate & spiritual freedom through Jesus Christ

Powered by